Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 27, 2016

UK economy picks up speed in second quarter but signs of slowdown appear

The UK economy gained momentum in the second quarter before the EU referendum, but growth looks set to slow sharply in the third quarter, with the risk of a downturn having risen sharply as post-referendum data have disappointed.

Policymakers won't be especially interested in what happened prior to the June 23rd vote, and the August policy meeting at the Bank of England will instead focus on how the economy has fared since the Brexit vote.

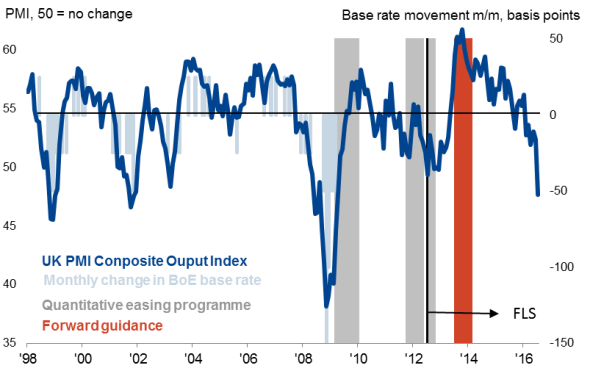

The sharp fall in the flash PMI in July has already been singled out by one MPC member, Martin Weale, as making him more inclined to vote for more stimulus sooner rather than later. Expectations have therefore risen that the MPC will vote to cut interest rates, probably by 0.25%, at its August meeting, with other non-standard measures such as additional quantitative easing also being mooted.

Growth accelerates in Q2

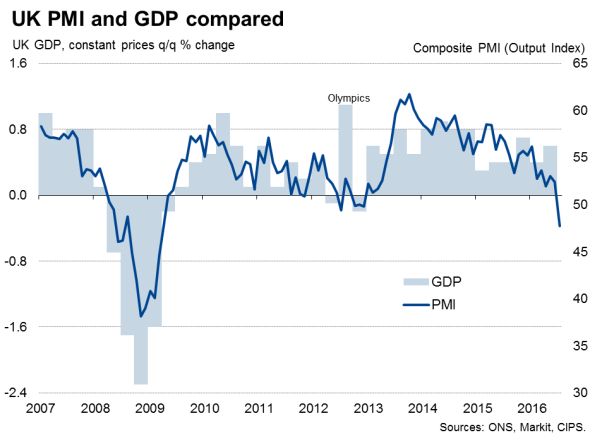

The first estimate of gross domestic product from the Office for National Statistics indicated that the economy grew 0.6% in the second quarter, up from 0.4% in the first three months of the year.

Growth was boosted by a surprisingly strong 2.1% surge in industrial production - the fastest rate of increase seen since 1999. Manufacturing output jumped 1.8%, recovering from a decline in the first quarter. Service sector output grew 0.5%, a solid reading though down from 0.6% in the first quarter and its weakest rise for a year. Construction output meanwhile fell 0.4%, meaning the building sector is now in a technical recession.

The strong industrial production and services growth figures need to be treated with caution, as these quarterly estimates are based largely on data from the early part of the quarter, with April having been an especially strong month. Evidence points to growth having slowed into June, which could mean these figures are subsequently revised lower. Survey data pointed to a mere 0.2-0.3% expansion of the economy in the second quarter.

Third quarter downturn risk

Current indicators point to the economy turning down in the third quarter, though longer-term prospects remain more uncertain. Markit's flash PMI for July pointed to the steepest falls in the survey's output, order books and future expectations indices on record. The headline PMI is now down to its lowest since April 2009; a level broadly consistent with GDP falling at a quarterly rate of 0.4%.

A recent CBI poll has also shown optimism among manufacturers sliding to its lowest since 2009.

Surveys of consumers, such as Markit's Household Finance Index, meanwhile show that the majority of survey respondents believe the referendum result has damaged the UK economy's short-term prospects, but that the longer-term impact was seen to be more neutral. As such, the data point to consumers potentially reining-in spending in coming months until the longer-term picture becomes clearer.

Policy stimulus to shore up confidence

It remains to be seen if the recent weak data for July are a reflection of the immediate shock of the Brexit vote and a knee-jerk reaction of many companies to cancel or postpone orders, meaning growth will quickly pick up again as the shock passes. Policymakers are unlikely to risk taking such a complacent view, however, and its seems likely that the August MPC meeting will see the announcement of more stimulus designed to provide a boost to business and consumer confidence, helping to soften the impact of the uncertainty caused by the Brexit vote.

PMI and Bank of England policy

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072016-economics-uk-economy-picks-up-speed-in-second-quarter-but-signs-of-slowdown-appear.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072016-economics-uk-economy-picks-up-speed-in-second-quarter-but-signs-of-slowdown-appear.html&text=UK+economy+picks+up+speed+in+second+quarter+but+signs+of+slowdown+appear","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072016-economics-uk-economy-picks-up-speed-in-second-quarter-but-signs-of-slowdown-appear.html","enabled":true},{"name":"email","url":"?subject=UK economy picks up speed in second quarter but signs of slowdown appear&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072016-economics-uk-economy-picks-up-speed-in-second-quarter-but-signs-of-slowdown-appear.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economy+picks+up+speed+in+second+quarter+but+signs+of+slowdown+appear http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072016-economics-uk-economy-picks-up-speed-in-second-quarter-but-signs-of-slowdown-appear.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}