Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 23, 2015

France acts as drag on eurozone economic recovery

France appears to be once again acting as a drag on the eurozone economy.

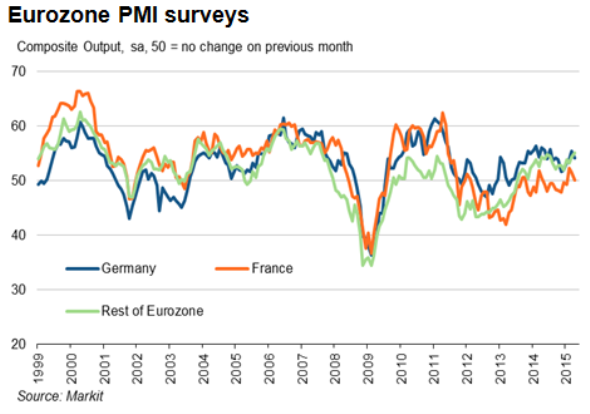

The eurozone as a whole saw slower economic growth at the start of the second quarter, according to Markit's PMI data. The weaker pace of expansion was centred on the so-called 'core', as growth outside of France and Germany accelerated to the fastest since 2007. A waning pace of expansion was seen in Germany, but more worrying was a near-stalling in the pace of growth in France.

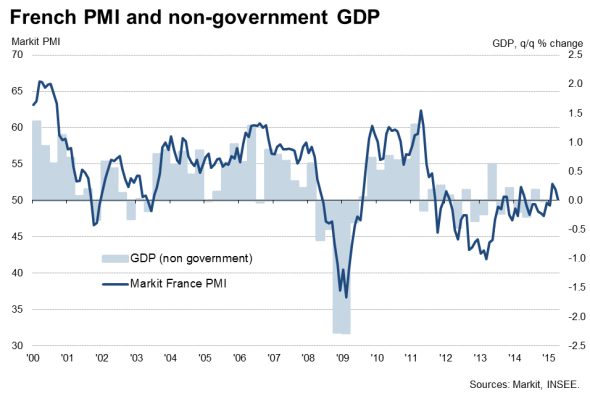

France has suffered an ongoing malaise since the financial crisis. Its GDP has recovered to rise 1.5% higher than its pre-crisis peak at the end of last year, but once rising government spending is stripped out, the economy is 1.6% smaller.

The PMI surveys had indicated that France was showing signs of being pulled out of the doldrums in the first quarter, enjoying its strongest growth since 2011 according. However, growth has stalled again in April, with the headline composite PMI only marginally above the 50.0 no-change level, sinking to 50.2. Service sector growth almost stagnated and factory output moved further into decline amid an increased loss of export orders and sluggish domestic demand.

The lack of growth in France has not gone unnoticed by investors. While exchange-traded funds exposed to the single-currency area saw record net inflows of $34.4bn in the first quarter, followed by a further $4.2bn so far in April, funds exposed only to France have so far this year seen a net outflow of $112m.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-france-acts-as-drag-on-eurozone-economic-recovery.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-france-acts-as-drag-on-eurozone-economic-recovery.html&text=France+acts+as+drag+on+eurozone+economic+recovery","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-france-acts-as-drag-on-eurozone-economic-recovery.html","enabled":true},{"name":"email","url":"?subject=France acts as drag on eurozone economic recovery&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-france-acts-as-drag-on-eurozone-economic-recovery.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=France+acts+as+drag+on+eurozone+economic+recovery http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-economics-france-acts-as-drag-on-eurozone-economic-recovery.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}