Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 23, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Short sellers target DVDs through Outerwall's Redbox as rentals and new business stall

- Shorts take second bite out of Carbo Ceramics as US shale industry continues to suffer

- Markit Dividend Forecasting expects dividend suspension at shorted coal miners

North America

Most shorted ahead of earnings this week in North America is Outerwall with 36% of shares outstanding on loan. Short interest has surged by two-thirds, with the stock falling 30% post a 14% one-day fall after the company reported a loss last quarter.

Outerwall is reliant on DVD rentals for the majority of its revenue, and new product launches, aimed at diversifying sales, are actually responsible for the write downs attributable to recent losses.

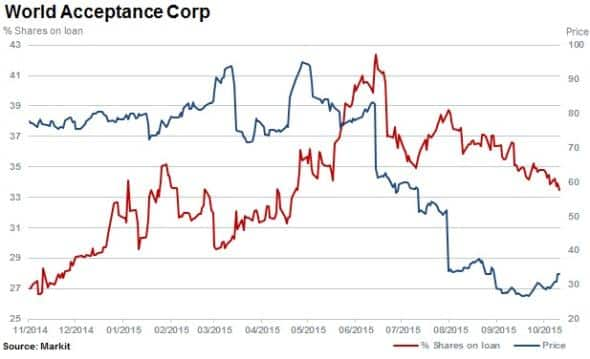

Losing the top spot in the US is second most shorted World Acceptance Corp. The small-consumer loan finance company has 33% of shares out on loan, and the stock price has halved in the last 12 months.

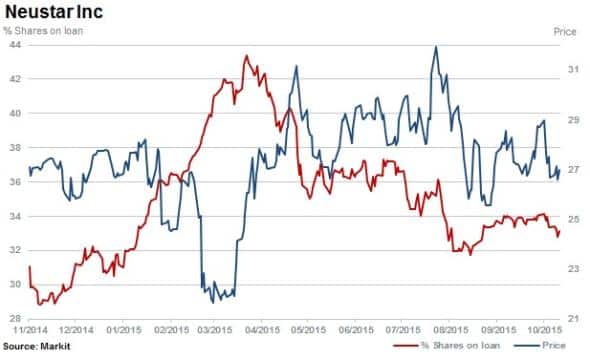

Short sellers have marginally covered in Neustar since last quarter where the stock featured among the most shorted. The stock has bounced over the last 12 months (up 50% at a point) but is up only 3%.

Carbo Ceramics has 33% of shares out on loan ahead of earnings, and its stock price has continued to fall, down 68% over the last 12 months. This is after short sellers first began targeting the supplier to the shale oil and gas industry in 2014.

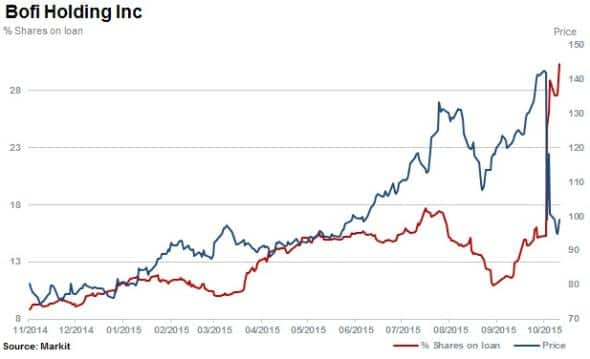

Shares out on loan for Bofi Holding have broken the 30% mark following the recent tumble in the lender's shares after a former internal auditor filed a lawsuit against the firm.

Europe

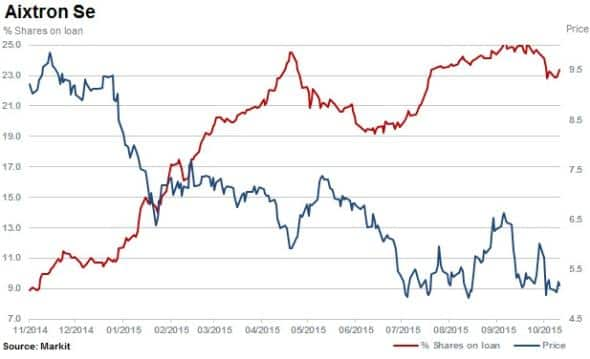

Most shorted in Europe ahead of earnings is Aixtron, which has continued to see resilient short interest at 23.4% of shares outstanding on loan. The stock has fallen 46% over the last 12 months.

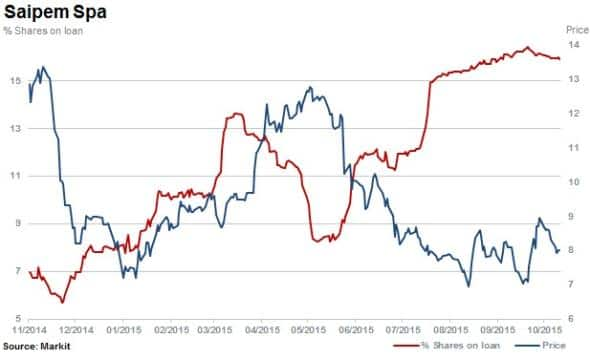

Second most shorted in Europe is engineering, construction and drilling company Saipem, predominantly exposed to the Oil & Gas industry.

Saipem has 15.4% of shares outstanding on loan currently. with the stock falling a third in the last six months while lower energy prices persistently impact spending in the sector.

Spanish consulting and technology group Indra Sistemas, is the third most shorted ahead of earnings in Europe with 13.6% of shares out on loan. Short sellers have increased positions by over 150% in the last 12 months while the stock has moved higher by 12%.

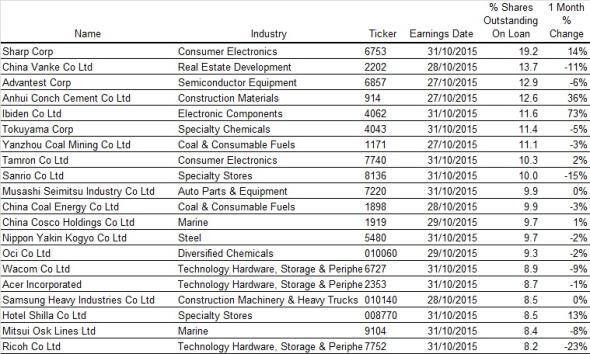

Apac

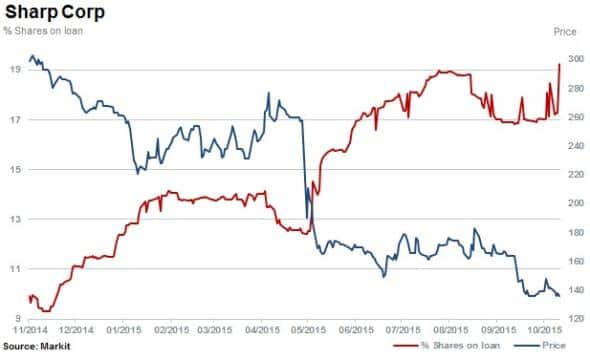

Sharp is the most shorted ahead of earnings in Apac with 19.2% of shares outstanding on loan, an all-time high.

Intensifying competition saw a further slump in LCD TV and display device sales in Q1 FY16, leading to a larger quarterly loss reported than the year before. Accordingly dividend payments are not expected to resume this fiscal year.

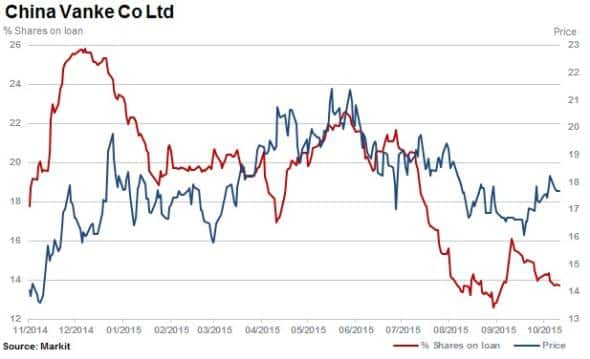

Second most shorted in Apac is residential property developer China Vanke with 13.7% of shares outstanding on loan. Short sellers have continued to reduce positions in the stock, which has rallied slightly in the last month, up 7% while shorts covered 10% of positions.

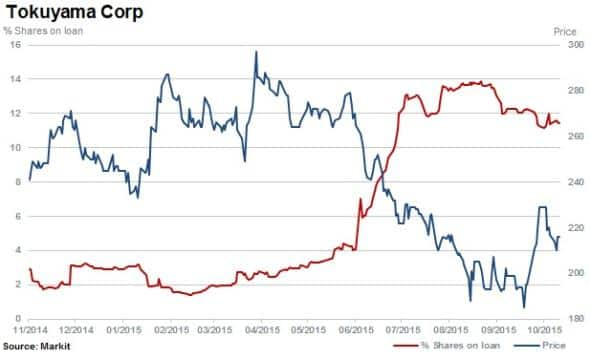

Tokuyama has seen short interest increase six fold to 11.4% in the last 12 months. In FY15, the firm suspended its dividend after posting a loss, largely due to impairments related to a polycrystalline silicon plant of its consolidated subsidiary Tokuyama Malaysia.

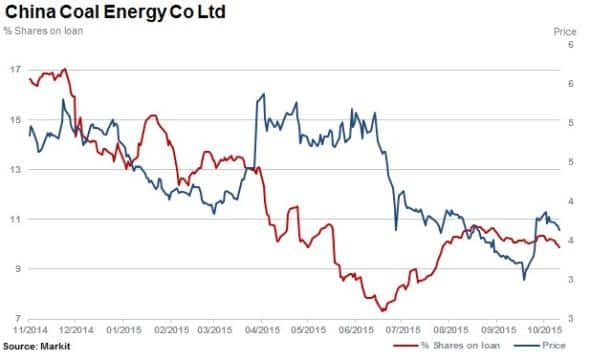

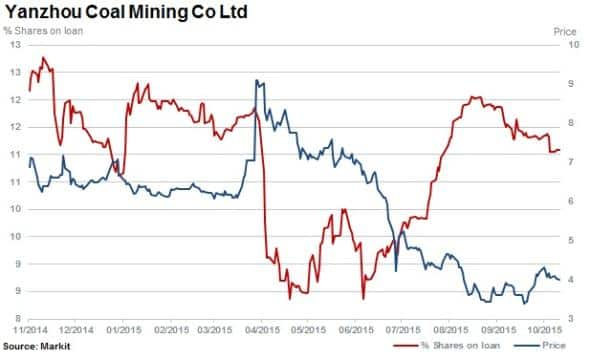

Driven by continued low prices for energy and commodities, Markit Dividend Forecasting expects losses at coal miners China Coal Energy and Yanzhou Coal Mining to result in in dividend suspensions.

Both firms have seen shorts increase positions since July to 10% and 11% for China Coal and Yanzhou, respectively. Yanzhou has fallen 50% in the last six months while China Coal has fallen by 35%.

Relte Stephen Schutte, Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}