Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 26, 2016

Wells Fargo CDS spread still lowest among peers

The ongoing scandal surrounding Wells Fargo has seen its CDS spread widen significantly since the start of September, but the bank is still viewed as the least risky among its peer group of large US banks.

- Wells Fargo CDS spread has widened by 7.4bps in September, remains tightest of peer group

- Wells Fargo spread discount to peers less than 20bps for the first time since July of last year

- Spread widening largely contained to Wells Fargo

The scandal that has engulfed Wells Fargo in the last few weeks has created some pretty uncomfortable headlines for the firm and taken a tenth off its share price. While the company's high pressure sales target and lack of high level accountability have incurred the wrath of the senate banking committee, especially Massachusetts senator Elizabeth Warren, the credit market looks to have taken the recent developments in stride as Wells Fargo's CDS spread is still the tightest among the six large tier on US lenders.

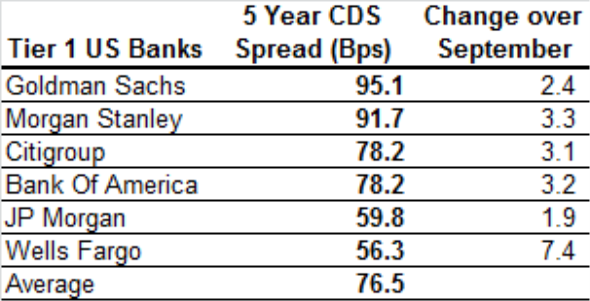

Wells Fargo's current five year CDS spread has jumped by 15% since the scandal broke earlier this month but its current CDS spread, 56bps, is still the lowest among the six large US banks which includes Bank of America, Citigroup, Goldman Sachs, JP Morgan and Morgan Stanley. Even in light of the recent spike in spread, Wells Fargo is still trading tighter than at the start of the year.

the gap to JP Morgan in second place is narrowing, the fact that Wells Fargo has managed to hang on to its spot as the tightest contract in its peer group indicates that the negative headlines have so far been contained to the court of public opinion and the equities market as they have yet to materially impact the market's perception of Wells Fargo's credit risk.

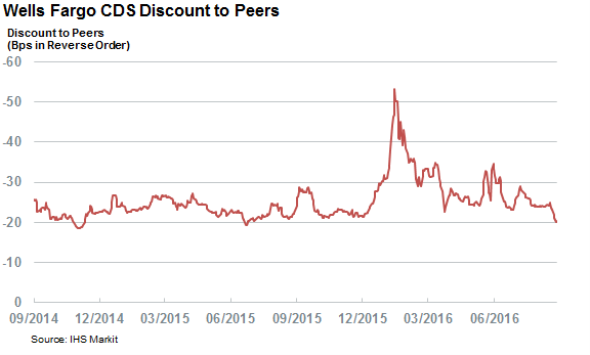

Despite hanging on to its title as the bank that requires the least premium in order to insure its debt against default, the scandal has eroded some of the market's willingness to view Wells Fargo as a relatively safe player in the US banking sector. Wells Fargo's large domestic presence and its retail heavy business model meant that it's CDS spread traded over 50bps tighter than the average tier one US bank over February. That discount is now 20bps, a full 20% less than the average discount Wells Fargo enjoyed over the last 24 months.

Unlike other financial scandals which have hit several banking players at once, the recent issues surrounding Wells Fargo look relatively constrained as none of its peer group have experienced nearly the same level of spread widening over the last three weeks. While all six banks are trading wider for the month, Wells Fargo's spread widening is over twice that seen by the second largest widener, Morgan Stanley which is trading 3.3bps wider for September so far.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-Credit-Wells-Fargo-CDS-spread-still-lowest-among-peers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-Credit-Wells-Fargo-CDS-spread-still-lowest-among-peers.html&text=Wells+Fargo+CDS+spread+still+lowest+among+peers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-Credit-Wells-Fargo-CDS-spread-still-lowest-among-peers.html","enabled":true},{"name":"email","url":"?subject=Wells Fargo CDS spread still lowest among peers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-Credit-Wells-Fargo-CDS-spread-still-lowest-among-peers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Wells+Fargo+CDS+spread+still+lowest+among+peers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-Credit-Wells-Fargo-CDS-spread-still-lowest-among-peers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}