Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 28, 2015

European investors head overseas for yield

With the US and Europe pursuing diverging monetary policy paths, European investors have been eagerly adding to their positions in US exposed bond ETFs which now yield much more than domestic products.

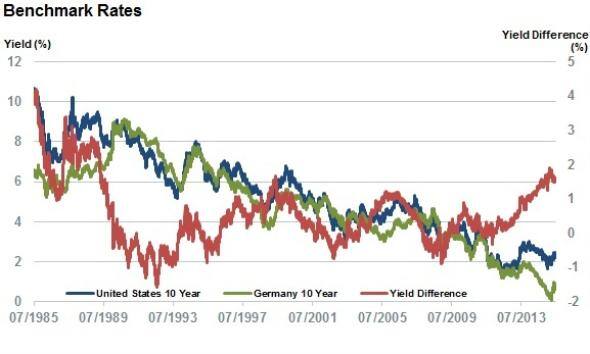

- Extra yield offered by 10 year US treasuries over bunds hit a 27 year high in March

- European listed US dollar bond ETFs have seen record inflows in the last two quarters

- European investors have been buying up corporate bonds in the recent spree

The global quest for yield has sent European bond investors to US shores in the wake of the ECB's QE policy. This programme has pushed benchmark interest rates down to all-time lows, as measured by the 10 year German bund whose yield fell below 8bps on April 20th. While bund yields have rebounded somewhat in recent weeks, the current 70bps delivered by the euro's benchmark rate is still just a quarter of its ten year average of 2.7%. These low yields are set to persist, as the ECB has committed to continue the programme until September 2016 at the very earliest.

These low rates coincide with increasingly loud talk from US policy makers in regards to a rate rise this side of the 2016. This talk has seen 10 year US treasury rates lift above the 2% mark, where it traded at for much of last year. These diverging monetary policies mean that the extra yield delivered by 10 year treasury bonds over their German counterparts now stands at 1.55%; three times the average seen over the last ten years.

European ETF investors head abroad

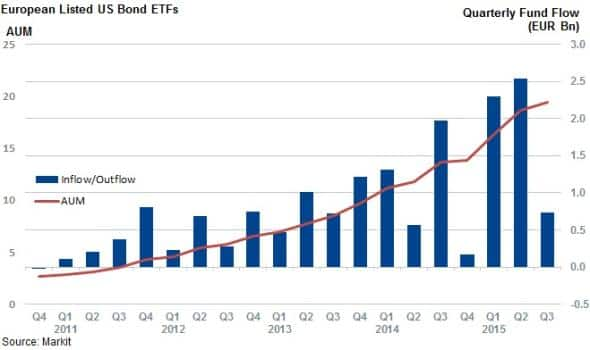

European investors have taken heed of this trend, as European listed US exposed bond ETFs have experienced their strongest inflows on record over the last few months. This trend is no doubt driven in part by a search for yield, given the depressed levels of income delivered by European bonds over the last few months.

The 77 products which provide European exposure to the US debt market have seen over $2bn of inflows in each of the opening quarters of the year; their best performance on record. This trend shows no signs of slowing down as that these funds have already seen over $780m of inflows in the opening three weeks of the third quarter, putting them on track to match the previous quarters.

From a European investor perspective the prospects of a US rate rise, which has spooked the dollar denominated bond market, could also be less daunting. This is due to the fact that higher US interest rates could push the value of the dollar up against that of the European currencies that these funds trade in.

Corporate exposure favoured

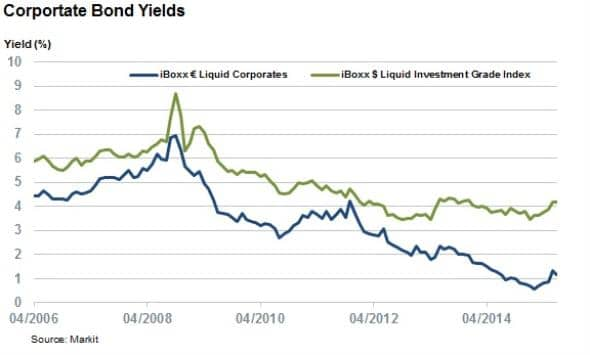

The funds most favoured by European investors since the start of the year have been corporate products. These funds have gathered $3.9bn of the $5.5bn of US bond exposure invested by European investors since the start of the year. This dwarfs the inflows seen in government bond funds by over four to one; no doubt driven by a quest for yield.

US dollar denominated investment grade corporate bonds now yield over 3% more than their euro peers, according to the yield difference between the Markit iBoxx $ Liquid Investment Grade and Markit iBoxx € Liquid Corporates indices.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Credit-European-investors-head-overseas-for-yield.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Credit-European-investors-head-overseas-for-yield.html&text=European+investors+head+overseas+for+yield","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Credit-European-investors-head-overseas-for-yield.html","enabled":true},{"name":"email","url":"?subject=European investors head overseas for yield&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Credit-European-investors-head-overseas-for-yield.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+investors+head+overseas+for+yield http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Credit-European-investors-head-overseas-for-yield.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}