Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 29, 2016

Week Ahead Economic Overview

The release of PMI data will provide data watchers with the first available information on global economic trends in 2016 and The Bank of England also announces its latest monetary policy decision, in a week which culminates in the release of US non-farm payrolls.

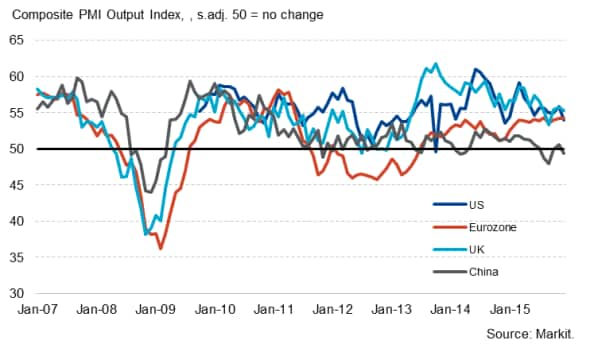

Composite PMI Output Index

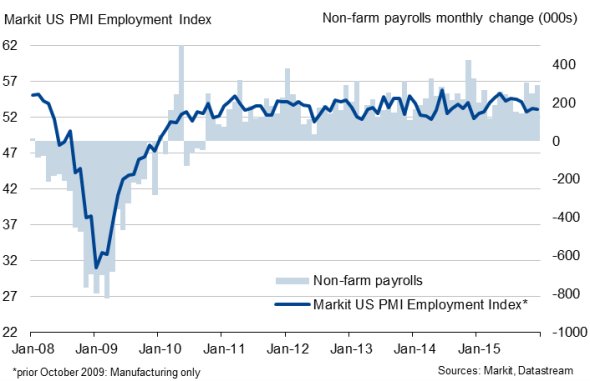

It was no surprise when the Fed's Open Market Committee left monetary policy unchanged. In a statement, following the announcement, the Fed stated that it "is closely monitoring global economic and financial developments and is assessing their implications for the labour market and inflation." The release of US non-farm payrolls, out on Friday, will therefore be an important steer for policy makers. December's Jobs Report showed a 292k rise in non-farm payroll employment, well above consensus and the unemployment rate remained at 5.0%. Markit's flash PMI data are consistent with a 205k rise in January, down from last year's high, but still robust overall. A strong report will rekindle appetite for further rate hikes in 2016 while soft numbers will inevitably see the Fed pare back its rate path projections.

US non-farm payrolls and the PMI

Data watchers will also be interested in final US PMI data, which are released on Monday for manufacturing and Wednesday for services. According to a flash estimate, growth in the US economy slowed at the start of the year, with the Markit PMI Composite Output Index the lowest since December 2014. If the weakness in the data persists, the Fed may postpone the next rate hike. Trade data and factory orders numbers will also be important in ascertaining how the US economy is coping with global economic headwinds.

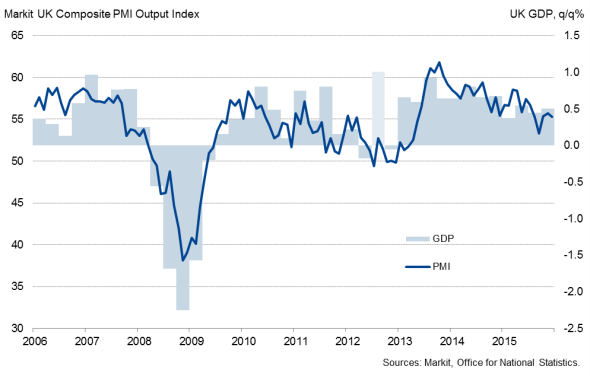

The Bank of England seems a long way off starting to raise interest rates, despite UK GDP growth accelerating slightly in the final quarter of 2015. Although the labour market is in good shape, inflation is expected to remain ultra-low and wage growth is relatively weak. It is therefore widely expected that the Bank will leave interest rates at their historic lows.

UK GDP and the PMI

The release of PMI results for the UK will meanwhile give first insights into UK economic growth trends at the start of 2016. December's survey results highlighted the strength of the services and construction sectors, while manufacturing growth remained subdued.

Eurozone economic growth has somewhat disappointed recently, especially given the ECB's quantitative easing programme. Flash PMI results signalled that the euro area economy saw growth slacken at the start of 2016. If confirmed by the final data (which includes more national detail), a further loosening of monetary policy would become more likely. ECB boss Mario Draghi has already hinted at more stimulus, saying that the bank will "review and possibly reconsider" monetary policy at its March meeting. Unemployment and retail sales numbers, released by Eurostat, are likely to add to the policy debate.

There will also be a big focus on the PMI releases in Asia. While recent data have shown that Japan's economic situation is improving slowly, as an initial economic recession in the third quarter was eventually revised away, a lack of inflation remains a major concern and has prompted the Bank of Japan to introduce negative interest rates.

The PMI releases for China have been worryingly weak, with manufacturing malaise spreading to services. Latest GDP results showed that the Chinese economy grew at the slowest pace in 25 years in 2015. If the data continue to disappoint, more stimulus would certainly become an option. The release of the Caixin Manufacturing and Services PMI results will provide data watchers with the first available information on the state of the Chinese economy in 2016.

Monday 1 February

Manufacturing PMI results are published worldwide by Markit.

The latest AIG Manufacturing Index is released in Australia.

The Bank of England issues data on mortgage approvals.

In the US, personal consumption and spending data are published by the Bureau of Economic Analysis.

Tuesday 2 February

The Reserve Banks of Australia and India announce their latest monetary policy decisions.

Producer price and unemployment figures are issued in the eurozone.

The January Markit/CIPS UK Construction PMI is released.

Brazil sees the publication of industrial output numbers.

Wednesday 3 February

Markit publishes worldwide Services PMI results.

In Australia, the AIG Services Index, building permit numbers and trade data are published.

Consumer confidence figures are meanwhile updated in Italy and Japan.

M3 money supply information are issued in India.

Eurostat releases latest retail sales numbers for the currency union.

Halifax house price data are published in the UK.

The US sees the release of ADP employment and mortgage numbers.

Thursday 4 February

Retail PMI results are issued by Markit for the eurozone.

The Bank of England announces its latest monetary policy decision.

In the US, initial jobless claims and factory orders data are published.

Friday 5 February

Retail sales and the latest AIG Construction Index are issued in Australia.

Consumer price data are out in Russia.

Industrial orders numbers are released by Destatis in Germany.

France sees the publication of trade figures.

In Brazil, inflation data are updated.

Employment and trade numbers are meanwhile issued in Canada.

The January Jobs Report and trade figures are released in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}