Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 06, 2025

By Jingyi Pan

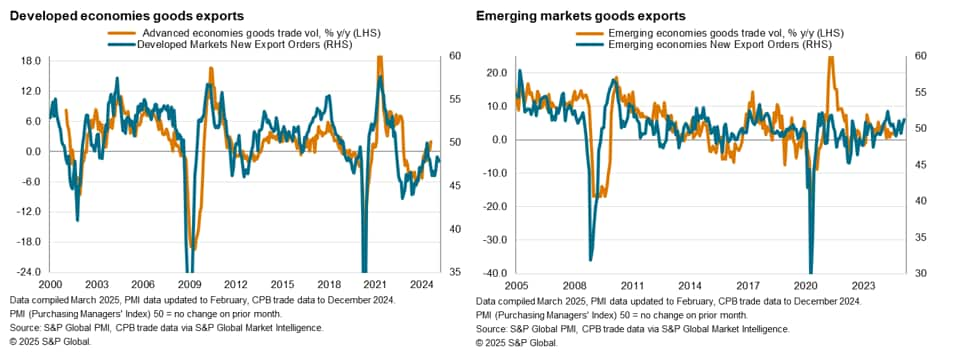

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that the recent contraction of global trade moderated to a near-neutral level midway through the first quarter of the year, albeit with regional variations apparent.

The seasonally adjusted Global PMI New Export Orders Index, sponsored by JPMorgan and compiled by S&P Global, rose to 49.8 in February, up from 49.6 in January. Posting below the 50.0 neutral mark for the ninth month in a row, the latest reading signalled that trade conditions deteriorated again. That said, the reduction in export orders was only marginal, having softened for a second successive month. This reflected a near-stabilisation of global trade conditions ahead of additional US tariffs implementation.

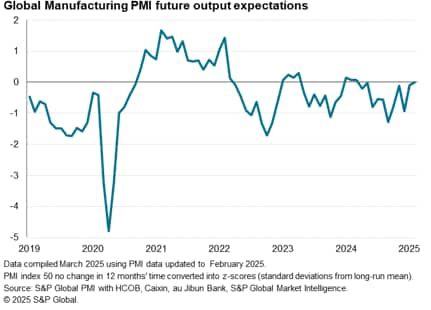

The downturn in manufacturing new export orders eased into the second month of 2025, according to the latest PMI data. In fact, the pace at which manufacturing export orders shrank was the slowest in the current nine-month sequence and only marginal, thereby signalling a near-steadying of trade flows. The latest easing of export orders decline unfolded amidst further improvements in overall manufacturing sector conditions. Global goods new orders and output growth both accelerated in February, with the former notably rising at the fastest pace in nearly three years. Furthermore, manufacturing sector sentiment picked up with goods producers being the most optimistic since last May. The forward-looking indicators therefore painted a positive picture for near-term manufacturing production growth, including with the Export Order Index being on an uptrend.

That said, regional variations were apparent with incoming new orders from abroad rising largely for Asian manufacturers while the US acted as a drag on global exports in February. This was reflective of a recovery driven by the front-loading of goods orders ahead of additional tariff implementation by the US. With newly implemented tariffs being announced at the time of writing by both the US and other key trading partners, the risk is that further improvements may be derailed.

Additionally, a trend of rising prices has already been in place since the start of the year with the rate of goods output price inflation rising globally for a second successive month to the highest in eight months, underpinned by intensifying cost pressures. With additional tariffs being put in place in various parts of the world in early March, the risk is that rising prices may also dampen export demand headed further into 2025. As it is, the extent to which panellists indicated that exports declined due to higher prices was already at the highest seen since last July.

Meanwhile services export business continued to expand globally midway through the first quarter of 2025. However, the rate of expansion eased to softest in just over a year and was only slight. Only the consumer services industry experienced any notable rise in export business among the eight industries tracked in February, while financials led the downturn.

Detailed sector PMI data meanwhile showed that all of the top five sectors leading growth of exports were services sectors - namely the insurance, tourism & recreation, media, other financials and commercial & professional services sectors. Other sectors seeing an improvement in export business had recorded only marginal upticks in new orders from abroad. On the other hand, it was also services sectors - the banks and real estate - that led the downturn in export orders in February.

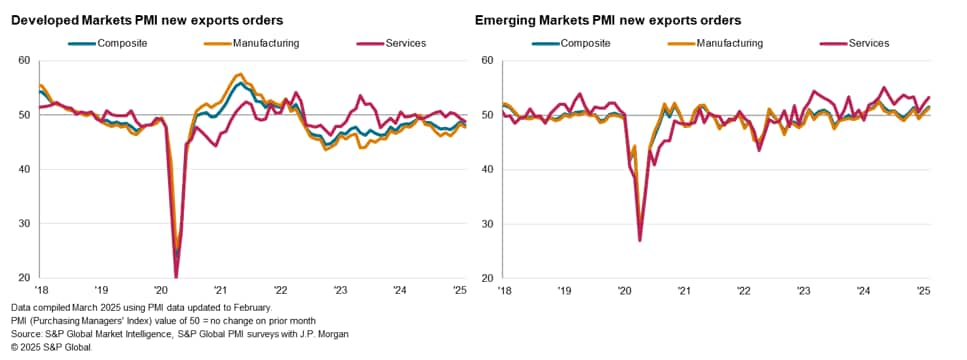

While a convergence of sector trade conditions was observed, a widening divergence by region was evident in February. Developed economies received fewer export orders across both the manufacturing and service sectors, both falling at accelerated rates. Although the developed market manufacturing economy recorded the steeper fall of the two sectors, services export business notably contracted at the fastest pace since the end of 2023.

In contrast, emerging market export business expanded for a second successive month and at the quickest pace in ten months. Growth in export business was also broad-based with both goods and services exports growth accelerating since January. Although mild, the pace at which manufacturing export orders rose was the fastest since last April. That said, against a backdrop of trade uncertainty in February, there lacks conviction that the ongoing improvement in emerging market goods export represent a recovery. Instead, we continue to find evidence of the trend representing the front-loading ahead of further US tariffs, especially amidst frequent mentions of US policy uncertainty among panellists in the latest survey period. Any changes in trend here will be closely watched with the upcoming March PMI releases for insights into the impact of recently administered tariffs in the US and across other parts of the world.

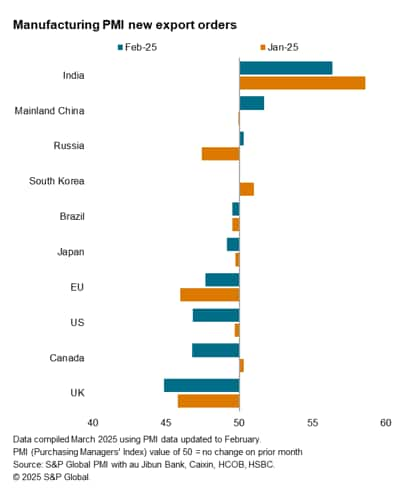

The number of top ten trading economies reporting higher exports increased to four from three in January, though with South Korea and Russia recording only marginal improvements. Growth in exports continued to be led by India. Export demand for Indian manufactured goods remained strong even as it eased from January's near 14-year high, thereby underscoring the robust performance of the Indian manufacturing sector at the start of 2025. Moreover, India continued to maintain a wide lead against the next best-performing major goods exporter, which was mainland China, in February. Export orders in mainland China returned to growth for the first time in three months. Although modest, the rate of export orders expansion was the fastest since last April.

In contrast, the UK recorded the sharpest fall in goods trade among the top ten trading economies. The pace at which manufacturing export orders declined was also the steepest in a year, unfolding amidst a deepening downturn in the UK manufacturing sector that is affected by weak demand and rising price pressures. The US and Canada meanwhile both saw similar steep export falls, both having seen goods trade conditions worsen from near-neutral conditions at the start of the year. Meanwhile the EU saw the rate of export demand contraction ease to the least pronounced level in nearly three years. According to the HCOB Eurozone Manufacturing PMI, the eurozone manufacturing sector saw the smallest deterioration in health in nearly two years. Finally, manufacturing export orders again declined only marginally in Brazil and Japan.

Access the press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings