Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 26, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week.

- Greenbrier still feeling effects of the slowdown in energy infrastructure spend in US

- Ocado shares rally sending short sellers covering ahead of earnings

- Japanese retailers rally, with Keiyo seeing a surge in short interest

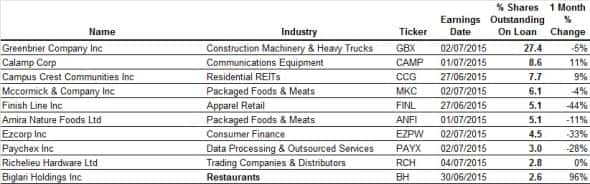

Greenbrier once again tops the most shorted stocks in North America ahead of earnings. Exposed to the energy sector, the company manufactures and supplies railroad freight-cars, equipment as well as marine barges. The stock has fallen 16% since early April when it last featured in the most shorted ahead of earnings. Short interest has remained stable, with short sellers shedding less that 2% of shares outstanding on loan; declining from 29% to 27%.

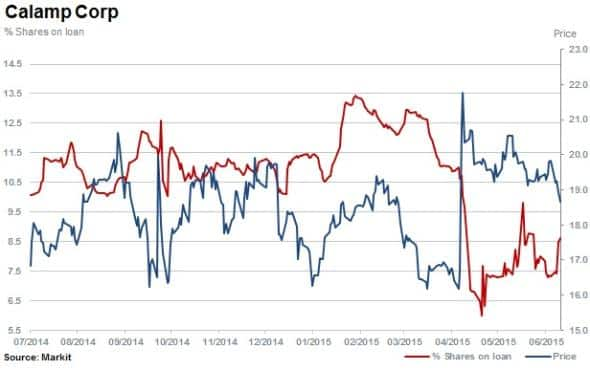

Calamp provides Machine-to-Machine (M2M) communication solutions and is the second most shorted company ahead of earnings with 8.6% of shares outstanding on loan. Short interest dropped sharply in late April following a 25% spike in the share price after the company released of positive set of earnings. However since then, both the share price and shares out on loan have continued to drift lower by 14% each.

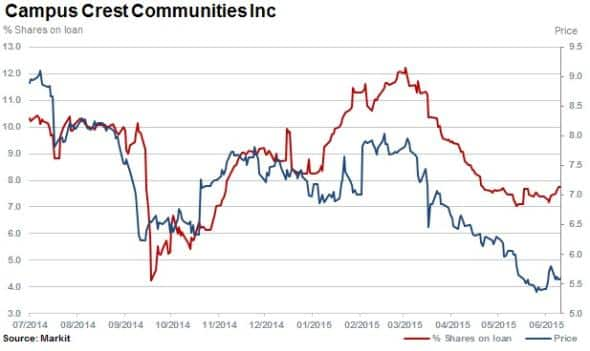

Short sellers have increased their positions in Campus Crest Communities after a long period of covering while the share price has declined. The company builds and operates student housing property projects. Shares out on loan have increased by 10% in June, reaching 7.7% while the stock price has managed to hold steady during the month, but is still down 23% over the last three months.

Western Europe

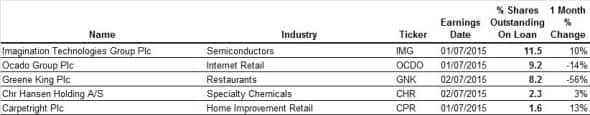

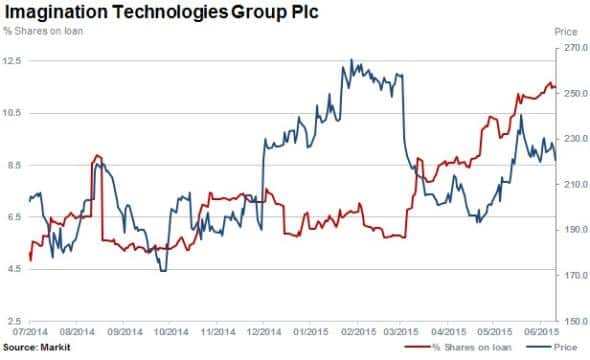

Most shorted in Europe ahead of earnings is Imagination Technologies, a supplier of graphic processor chips for mobile device manufacturers. Short sellers have steadily increased their positions in the stock since March, after the firm issued a disappointing trading update. Shares outstanding on loan have increased by a third to 11.5% while the stock price, which initially fell, has managed to hold up - actually increasing by 3% over the last three months.

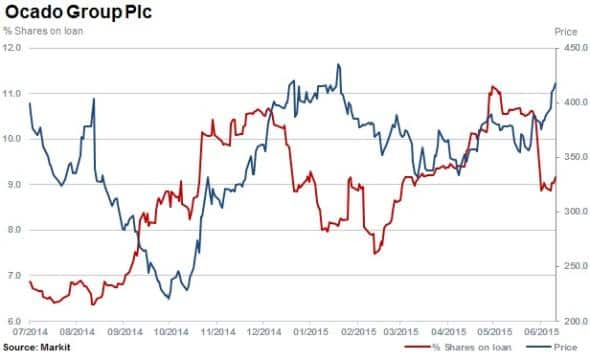

Second most shorted ahead of earnings in Europe is online grocer Ocado with 9.2% of shares outstanding on loan. The stock has rallied over 10% in the last few weeks with short interest falling ahead of earnings.

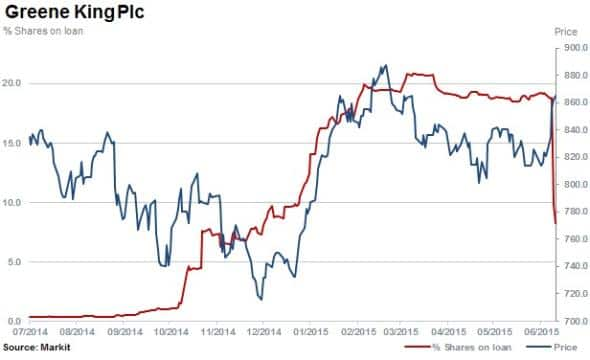

Short sellers in Green King have shed positions by more than half after the "774m takeover of Spirit Pub was confirmed on the 23rd June 2015. Shares out on loan fell from 18.8% to 8.2% while the stock rallied moderately by 5%.

Asia Pacific

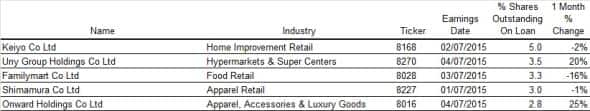

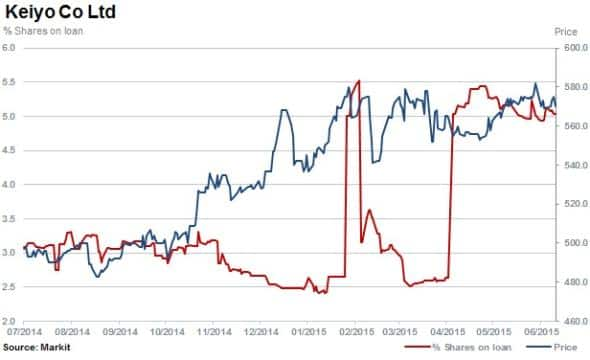

Japanese home improvement store operator Keiyo is the most shorted in Apac ahead of earnings. The company has seen shares out on loan increase to 5%.

Keiyo's sales have stagnated and operating profits have dropped by more than two thirds over the last two years.

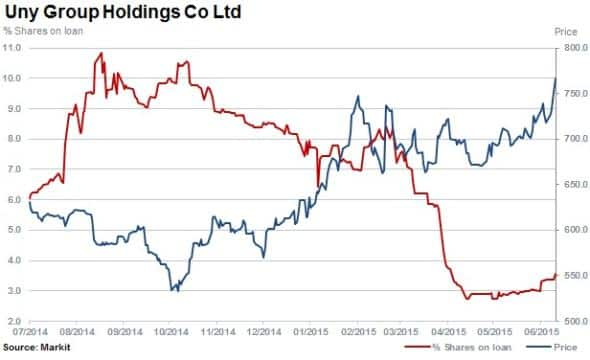

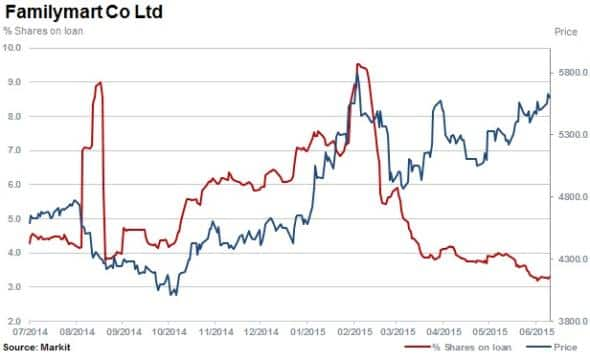

Short interest has fallen for Japanese retailers Uny Group and Familymart while both companies' share prices have risen recently. Shares outstanding on loan for Uny and Familymart have declined by 43% and 16% respectively. This occurred while shares rallied by 16% in Uny and 13% for Familymart.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26062015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26062015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26062015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26062015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26062015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}