Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 23, 2015

Week Ahead Economic Overview

Economic data are likely to show that growth has slowed in the US and UK, as preliminary third quarter GDP numbers are published throughout the week. More information on the health of the eurozone economy will meanwhile be provided by updates on consumer confidence, inflation and unemployment data. Perhaps most closely watched, however, will be the US Fed's latest interest rate decision.

One of the biggest topics for financial markets this year so far has been the timing of the Fed's first rise in interest rates since 2008. The Federal Reserve left monetary policy unchanged at its September meeting amid worries about China and financial market volatility , stressing that it will observe the data flow carefully for signs of stronger inflation and reassurance that the US economy is stable enough to absorb the effects of a rate rise. Recent data have been disappointing, pushing out rate hike expectations into next year.

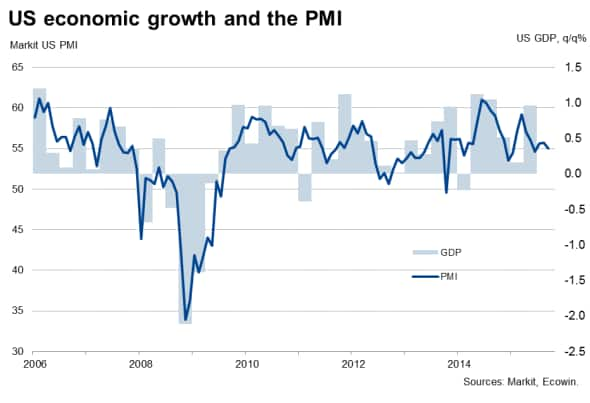

US consumer prices were unchanged in the 12 months to September and economic growth is expected to have slowed in the third quarter, with GDP numbers released on Thursday. PMI survey data are consistent with economic growth of around 2.2%, while economists polled by Thomson Reuters predict a slightly weaker expansion of 1.7%. Data on trade, personal spending and durable goods will provide data watchers with additional information on how the US economy performed in the third quarter.

Information on the health of the US economy in the final quarter of 2015 will meanwhile be provided by Markit's flash US Services PMI results, released on Tuesday.

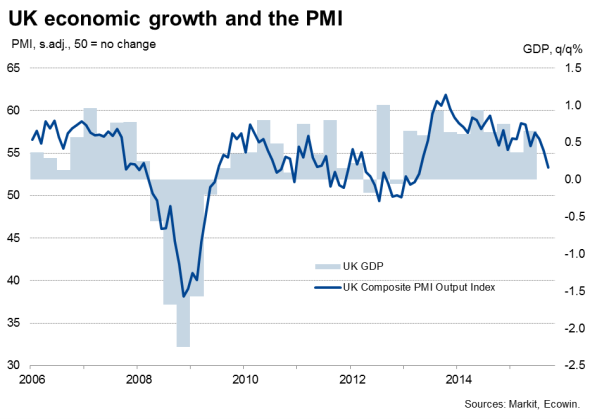

The data flow in the UK has also been disappointing in recent months, suggesting that economic growth has slowed in the third quarter, official GDP data for which will be released on Tuesday. PMI data point to GDP growth of 0.5%, down from 0.7% in the second quarter, as the strong pound and global economic uncertainty look to have taken their tolls. The survey data highlight how the persistent weakness of the manufacturing sector has spread to the services economy.

The Bank of England is in no rush to start raising interest rates, with only one of nine members of the Monetary Policy Committee, Ian McCafferty, voting for a rate hike at the bank's latest meeting. Markets don't expect a first rate rise until the end of next year, with survey data from Markit suggesting that households have become more dovish since September.

Eurozone analysts and policy makers will be treated to a raft of fresh data, including consumer confidence, inflation and unemployment numbers. With consumer prices falling and the economy growing at only a moderate pace of just 0.4%, according to flash PMI data, it seems likely that the ECB is edging closer to unleashing more monetary stimulus. In the press conference following October's ECB Governing Council meeting, Mario Draghi stated that "the degree of monetary policy accommodation will need to be re-examined at our December monetary policy meeting."

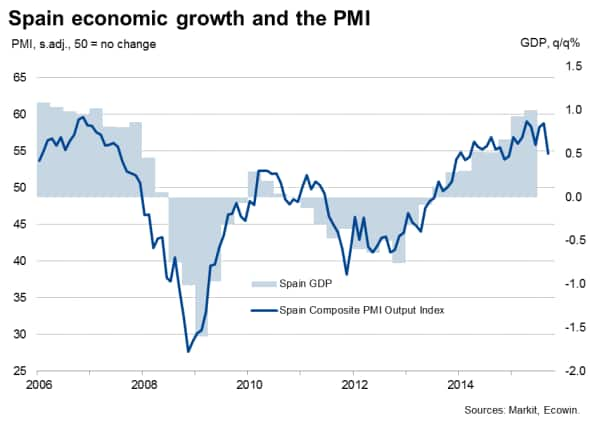

Meanwhile, third quarter GDP numbers are out in Spain. The Spanish economy has proved to be one of the leading lights in the eurozone recovery story, and it is likely that economic growth continued to run at a similar pace to the 1.0% rate in the second quarter, though recent PMI data suggest there are signs of growth waning.

Over in Asia, retail sales, inflation and household spending data in Japan will dominate the agenda in a quiet week for data watchers. September PMI data signalled a loss of growth momentum in the Japanese economy alongside the first fall in prices in almost two years. Expectations are therefore building that authorities will unveil new fiscal and monetary stimulus plans. However, the flash manufacturing PMI showed a positive start to the fourth quarter.

Monday 26 October

In Germany, import price numbers and latest Ifo business climate data are published.

Mortgage approval figures are released by the British Bankers' Association.

Consumer confidence numbers are meanwhile issued in Brazil.

The US Census Bureau publishes new home sales data.

Tuesday 27 October

Third quarter unemployment data are released by Statistics South Africa.

M3 money supply information are issued in the eurozone.

The UK sees the release of preliminary third quarter GDP numbers.

In Brazil, producer price data are out.

Durable goods orders, Shiller home price and Markit flash services PMI data are published in the US.

Wednesday 28 October

Australia sees the release of consumer price data.

Meanwhile, retail sales numbers are published in Japan.

M3 money supply data are issued in India.

GfK published consumer confidence numbers for Germany, while Destatis releases retail sales figures.

France and Italy also see the publication of consumer confidence data.

The US Bureau of Economic Analysis and the US Census Bureau publish trade data, while the Board of Governors at the Federal Reserve Bank announces its latest monetary policy decision.

Thursday 29 October

Trade price figures are published by the Australian Bureau of Statistics.

The Reserve Bank of New Zealand announces its latest monetary policy decision.

Industrial output numbers are issued by the Japanese Ministry of Economy, Trade and Industry.

In South Africa, M3 money supply and producer price data are out.

The European Commission releases economic sentiment data for the currency union.

Unemployment and consumer price numbers are meanwhile published in Germany.

Retail sales and inflation figures are meanwhile updated in Spain.

The Bank Austria Manufacturing PMI is published.

Nationwide releases house price numbers for the UK, while the Bank of England issues consumer credit and mortgage approval data.

In Canada, producer price figures are updated.

Third quarter GDP data and initial jobless claims numbers are out in the US.

Friday 30 October

In Australia, producer price numbers and private sector credit data are issued.

Consumer price and household spending data are released in Japan alongside construction orders and housing starts data.

Meanwhile, South Africa sees the release of trade numbers.

The Bank of Russia announces its latest monetary policy decision.

The eurozone sees the publication of consumer price and unemployment data.

Consumer spending numbers are out in France, while third quarter GDP numbers and current account data are issued in Spain.

Producer price figures are issued in Greece and Italy, with the former also seeing the release of retail sales numbers.

GfK consumer confidence data are published for the UK.

Brazil sees the release of budget balance numbers.

Monthly GDP numbers are out in Canada.

The latest Reuters/Michigan Consumer Sentiment Index is published in the US alongside personal spending data.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}