Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 25, 2015

Investors hunt for long dollar exposure

The impact of the direction of the US dollar on company earnings and stock prices has seen investors positioning themselves in ETFs as the currency moves sideways, while markets wait for an eventual rate rise.

- $550m flow into currency ETFs, with the majority of funds going to long dollar ETFs

- Long USD fund exposure outweighs short funds by two to one

- USD weakness provides basis for positive return strategies in Europe and Apac

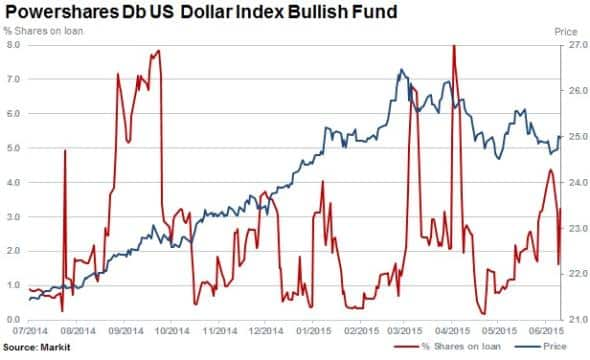

Since peaking in March 2015, the mighty greenback has moved sideways; drifting lower by 5.5%, as measured by the Power Shares DB US Dollar Index ETF (UUP) which tracks a basket of currencies against the dollar.

The rise of the USD in the second half of 2014 and first quarter of 2015 dampened earnings for US multinationals. However no clear medium trend exists, with investors increasingly looking for ways to position themselves for future USD strength or weakness.

Two factors driving the USD's movements and previous year's surge are resurgent US economic growth data and expectations of tighter monetary policy.

While consensus is not unanimous on the timing of when the US will raise rates, the waiting game looks set to continue into 2016. The IMF has voiced concerns over raising rates this year, supporting some FOMC officials who have cautioned against a September rate rise due to continued uncertainty around the economic recovery.

Net long the dollar

Meanwhile, investors on both sides of USD expectations are using ETFs to play the directionality. Since March 2015, the USD's relative value has declined and investors have poured $550m into dollar exposed ETFs.

Approximately 38% of funds have flowed into ETFs exposed to short USD movements, with the balance going towards long USD exposed funds. Additionally, AUM of USD long ETFs is greater at $3.04bn, with short ETFs' AUM currently at $1.57bn.

Strong dollar trade

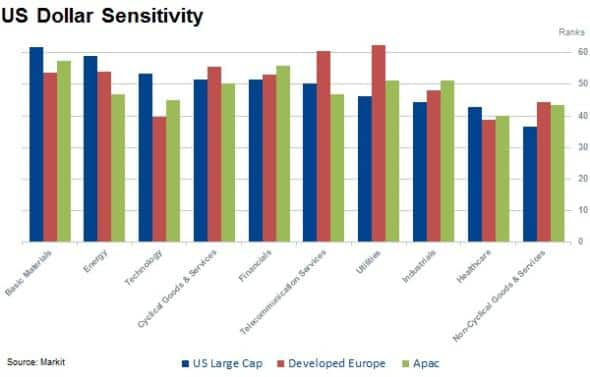

Markit's Research Signals' factor, US Dollar Value Sensitivity*, ranks companies by their respective sensitivity to movements in the dollar. Sensitivity is based on the ICE US Dollar Index futures contract.

Average sensitivity ranks for sectors across large US companies reveals that basic materials and the energy sector are the most exposed to a stronger dollar. Not surprisingly, following the first quarter of 2015 as the stronger dollar and low commodity prices impacted multinational earnings, these two sectors saw the worst level of analyst revisions - as ranked by Markit's 3-M revision in FY1 EPS forecast factor*.

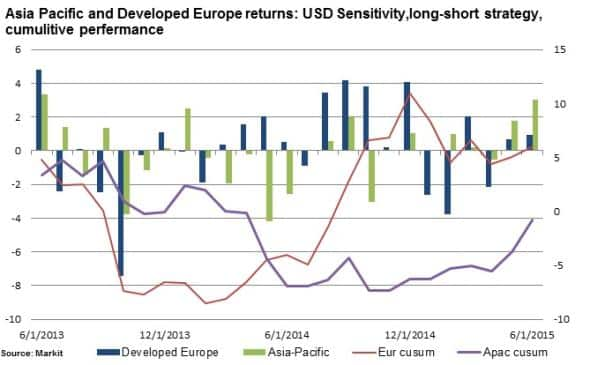

Going long the least sensitive stocks to the USD and short the most sensitive has continued to deliver strong results in a strengthening USD environment, with a large cumulative spread performance of 56% over the past two years. However since the USD has moved sideways since March, results have been less clear.

Interestingly, positive returns have converged for strategies employing the same factor as the above methodology across European and Apac universes in recent months. In Apac, the strategy returned 4.8% in the last two months with Europe returning 1.6%.

The Apac region shares basic materials with the US as the sector most exposed to dollar price movements; however average sector ranks are less significant.

Europe's most sensitive sectors to the value of the dollar are the telecommunication and utilities sectors.

* US Dollar Value Sensitivity is estimated by 60 month multiple regression of returns on several macroeconomic factors.

* 3-M Revision in FY1 EPS Forecasts is defined as the current mean consensus earnings estimate for fiscal year 1, less that of three months ago, deflated by its trading price.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Equities-Investors-hunt-for-long-dollar-exposure.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Equities-Investors-hunt-for-long-dollar-exposure.html&text=Investors+hunt+for+long+dollar+exposure","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Equities-Investors-hunt-for-long-dollar-exposure.html","enabled":true},{"name":"email","url":"?subject=Investors hunt for long dollar exposure&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Equities-Investors-hunt-for-long-dollar-exposure.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+hunt+for+long+dollar+exposure http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Equities-Investors-hunt-for-long-dollar-exposure.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}