Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 28, 2015

Shorts gain on Chinese A-Share ETFs

Offshore based investors have harnessed ETFs as an efficient vehicle to gain exposure to falling Chinese equities, while local Chinese investors have flocked to money market ETFs.

- Offshore investors able to short sell ~$1.2bn in ETFs tracking Chinese markets

- Local Chinese investors find refuge in money market ETFs, with record inflows of $10bn

- ETFs seeing significant foreign demand to short sell; cost to borrow above 25%

No shorting on the mainland

Chinese market regulators have turned to a familiar protagonist in order to explain the recent rout in domestic market; short sellers. But securities lending data shows that this accusation is by and large overblown, given the minimal short selling in mainland listed single names. The recent market rout cannot be blamed on short sellers of ETFs either, as the aggregate short position represents less than 1.2% of total ETF AUM.

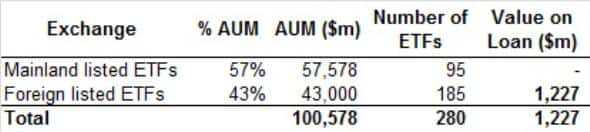

Investors have been able to gain short exposure to Chinese markets by using US and Hong Kong listed ETFs, essentially circumventing measures by the Chinese government to limit such activity domestically. The total value on loan of short bets on Chinese ETFs amounts to $1.23bn.

In total, over $100bn in ETFs track Chinese markets, with 57% listed on the mainland in Shanghai and Shenzen exchanges. These funds see no significant levels of short interest according to Markit securities lending data on ETFs. The shorting action has instead been concentrated on overseas listed ETFs which trade on the Hong Kong Stock Exchange and NYSE and are much more easily accessible to short sellers.

X-trackers popular

The highest conviction shorting activity has occurred in China A-Share ETFs, with demand from short sellers driving up the cost to borrow A-Share ETFs substantially higher than their H-Shares and ADR counterparts. These had historically been the preferred conduit for short sellers.

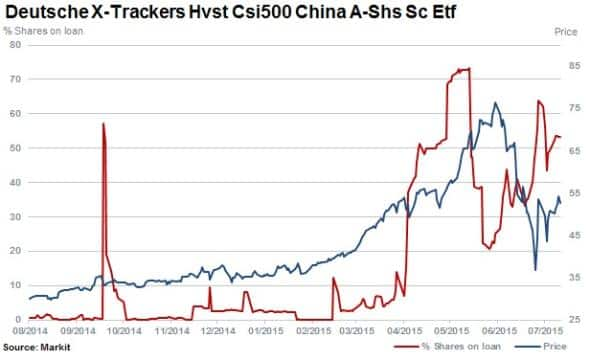

The Deutsche X-trackers Harvest CSI 500 China A-Shares Small Cap ETF (ASHS) is the most short sold ETF exposed to the region, with 53% of shares outstanding on loan and $17m of value on loan. Currently more than 90% of available stock is short sold. The ASHS tracks 500 small cap companies listed on the Shanghai and Shenzhen stock exchanges.

Paying up for liquid large caps

Related to the ASHS but focusing on the 300 most liquid stocks in the China A-share market, the Deutsche X-trackers Harvest CSI 300 China A-Shares ETF (ASHR) is the most in demand ETF from short sellers. The ETF has a cost to borrow three times that of ASHS's cost of almost 10%. ASHR has $595bn in AUM and $38m in value on loan.

Both ETFs have limited stock currently available to lend, which has played a role in driving the fees to borrow higher. Accordingly utilisation levels of available stock are currently very high at of 90% for ASHS and 98% for ASHR.

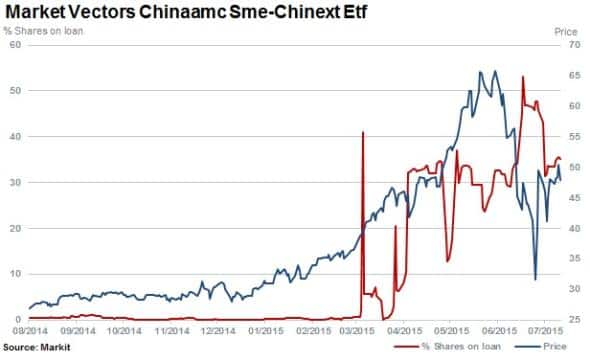

With utilisation of lending stock available nearing 100%, the Market Vectors Chinaamc Sme-Chinext ETF (CNXT) is the second most short sold China exposed ETF. With $46bn in AUM, $15m in value on loan and 35% of shares outstanding on loan, short sellers are currently prepared to pay a high cost to borrow to short the ETF which tracks small and medium-size companies traded on the SME Board and ChiNext Board of the Shenzhen Stock Exchange.

Money market ETFs to the rescue

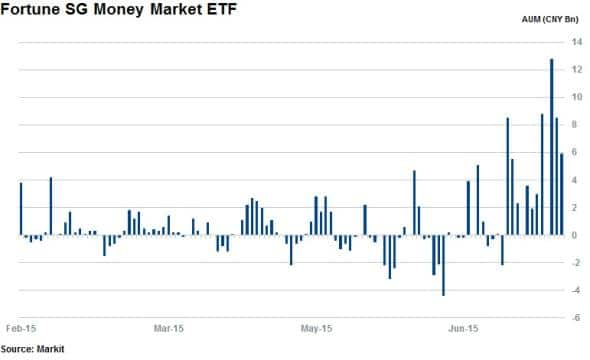

Domestic investors have flocked to the largest ETF (by AUM) in China, the Fortune SG Money Market ETF, which holds $16bn currently and saw record inflows totalling CNY57.6bn ($9.2bn) in July alone. Investing in this fund shields investors from falling equities as the government grapples with stabilising volatility in the stock market.

China shows 'hand' of the market

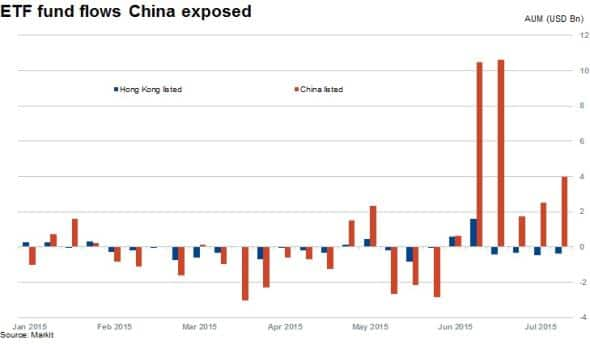

In the last four weeks investors have withdrawn $1.5bn from ETFs listed in Hong Kong that are exposed to China. Meanwhile, strong inflows of $18.8bn were recorded flowing into Chinese listed China exposed ETFs. There is speculation that these strong inflows emanate from local authorities in efforts to stabilise the markets.

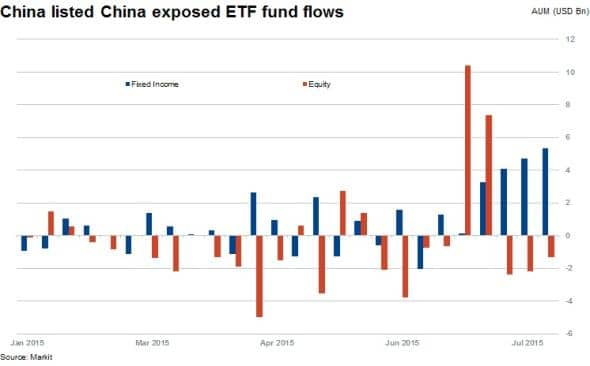

The three weeks post significant inflows in China has seen local investors move out of equity and into fixed income. Aggregate Chinese listed ETF flows income reveals that investors have pulled $5.9bn from equity ETFs while fixed income ETFs have attracted $14.1bn of inflows.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Equities-Shorts-gain-on-Chinese-A-Share-ETFs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Equities-Shorts-gain-on-Chinese-A-Share-ETFs.html&text=Shorts+gain+on+Chinese+A-Share+ETFs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Equities-Shorts-gain-on-Chinese-A-Share-ETFs.html","enabled":true},{"name":"email","url":"?subject=Shorts gain on Chinese A-Share ETFs&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Equities-Shorts-gain-on-Chinese-A-Share-ETFs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+gain+on+Chinese+A-Share+ETFs http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Equities-Shorts-gain-on-Chinese-A-Share-ETFs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}