Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 29, 2016

European insurance bonds sink to bottom of the pile

European bond yields have fallen to new recent lows as the market takes an increasingly dim view of growth prospects, which has in turn seen insurance bonds come under increased pressure.

- iBoxx " Insurance the worst performing sub index of the iBoxx " Corporates universe

- Investment grade insurance bonds have seen spreads double in 12 months to three year highs

- Generali's CDS spreads have tripled in the last 12 months

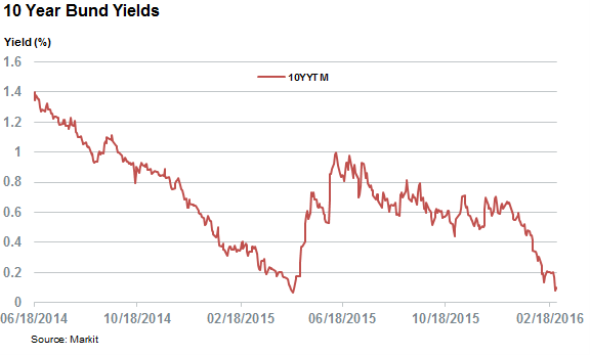

Financials have been at the forefront of the recent European credit headwinds, with the market taking an increasingly dim view of the sector's ability to thrive in a low growth, low interest rate environment. Although the market's risk perception has come down somewhat from the recent peaks seen a couple of weeks ago, the fundamental drivers remain unchanged. The latest lacklustre composite Markit Flash Eurozone PMI sent 10 year bund yields to within a couple of basis points of last year's all-time lows.

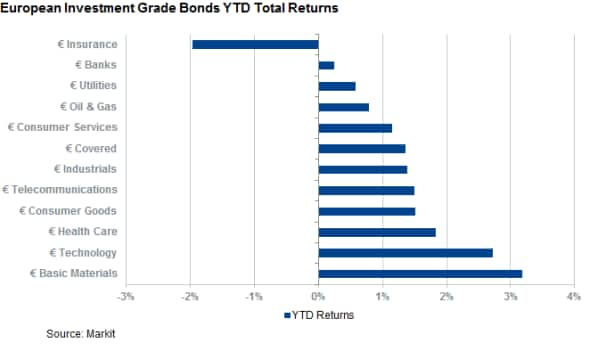

While the entire financials sector has trailed the rest of the European bond market since the start of the year, one area that has felt this trend particularly has been insurance bonds. The Markit iBoxx " Insurance index has delivered negative total returns of 1.96% since the start of the year; a full 277bps less than that delivered by the Markit iBoxx " Corporates universe.

In fact, insurance bonds are the only sector out of the 12 that make up the euro denominated investment grade universe to have delivered negative total returns since the start of the year. Even bank bonds, which have so far received most of the attention, have delivered positive total returns. The Markit iBoxx " Banks index has returned 24bps year to date, over 2% more than the corresponding insurance index.

Risk pricing surges

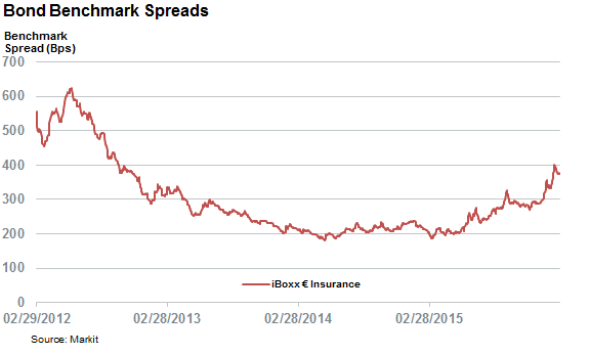

Investors have been demanding ever increasing amounts of extra yield in order to hold insurance bonds, with the benchmark spread priced into the " Insurance index steadily increasing in the last 12 months as investors threat about the sector's ability to grow profits and meet its commitments as bond yields hover near all-time lows.

Spreads across that index are now twice the levels seen in March of last year, with investors now requiring 378bps of extra yield in order to hold insurance bonds over similarly dated bunds.

Generali drives the trend

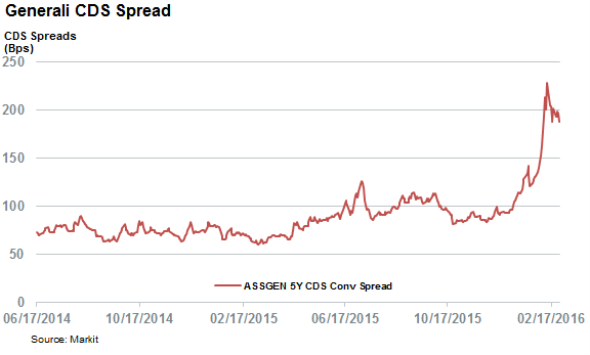

One firm that has been at the forefront of this sector wide re-pricing has been Italian insurer Generali, who's CDS spread has more than tripled in the last 12 months. The firm recently announced the departure of its CEO after announcing a fall in profits in the closing months of last year.

The firm's five year CDS spread crossed the 200bps for the first time in over two years during the worst of this month's volatility. This highlights the growing market unease over the firm's ongoing efforts to shore up its capital base and grow its profitability, a job which its outgoing CEO recently declared "just a quarter done".

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29022016-credit-european-insurance-bonds-sink-to-bottom-of-the-pile.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29022016-credit-european-insurance-bonds-sink-to-bottom-of-the-pile.html&text=European+insurance+bonds+sink+to+bottom+of+the+pile","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29022016-credit-european-insurance-bonds-sink-to-bottom-of-the-pile.html","enabled":true},{"name":"email","url":"?subject=European insurance bonds sink to bottom of the pile&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29022016-credit-european-insurance-bonds-sink-to-bottom-of-the-pile.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+insurance+bonds+sink+to+bottom+of+the+pile http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29022016-credit-european-insurance-bonds-sink-to-bottom-of-the-pile.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}