Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 27, 2015

UK economic growth slows to 0.5% in third quarter

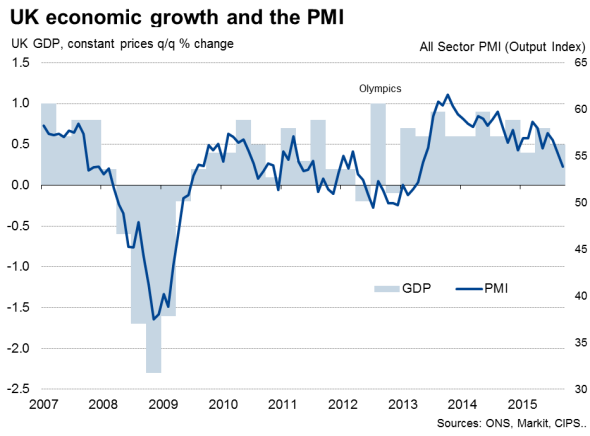

The UK economy lost growth momentum in the third quarter, weakening more than expected according to market expectations but in line with the survey data.

The third quarter slowdown, and warning lights from recent business surveys about the weakness intensifying in September, suggests that policymakers will want more time to assess the extent of the slowdown as we move into the fourth quarter, effectively postponing any rate hikes until next year.

GDP growth slows in line with PMI

Official data showed gross domestic product rising by 0.5% in the three months to September, down from 0.7% in the second quarter and below the consensus expectation of 0.6% (based on a Reuters' poll of economists).

Although the growth rate remained reasonably solid, the concern is that there are signs that the fourth quarter could be even weaker. In particular, PMI survey data signalled a marked slowdown in business activity growth in September, suggesting the economy has entered the fourth quarter expanding at a pace of just 0.3%.

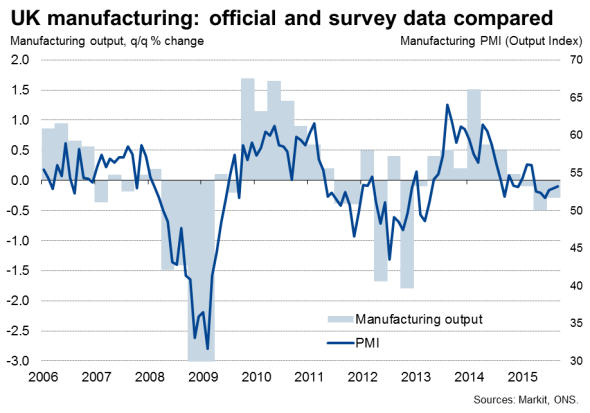

Downturns in manufacturing, construction

The slowdown is being led by the manufacturing sector, which is seeing a renewed recession as output has now fallen for three consecutive quarters, suffering a 0.3% decline in the three months to September. Manufacturing output has so far fallen 0.9% this year. Producers are struggling as weak demand in many overseas markets, notably China and other emerging nations, is being exacerbated by the appreciation of sterling.

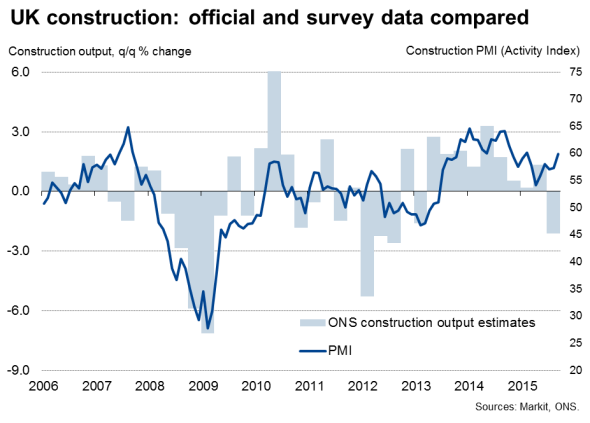

The construction sector also acted as a drag on the economy in the third quarter, with output slumping 2.2%, the largest fall for three years.

However, figures for the construction sector tend to be heavily revised, meaning it would be unwise to put too much emphasis on this early estimate in assessing the health of the building industry. Survey data paint a contrasting, brighter, picture of construction sector growth, buoyed in particular by house building.

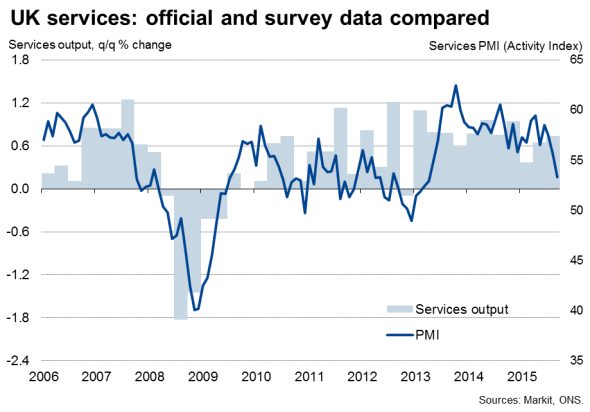

Service sector strength could wane

The main growth driver was therefore the service sector, where output rose 0.7% in the third quarter, its best performance so far this year. It seems likely that services growth is being buoyed by households, where the combination of low mortgage rates, rising wages and falling prices (and low energy and fuel bills in particular) are providing an ongoing boost to spending.

The cause for concern here is that the business surveys indicate that the slowdown is spreading from the struggling manufacturing sector to the far larger services economy, meaning growth looks set to ease further in the fourth quarter. The economy therefore looks to be on course to grow by 2.3% in 2015, down from 2.9% in 2014 and below its long-term trend rate.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Economics-UK-economic-growth-slows-to-0-5-in-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Economics-UK-economic-growth-slows-to-0-5-in-third-quarter.html&text=UK+economic+growth+slows+to+0.5%25+in+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Economics-UK-economic-growth-slows-to-0-5-in-third-quarter.html","enabled":true},{"name":"email","url":"?subject=UK economic growth slows to 0.5% in third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Economics-UK-economic-growth-slows-to-0-5-in-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economic+growth+slows+to+0.5%25+in+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Economics-UK-economic-growth-slows-to-0-5-in-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}