Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 27, 2015

The Canadian property short

Canada's property market has been supported by record low interest rates fuelling lending to overextended buyers, but a deteriorating economic outlook sustained by lower energy prices has attracted short sellers.

- PMI signals the sharpest decline in Canadian business conditions in survey history

- Shorts target non-traditional mortgage lender Home Capital as growth in loan book slows

- Canadian Western sees short sellers maintain high levels of positions as stock drifts lower

PMI signals further deterioration

The sudden oil price collapse in 2014 quickly filtered through, impacting the Canadian economy, which has roughly 20% of inherent structural exposure to energy markets. Sustained lower energy prices have continued to mount pressure, with the sharpest PMI decline in history reported this month for the manufacturing sector.

Weak economic data goes against earlier views this year from the finance ministry, which expected the lull in growth and contraction to be transitory and for the momentum in property prices to cool over the coming years, not crash.

Property bubbles on

Short sellers have been trying to call the top of the Canadian property market for some years now, which has proven to be a tricky trade as the continued cheapness of credit has continued to propel local demand and prices. Foreign buyers have also been exasperating the trend on the upper end of the market, which as fuelled price growth in Toronto and Vancouver.

The continued property price growth saw the Vancouver market become the most expensive in the world this year, estimated to be overvalued by 89% using the relative rental rates of other cities. Even the Bank of Canada has maintained its concerns that the market is overvalued to the tune of 30%. The bank cited continued low interest rates, commodity prices, risky consumer lending and record levels of debt burdens as culprits.

Lenders lead the shorts

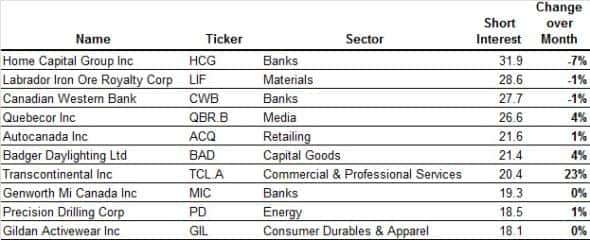

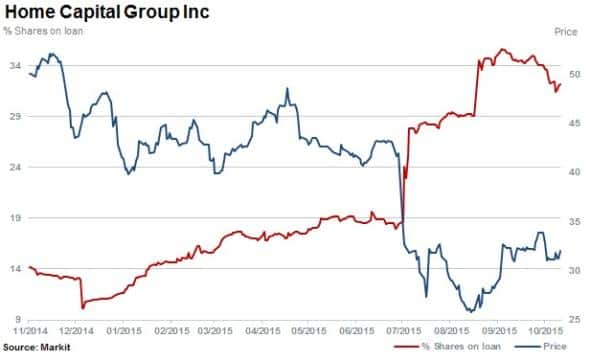

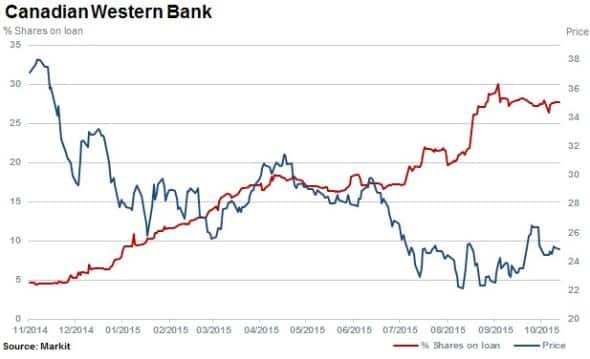

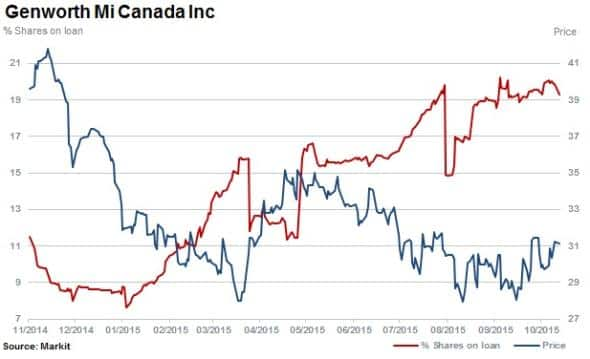

While the energy sector has proved fertile ground for short sellers over the past 12 months in the US and Canada, three of the top ten shorts in the region are financial institutions, which are exposed to the vulnerabilities in the housing market.

Prior the collapse in 2008, property price increases underlined the profit growth of lenders who continued to grow and securitise sizable residential portfolios. Like the US, less diversified lenders and regional banks in Canada will be more vulnerable to system shocks. This is more acute to operators in the "subprime" market. These firms are poised to suffer the most should borrowers come under pressure.

The most short sold name currently is mortgage lender Home Capital, which finances homeowners who "typically do not meet all the lending criteria of traditional financial institutions".

With 32% of shares outstanding on loan, the company reported lower second quarter origination volumes than were expected, impacted by a review of business partners, company conservative lending practices and competitive market. The news triggered an 18% sell off in shares and subsequent doubling in short interest levels. Additionally high demand to short Home Capital has seen its cost to borrow soar above 10%.

Fourth most shorted in the country is Canadian Western Bank with 27.7% of shares outstanding on loan. The bank has a significant portion of loans in commercial mortgages, real estate projects and personal loans and mortgages totalling 54% of a $19bn portfolio.

Short sellers have also targeted mortgage insurer Genworth Mi Canada, which has seen shares outstanding on loan increase to 19.3% in the last 12 months while the stock has slid 22%. The company specifically underwrites mortgage insurance for private residential mortgages.

The recent rise in short interest of Genworth has been accompanied by increased conviction from short sellers, as the cost to borrow Genworth shares to go short jumped tenfold in recent weeks to 500bps as of latest count.

Short seller's ambitions of profiting from an across the board price decline in Canada's housing market could be thwarted by the central bank as further rate cuts are expected, especially if the economic outlook deteriorates further. Additionally the US is now only expected to raise interest rates in 2016, further delaying possible market corrections.

However after Canada recently cut interest rates in July to 0.5%, there is not much manoeuvrability left to cushion a collapse in the housing market.

Relte Stephen Schutte, Analyst at Markit

Posted 27 October 2015

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Equities-The-Canadian-property-short.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Equities-The-Canadian-property-short.html&text=The+Canadian+property+short","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Equities-The-Canadian-property-short.html","enabled":true},{"name":"email","url":"?subject=The Canadian property short&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Equities-The-Canadian-property-short.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Canadian+property+short http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102015-Equities-The-Canadian-property-short.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}