Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 26, 2015

Shorts target investors' big oil shelter

Large firms have been a source of relative outperformance in the Oil & Gas sector over the recent slump, but short sellers have been targeting some of the sector's largest names ahead of earnings.

- Oil & Gas majors have outperformed minors by 50% since the beginning of 2014

- Shorts find success in targeting smaller firms facing sustained lower energy prices

- ExxonMobil and Chevron see a $4bn surge in short interest value on loan

Relative safe haven of big oil

It has been a difficult period for Oil & Gas stocks as the price of crude and natural gas continues to come under pressure. Ahead of earnings from majors ExxonMobil and Chevron in the week ahead, expectations are that current supply gluts and peak storage levels will put further downward pressure on prices and the sector could fall further.

Major Oil & Gas firms have done relatively well in recent months compared to smaller focused players. This is due to the diversified nature and resilience of larger names, thanks in part to the sheer size of balance sheets involved and counter cyclical business units. Larger firms who have done well have tended to be those with vast refinery operations which have outperformed year to date.

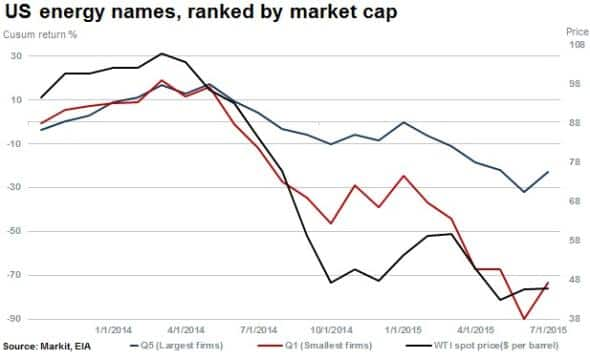

This outperformance trend is highlighted by using Markit's Research Signalsto rank Energy companies by market cap. This reveals that during the plunge in energy prices, investors have been rewarded for holding or taking shelter in larger names within the sector.

Across the US total cap universe, on a cumulative return basis, the largest fifth of US energy companies have outperformed by a material 50% spread since the beginning of 2014. While these larger companies have fallen 23% on average, the smallest fifth of firms have fallen by a staggering 74%.

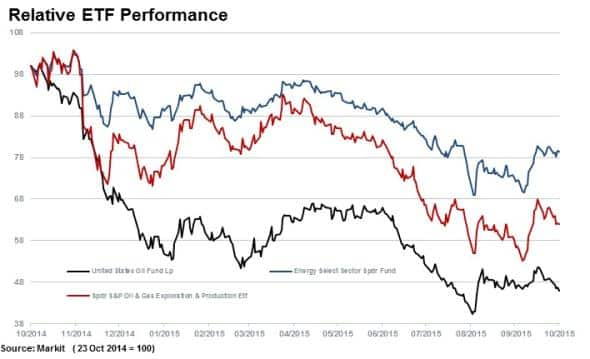

The clear benefits or attractiveness to investors of size and diversification is confirmed by the performance of select energy ETFs. The Energy Select Sector SPDR ETF has outperformed the SPDR Oil & Gas Exploration ETF by 17 percentage points year to date. The latter's constituents have an average market cap of $18.3bn while the former's (larger focus) constituents have an average market cap that is almost double at $33.9bn.

Shorts begin to target majors

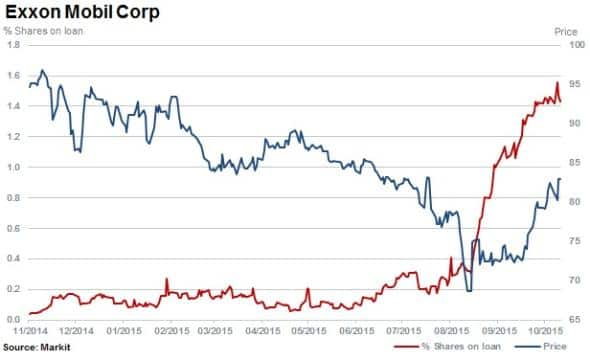

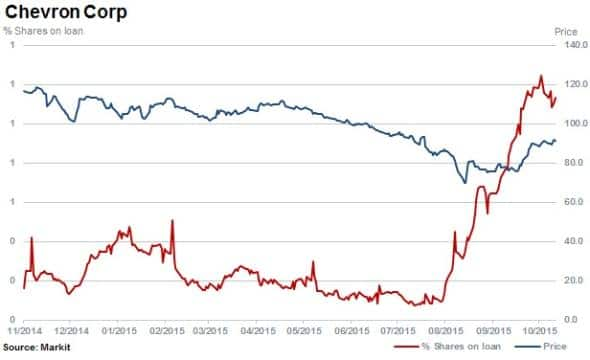

Short sellers have generally targeted smaller, more vulnerable firms in the Energy sector as seen by the relationship between the percentage of shares outstanding on loan and the market cap of companies. Even though short sellers have been attracted to smaller names, the bulk of the value on loan in the sector is held in the larger capitalisation names.

Currently with $3.4bn value on loan is ExxonMobil, the largest in the sector. As a percentage of shares outstanding on loan, the stock has a relatively insignificant level of short interest at 1.4%. However, this figure has increased six fold in the last three months, representing almost $3bn worth of short positions.

Similarly, shorts have increased positions in Chevron by almost $1bn in the last three months, with short interest rising more than threefold to 1.1% of shares outstanding on loan.

Conviction in shale shorts continue

Chesapeake Energy typifies the more "traditional shale short" seen over the past 18 months. Chesapeake has fallen 67% over the last 12 months and short sellers have increased positions to 28.7% of shares outstanding on loan. Despite losing more than two-thirds of its value, short seller's demand remains high with a cost to borrow nearing 15% to short Chesapeake.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26102015-equities-shorts-target-investors-big-oil-shelter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26102015-equities-shorts-target-investors-big-oil-shelter.html&text=Shorts+target+investors%27+big+oil+shelter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26102015-equities-shorts-target-investors-big-oil-shelter.html","enabled":true},{"name":"email","url":"?subject=Shorts target investors' big oil shelter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26102015-equities-shorts-target-investors-big-oil-shelter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+target+investors%27+big+oil+shelter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26102015-equities-shorts-target-investors-big-oil-shelter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}