Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 29, 2016

US economy slowed sharply in late 2015 with warning lights flashing for 2016

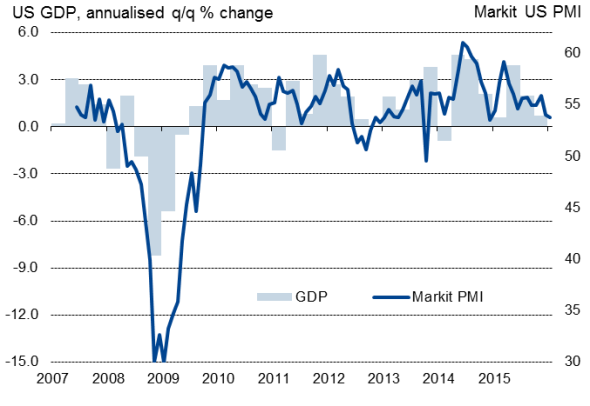

US economic growth slowed sharply in the final quarter of last year, according to the first official estimate. At least some of the weakness looks temporary, but there are also signs that the underlying pace of expansion is on the wane.

Gross domestic product rose at an annualised rate of just 0.7% in the three months to December, down from 2.0% in the third quarter. The final quarter's reading completes a year in which the economy grew 2.4%, unchanged on the expansion seen in 2014.

Consumer uncertainty

Overall consumer spending rose at an annualised rate of 2.2%, down from 3.0% in the third quarter. At least some of this could be accounted for by subdued winter clothing sales resulting from the unseasonably mild weather, but the drop in growth of consumer spending will no doubt sustain fears that the US economy is reaping few benefits from the oil price rout while paying the cost as oil sector revenues plunge. Business investment on structures and equipment fell at 5.3% and 2.5% rates respectively, with overall investment in the mining sector plunging by over a third in 2015.

Speed bump?

Rising inventories meanwhile took almost half a percentage point off the pace of growth, and the mild weather also led to reduced demand for energy for heating, adding further to evidence that the slowdown may prove temporary. If the economy merely hit a speed bump, GDP could rebound in the first quarter.

However, the recent increase in financial market uncertainty, and expectations of an upward trend in interest rates in 2016, may mean consumers and businesses will continue to show reluctance to spend. There are already signs that we should expect a further disappointment in the first quarter GDP number. Markit's flash PMIs pointed to a further slackening-off in the rate of economic growth at the start of the year. The official first quarter GDP data have also typically been weak in recent years, appearing to retain some seasonality, a pattern which may well be repeated in 2016.

Markit PMI points to further Q1 weakness

The slowdown adds more pressure to the Fed to reconsider the timing of future rate hikes, and suggests that policymakers may pare back their current expectations of a further four quarter-point hikes in 2016.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-Economics-US-economy-slowed-sharply-in-late-2015-with-warning-lights-flashing-for-2016.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-Economics-US-economy-slowed-sharply-in-late-2015-with-warning-lights-flashing-for-2016.html&text=US+economy+slowed+sharply+in+late+2015+with+warning+lights+flashing+for+2016","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-Economics-US-economy-slowed-sharply-in-late-2015-with-warning-lights-flashing-for-2016.html","enabled":true},{"name":"email","url":"?subject=US economy slowed sharply in late 2015 with warning lights flashing for 2016&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-Economics-US-economy-slowed-sharply-in-late-2015-with-warning-lights-flashing-for-2016.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+economy+slowed+sharply+in+late+2015+with+warning+lights+flashing+for+2016 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012016-Economics-US-economy-slowed-sharply-in-late-2015-with-warning-lights-flashing-for-2016.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}