Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 29, 2015

China's fixed income stable amid equities volatility

China's equity market is experiencing some of the most severe correction on record, but the volatility has not reached the country's bond market.

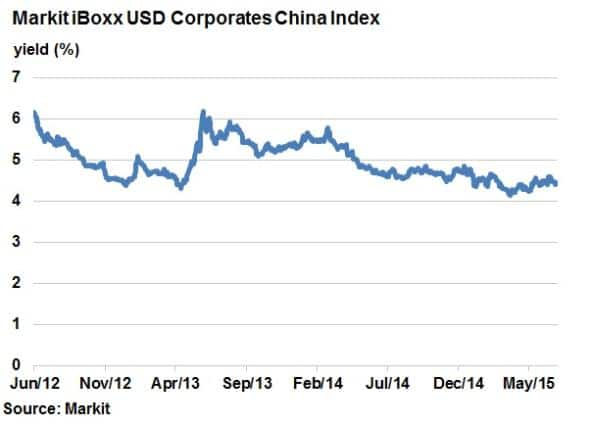

- Markit iBoxx USD Corporates China index's yield is 3bps tighter this month

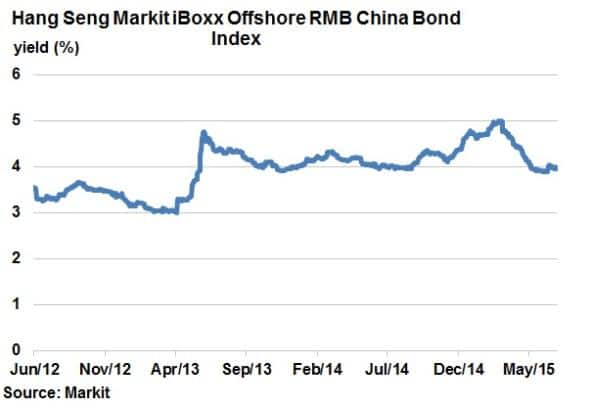

- China's offshore RMB bond market has seen its average yield fall 1% since March

- Gains driven by a recovery in real estate, which makes up a large share of the market

The Shanghai composite equity index has fallen around 30% from the highs seen in mid-June. This volatility has spurred Chinese policy makers to react with a combination of market restrictions and a loosening of monetary policy.

But these steps appear to have had little impact on the equity market, as evidenced by the 8% fall on Monday. Though Chinese equities are still in positive territory for this year overall, the severity of the recent drop has led to speculation of a bubble bursting.

One area that looks to have benefited from the loosening of China's monetary policy has been the country's burgeoning bond market, which has proven relatively immune to the volatility seen in equities. This holds true for both RMB and dollar denominated debt.

Dollar bonds resilient

China's eurobond market, which is made up of US dollars denominated debt issued by Chinese corporates, has seen little deterioration. The Markit iBoxx USD Corporates China Index has seen its yield fall 26bps in 2015, range bound between 4% and 5%. This trend has held up even in the worst of the equity volatility as the index has seen its yield tighten by 3bps in July so far.

China's investment grade euro dollar bonds have also proven more resistant to the recent global commodities slump which has hurt Latin American and Australian credit.

Oil and gas issuers make up 22% of the index, second only to real estate which makes up 23% of the index. China's investment grade issuers have proved largely resilient to the recent challenges. The sector, which includes names such as Sinopec group and CNPC General Capital, actually has a lower asset swap spread than the average seen across the index.

Real estate leads offshore RMB tightening

China's fast growing domestic bond market is the third largest in the world behind the US and Japan, and the RMB has become an important funding currency.

China's offshore RMB bond market has seen its yield fall 1% since March; now the lowest since last September according to the Hang Seng Markit iBoxx Offshore RMB China Bond index. The index yield is currently less than 4%.

Real estate issuers, which are the second best represented sector behind banks, have led the recent tightening as demonstrated by the performance of Central Plaza Development. The company, which is the largest real estate issuer of the RMB index, has seen its 5.75% 2017 notes trade 100bps tighter since the start of the year.

Oil and gas issuers make up small percentage of the index has isolated it somewhat from the recent slump.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072015-Credit-China-s-fixed-income-stable-amid-equities-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072015-Credit-China-s-fixed-income-stable-amid-equities-volatility.html&text=China%27s+fixed+income+stable+amid+equities+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072015-Credit-China-s-fixed-income-stable-amid-equities-volatility.html","enabled":true},{"name":"email","url":"?subject=China's fixed income stable amid equities volatility&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072015-Credit-China-s-fixed-income-stable-amid-equities-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China%27s+fixed+income+stable+amid+equities+volatility http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072015-Credit-China-s-fixed-income-stable-amid-equities-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}