Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 27, 2015

Egyptian credit risk climbs in earnest

The country's current account chasm and freefalling currency has seen the country's bonds exhibit its largest amount of credit risk in 18 months.

- CDS spreads now at 400bps, highest since the Sisi election

- Egypt's 10 year bonds have seen their yield jump by over 1% since their June issuance

- The country's 2040 USD bonds are trading with a spread of 500bps for the first time in two years

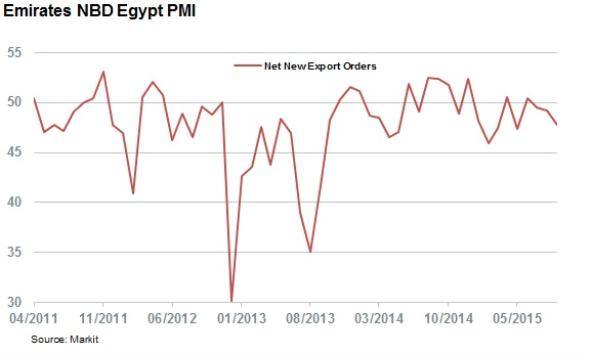

Egypt's slowing exports and foreign direct investment has put pressure on the country's current account, which has widened to recent highs. July's trade deficit stood at $4.4bn, a 39% increase compared to the same period in the previous year. The export imbalance shows little signs of slowing as the Net New Export portion of the September Emirates NBD Egypt PMI index compiled by Markit indicated that the country's exports fell at its fastest pace in six months as the index dropped further into negative territory.

This imbalance and resulting imbalance of payment has seen the country's foreign reserves more than halve from the levels seen four years ago. This has prompted Egyptian policy makers to devalue their currency by 12% against the US dollar.

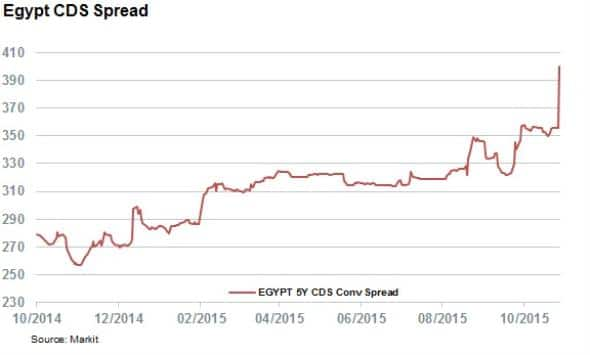

This devaluation, reminiscent of recent similar moves from hard up countries around the world, has in turn seen investors take an increasingly bearish view towards the country's sovereign debt. Egyptian 5 year CDS spreads now stand at 377bps, which is over 40% higher than the post "Arab spring" lows seen at the end of October last year.

The deterioration has accelerated in recent weeks with the 45 bps widening experienced today being the worst one day surge since the 2013 military overthrow of President Mohamed Morsi, led by current President Abdel Fattah el-Sisi.

Bonds starting to take a hit

The increased costs to insure Egyptian bonds against defaults are also reflected in the cash bond market as seen by the yields of the recently listed 5.875% June 2025 dollar denominated bonds jumping past the 6.8% mark. These bonds are now trading at 93 cents on the dollar after commanding a premium upon their initial issuance in June.

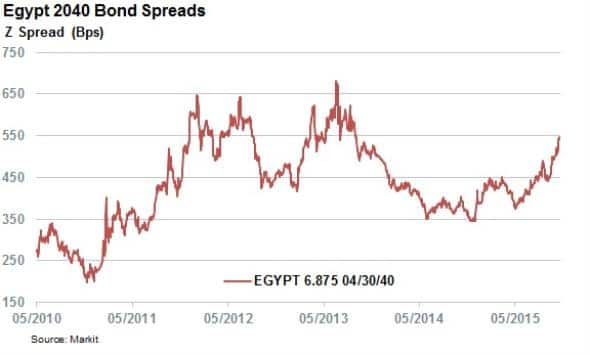

Things are equally bleak further down the maturity curve as the 6.875% notes maturing in April 2040 have seen their yield jump 1.2% in the last 12 months to 7.84%. This means that investors are now requiring more than 5% of extra yield to hold these bonds for the first time since just after the 2013 coup. While the spread is still 1.5% off the highs seen during the worst of the country's woes in 2013, the direction of travel shows that economic reality is trumping the country's recently found political stability in the eyes of investors.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Credit-Egyptian-credit-risk-climbs-in-earnest.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Credit-Egyptian-credit-risk-climbs-in-earnest.html&text=Egyptian+credit+risk+climbs+in+earnest","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Credit-Egyptian-credit-risk-climbs-in-earnest.html","enabled":true},{"name":"email","url":"?subject=Egyptian credit risk climbs in earnest&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Credit-Egyptian-credit-risk-climbs-in-earnest.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Egyptian+credit+risk+climbs+in+earnest http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Credit-Egyptian-credit-risk-climbs-in-earnest.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}