Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 26, 2015

Investors shun covered bonds as more QE expected

The growing market consensus regarding more Eurozone quantitative easing has seen investors trim their covered bond holdings despite the asset class's spread standing at a yearly high.

- Markit iBoxx € Covered index spread over bunds stands at a yearly high of 55bps

- Covered bond ETFs have seen $143m of outflows so far in October

- Periphery yields remain higher than core, with Spanish covered bonds offering twice the yield of their French peers

Covered bonds have fallen out of favour with investors again. The quasi-rate product, which uses collateralisation and duel recourse as safety measures, have been around for over a hundred years without a single default. They have also been popular among the ECB as a product used to conduct QE, with covered bonds already being in the ECB's third round of purchases (CBPP3).

Last Thursday's ECB announcement that it would do whatever was warranted to bring eurozone inflation and growth back to target saw the asset class rally with the Markit iBoxx € Covered Bond index yield trading 4bps tighter on the day to 61bps. While encouraging at first glance, this lagged the overall market. The extra yield offered by the asset class as tracked by the benchmark spread was 2bps wider, taking that number to a 14 month high.

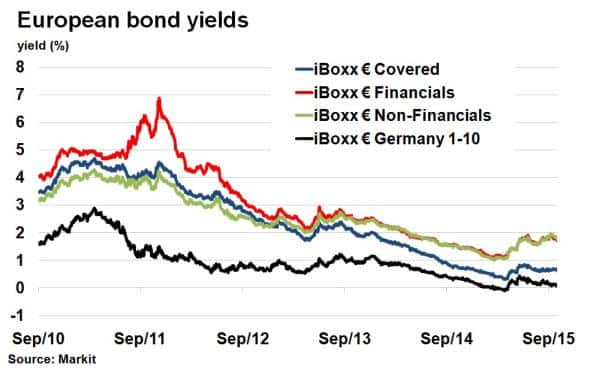

This marks a decoupling from recent market movements as the ECB's purchase of covered bonds under its recent quantitative easing program had sent the Markit iBoxx € Covered index spread down to all-time low levels. The index was yielding over 4% in 2011, on par with the iBoxx € Non-Financials index, but has since tightened significantly. Covered bond yields were pretty much on par with sovereign bonds over May, when the extra yield offered by the Markit iBoxx € Covered index was only 32bps more than the Markit iBoxx € Germany 1-10 index. That link looks to be weakening in current market conditions.

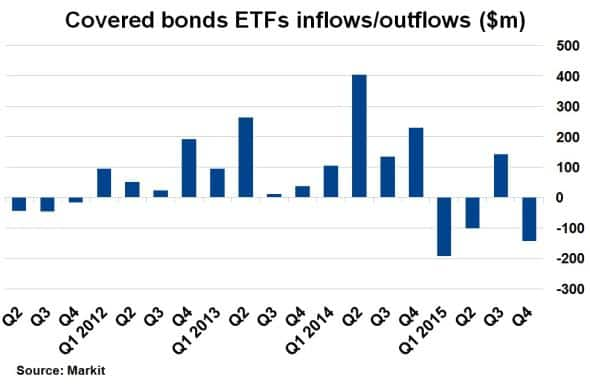

The asset class's rising spread over recent weeks has also seen ETF investors head to the door, with ETFs tracking covered bonds seeing $143m of net outflows so far in October. This puts them on track for their worst quarterly outflow in five years. Thin market liquidity and squeezed yields have also been a negative for income investors.

In search for yield

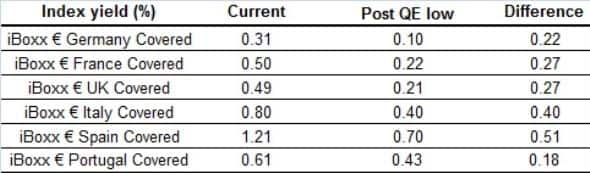

In terms of yields, covered bonds from Europe's periphery offer the highest returns. Spanish covered bonds, as represented by the Markit iBoxx € Spain Covered index, currently yield 1.21%, more than twice the amount of French covered bonds.

Covered bonds from Europe's periphery (Italy and Spain) have actually diverged in credit risk versus covered bonds from Europe's core (France and Germany) over the past month, yielding 40bps (Italy) and 51bps (Spain) more than post-QE lows. As investors shun covered bonds, certain segments of the market may prove to be attractive than others should the ECB deliver a monetary boost to the region.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26102015-Credit-Investors-shun-covered-bonds-as-more-QE-expected.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26102015-Credit-Investors-shun-covered-bonds-as-more-QE-expected.html&text=Investors+shun+covered+bonds+as+more+QE+expected","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26102015-Credit-Investors-shun-covered-bonds-as-more-QE-expected.html","enabled":true},{"name":"email","url":"?subject=Investors shun covered bonds as more QE expected&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26102015-Credit-Investors-shun-covered-bonds-as-more-QE-expected.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+shun+covered+bonds+as+more+QE+expected http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26102015-Credit-Investors-shun-covered-bonds-as-more-QE-expected.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}