Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 23, 2015

ECB fuels bonds and credit rally; China joins in

The ECB reinforced its dovish stance towards monetary policy, sending eurozone government bonds higher and global corporate credit indices tighter.

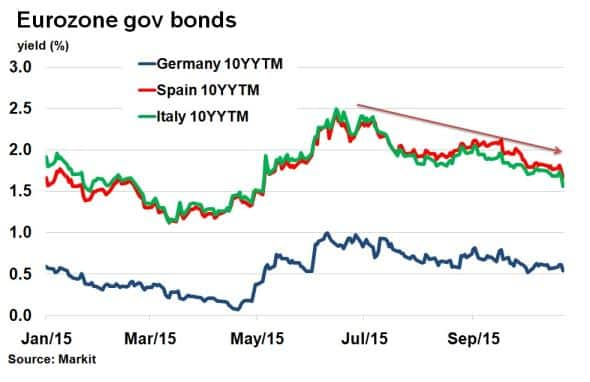

- Spanish and Italian 10 year bond yields tightened 12bps and 8bps, respectively, after ECB meeting

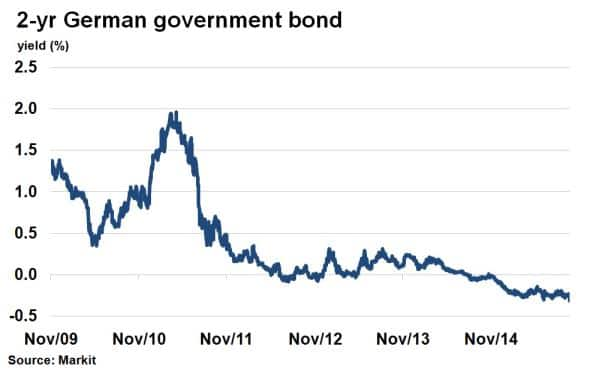

- PMI data sends German 2-yr yields down to -0.3%, the lowest ever recorded

- Global corporate credit indices have rallied this week to September lows;` China cuts rates.

Super Mario

ETFs tracking eurozone government bonds had seen inflows grow over the past few months in anticipation of further ECB easing, a trend we highlighted on Monday and one which looks to have paid off for investors.

During yesterday's eventful ECB monetary policy meeting, President Mario Draghi was quick to declare that he would do whatever was warranted to bring inflation to its 2% target. The finer details included a re-examination of the current QE programme in December, in both size and duration.

Draghi's ultra-dovish stance sent bond yields in the region sharply lower. They had already been on a downward trajectory since mid July, as inflation expectations waned in the face of collapsing commodity prices. Yesterday's meeting, however, added further fuel to the trend and sent German 10-yr yields down 7bps to 0.54%, a five month low according to Markit's bond pricing service. Peripheral bond yields also moved markedly, with Spanish and Italian government bond yields tightening 12bps and 8bps, respectively. Their recent march sees Spanish and Italian government bonds widen 55bps and 43bps, respectively, than post-QE lows seen in March.

One of the more unexpected takeaways from yesterday's ECB meeting was the comment around the possibility of further cuts to the deposit rate, opening up the scope for bonds eligible for QE. The German 2-yr rate, was quick to address this, falling 7bps to -0.32% (suggesting a 10bps deposit rate cut from -0.2% to -0.3%), its lowest ever yield on record.

Markit's Eurozone composite PMI today signalled that weak growth and inflationary pressures remain at large, stifling business activity in the process, further confirming the need for more stimulus in the region.

Corporate rally

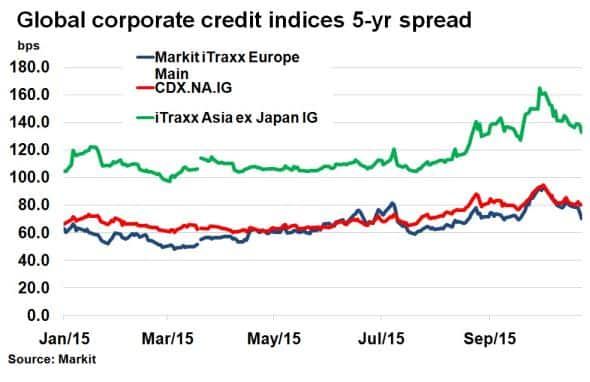

The news out of Europe also boded well for global corporate credit indices, highlighting the increasing interconnectivity between global markets.

Markit's iTraxx Europe Main index, made up of 125 investment grade corporate single name credit spreads, tightened 4bps after the ECB announcement and 20bps overall this month. In the US, Markit's CDX NA IG index shaved 2bps to 80bps, while the iTraxx Asia ex Japan IG index reacted to the ECB's comments with a 5bps tightening.

Credit indices were sent further down today as China announced a 25bps interest rate cut, sending commodities higher and credit risk lower. The iTraxx Main and the CDX indices were tighter 4bps and 3bps, respectively, on an intraday basis, according to Markit's CDS pricing service. This again highlights the global impact central bank policy has on markets.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Credit-ECB-fuels-bonds-and-credit-rally-China-joins-in.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Credit-ECB-fuels-bonds-and-credit-rally-China-joins-in.html&text=ECB+fuels+bonds+and+credit+rally%3b+China+joins+in","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Credit-ECB-fuels-bonds-and-credit-rally-China-joins-in.html","enabled":true},{"name":"email","url":"?subject=ECB fuels bonds and credit rally; China joins in&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Credit-ECB-fuels-bonds-and-credit-rally-China-joins-in.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ECB+fuels+bonds+and+credit+rally%3b+China+joins+in http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Credit-ECB-fuels-bonds-and-credit-rally-China-joins-in.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}