Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 29, 2016

UK's dividend champions to add '5bn by 2018

Despite a rough start to the year for yield focused investors, Markit has identified a group of 50 UK companies poised to defy the gloom and grow their payments by more than 10% in each of the next three years.

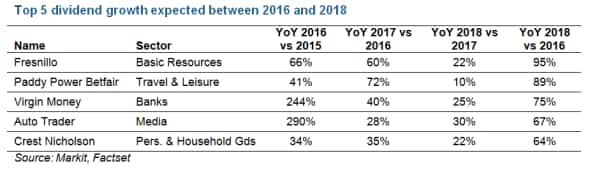

- Fresnillo's recovery places Mexican miner on track to grow dividends 95% by 2018

- 18 companies expected to post above 15% dividend growth per annum

- Home builder Crest Nicholson expected to see dividends soar two thirds by 2018

To view the full report outlining the top UK companies growing dividends over the next three years, please contact us.

The UK's thrifty fifty dividend stocks

Overall momentum for the UK dividend outlook remains bearish due to recent large cuts by energy and resource firms. Overall aggregate dividends are expected to fall 1% across the FTSE 350 in the coming year.

However Markit Dividend Forecastinghas identified 50 companies in the UK that are expected to deliver dividend growth of at least 10% in each of the next three fiscal years. 17 of the top 50 are FTSE 100 firms, and 18 are expected to grow above 15% per annum.

Almost a third of the 50 firms are made up of Travel & Leisure and Personal & Household Goods companies. Together with Industrial Goods & Services and Food and Beverage companies - the above four sectors represent over half of the top 50 companies growing dividends.

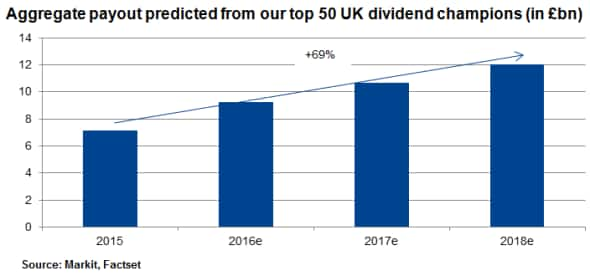

Overall, dividend payments by these 50 dividend champions are set to grow by "5bn in the coming three years to "12.1bn, 69% more than that paid in 2015.

Aggregate dividend growth however is heavily concentrated across seven companies, accounting for 71% of the increase expected between 2016 and 2018 of "3.5bn.

Banks and Insurance firms represent only 12% of the 50 however they are responsible for 54% of total dividends expected in 2018.

Top 5 dividend growers' silver lining

Leading UK companies set to grow dividends is the world's largest silver miner and Mexico's second largest gold producer - Fresnillo. The company joins only two other Oil and Basic Resource companies expected to deliver above 10% dividend growth per year. Basic resource majors such as BHP, Rio Tinto and Anglos have slashed their dividend payments as demand for basic commodities continue to stagnate amid declining demand resulting in decade low prices.

A 12 month forward yield of less than 1% is forecast for Fresnillo as the company begins to grow its dividend off a small base, and is clearly noyield trap. Healthy growth of 95% in the dividend is forecast by 2018.

This reversal of fortunes for Fresnillo has also been supported by a stronger gold price and a positive production report released by the company in January. This has seen the share price rally 55% and short sellers have continued to cover positions.

Other than Virgin Money, which features in the top 5 growers, the only major Bank expected to deliver robust dividend growth currently is Lloyds. Lloyds revealed a bumper "2bn dividend payment last week and is the largest payer on aggregate among the top 50 growers, expected to pay "2.6bn in 2018. However the top five names are expected to post above 65% growth by 2018.

Paddy Power Betfair is expected to grow dividends by almost 90% by 2018. Following the merger between Paddy Power and Betfair, the company aims to drive dividend growth due to larger scale, complementary products and cost synergies.

Virgin Money and Auto Trader have recently initiated dividends at low levels, which enable them to quickly raise payouts. Additionally Virgin Money is benefitting from good earnings momentum and capital ratios currently above peers.

Fifth fastest dividend grower and benefiting from continued strength in the demand for housing in the UK is Crest Nicholson which joins two other homebuilders expected to grow dividend payments; Galliford Try and Redrow. Crest Nicholson is expected to see dividends increase by over 20% annually, rising 64% by 2018.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29022016-Equities-UK-s-dividend-champions-to-add-5bn-by-2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29022016-Equities-UK-s-dividend-champions-to-add-5bn-by-2018.html&text=UK%27s+dividend+champions+to+add+%275bn+by+2018","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29022016-Equities-UK-s-dividend-champions-to-add-5bn-by-2018.html","enabled":true},{"name":"email","url":"?subject=UK's dividend champions to add '5bn by 2018&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29022016-Equities-UK-s-dividend-champions-to-add-5bn-by-2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK%27s+dividend+champions+to+add+%275bn+by+2018 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29022016-Equities-UK-s-dividend-champions-to-add-5bn-by-2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}