Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 01, 2016

Czech Republic breaks developed world dominance of manufacturing rankings

Global manufacturing remained in the doldrums at the start of the year, beset by downturns in some of the world's largest emerging markets.

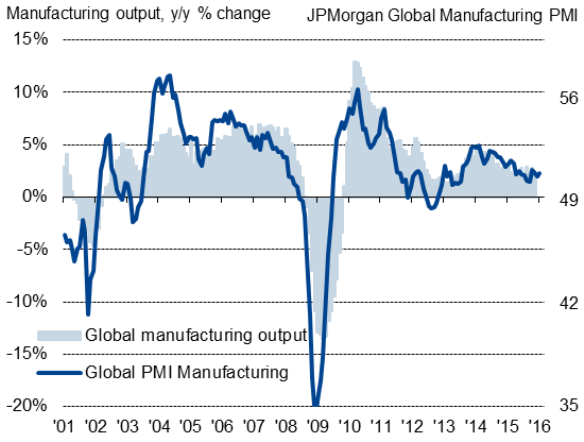

Global factory output

The JPMorgan Global Manufacturing PMI rose from 50.7 in December to 50.9, signalling a marginal increase in the rate of activity growth but running just below the average of 51.0 seen throughout last year. The subdued reading signals an ongoing sluggish expansion of the world's factories. The data are broadly consistent with worldwide factory output rising at an annual rate of just 2.0%.

January manufacturing PMI rankings

Exports and employment barely rose, and only modest improvements were seen in production and order books compared to December volumes.

Firms also cut selling prices on average, responding to weak demand and allowing customers to benefit from the steepest drop in producers' input costs seen for a year.

Production was once again characterised by modest growth in the developed world contrasting with a marginal decline in output across emerging markets on average.

Manufacturing across the emerging markets as a whole contracted for a tenth successive month, led by downturns in China and Brazil, which sat at the bottom of the global manufacturing PMI rankings.

The downturn in China - of similar magnitude to that seen in December - was accompanied by deteriorating activity in South Korea, Indonesia and Malaysia. Some pockets of growth in Asia were once again seen, however, with activity rising (albeit only modestly) in India, Vietnam and Taiwan.

Despite sitting at the foot of the rankings, Brazil's steep downturn moderated, with January seeing the smallest drop in activity for eleven months.

Manufacturing in Russia showed signs of stabilising, with the rate of decline easing to register only a marginal contraction.

Canada, suffering from weak exports to emerging markets, was the only developed country to have suffered a manufacturing downturn in January, albeit with France and Greece stagnating.

In the developed world, growth accelerated in both the US and UK but slowed slightly in the eurozone and Japan, although all four continued to record moderate expansions. Three of the top four countries were eurozone nations, however, leaving the UK and US in fifth and sixth places respectively.

Developed world

Despite seeing their currencies appreciate over the past year, the global rakings suggest that the US and UK manufacturers continue to fare well on a comparable basis to many other countries, helped by robust domestic demand.

A simple developed versus emerging world dichotomy is too simple, however, with January once again seeing the Czech Republic, a rising star in Eastern Europe over the past year, holding on to top place in the global manufacturing rankings.

Main emerging markets

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01022016-Economics-Czech-Republic.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01022016-Economics-Czech-Republic.html&text=Czech+Republic+breaks+developed+world+dominance+of+manufacturing+rankings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01022016-Economics-Czech-Republic.html","enabled":true},{"name":"email","url":"?subject=Czech Republic breaks developed world dominance of manufacturing rankings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01022016-Economics-Czech-Republic.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Czech+Republic+breaks+developed+world+dominance+of+manufacturing+rankings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01022016-Economics-Czech-Republic.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}