Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 26, 2015

FI ETFs fall out of favour; Greece on borrowed time

Investors rush to reduce FI exposure on fears of "overheating" market, while Europe still waits on Greece but markets signal cautious optimism.

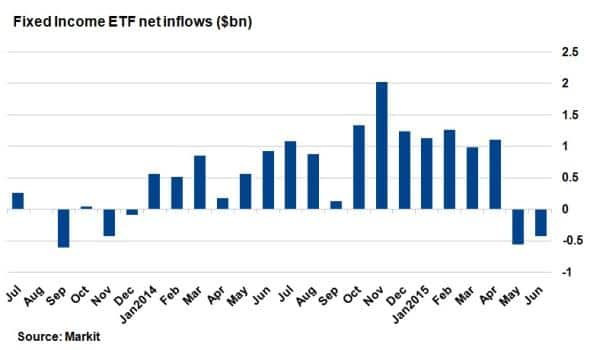

- Fixed income ETF outflows have amounted to nearly $1bn over the past two months

- Sabine Oil & Gas becomes the first oil and gas casualty this year in the CDS space

- Greece optimism has reduced bond yields, but market remain cautious

A review of ETF flows shows fixed income has fallen out of favour with investors over the past two months. Fixed income ETF net outflows have amounted to nearly $1bn over the past two months as volatility in bond markets has caused investors to rotate out of fixed income.

It was the first time since the end of 2013 that fixed income ETFs have experienced two consecutive months of net outflows. This week, prominent investor Carl Icahn added fuel to the fire by suggesting that the high yield bond market was "overheated".

Credit auction

This week, Sabine Oil & Gas became the third corporation this year to undergo a credit event auction, following the path of Caesars Entertainment and RadioShack. The credit event followed Sabine's decision to delay an interest payment on its 7.25% coupon bond due in 2019, as the company continues to address its debt problems and tries to form a restructuring plan. Sabine had previously failed to make an earlier interest payment in April, prompting rating agency Moody's to recognise the missed payment as a default.

The number of credit events has slowed over the last few years as the global economy has recovered. 2014 saw six auctions while 2012 and 2013 saw 14 and 10 respectively. While there have only been three so far this year, Sabine's credit event was significant, being the first in the oil & gas sector. Oil prices have dropped over 40% over the past year and many corporations in the sector have had to reshape operations. This has led many market commentators expecting further defaults in the space.

Extra time

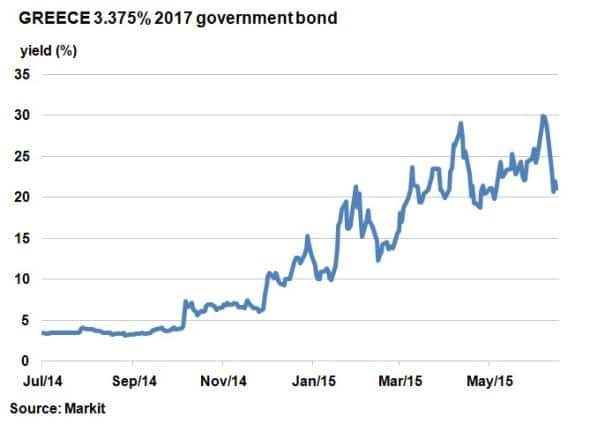

After optimism of a breakthrough last weekend promoted credit markets to cheer, Greek bailout negotiations hit yet another snag as reform details clashed once again. As talks move into extra time this weekend, an agreement must be found or Greece risks missing a €1.5bn IMF payment next Monday.

Bond markets are certainly more confident than they were this time last week. The Greek 2-yr bond yield is 6.84% lower than this time last week but remains above 20%, according to Markit's bond pricing service. What is interesting is that credit markets seem to have taken the latest mid-week set back rather lightly in comparison to previous (and there have been many) failed meetings.

The 2-yr bond yield has widened only 70bps since Tuesday, while European sovereign periphery credit spreads have also continued to fall on the back of last weekend's optimism. Portugal, the most sensitive sovereign to Greek contagion risk, has actually seen its 5-yr CDS spread tighten 32bps this week. Judging by this action, the market is not expecting things to deteriorate any further, but the saga is far from over yet.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26062015-credit-fi-etfs-fall-out-of-favour-greece-on-borrowed-time.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26062015-credit-fi-etfs-fall-out-of-favour-greece-on-borrowed-time.html&text=FI+ETFs+fall+out+of+favour%3b+Greece+on+borrowed+time","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26062015-credit-fi-etfs-fall-out-of-favour-greece-on-borrowed-time.html","enabled":true},{"name":"email","url":"?subject=FI ETFs fall out of favour; Greece on borrowed time&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26062015-credit-fi-etfs-fall-out-of-favour-greece-on-borrowed-time.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=FI+ETFs+fall+out+of+favour%3b+Greece+on+borrowed+time http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26062015-credit-fi-etfs-fall-out-of-favour-greece-on-borrowed-time.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}