Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 23, 2015

Japan manufacturing PMI raises prospect of renewed economic downturn

Japan's manufacturing economy contacted for the first time in almost a year, according to PMI data from Markit. Together with signs of price pressures easing in the survey, the downturn means the goods-producing sector joins the service sector in a new downturn, highlighting a need for further policy stimulus.

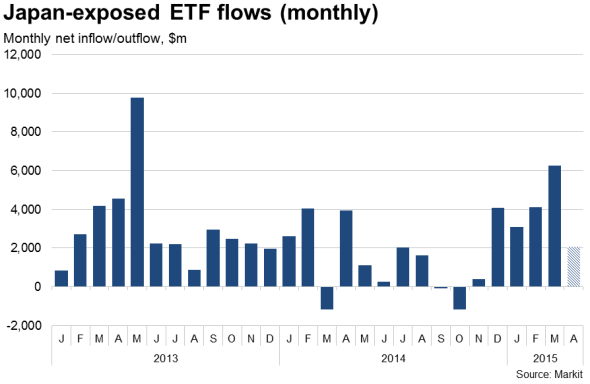

Investors have ploughed into Japanese funds, largely on the basis that the economy will revive on the back of aggressive stimulus initiatives from the government and Bank of Japan. But inflows slowed in April, according to exchange-traded fund data, and investor appetite for exposure to Japanese equities in particular could weaken further on the basis of a darkening economic outlook.

Renewed downturn

The headline Markit Manufacturing PMI fell from 50.3 in March to 49.7 in April, according to the preliminary 'flash' PMI. Any reading below 50.0 signifies a deterioration of business conditions compared to the prior month.

The latest index was the lowest seen since April of last year and represents a disappointing start to the second quarter. After GDP rose 0.4% in the final quarter of last year, PMI data so far this year have signalled a weakening in the pace of expansion in the first quarter, and now raise the possibility of the economy sliding back into contraction in the second quarter. In addition to the renewed contraction of manufacturing signalled in April, March PMI data showed the service sector to have already been in a state of accelerating decline.

As such, the PMI survey calls into question the Bank of Japan's latest assessment of the economy enjoying a "moderate recovery trend".

Weakened demand paints bleaker outlook

The latest survey showed new factory orders fell for a second successive month, dropping at the steepest rate for almost a year, led by a downturn in domestic demand. Export order book growth also waned, showing the smallest monthly gain since July of last year despite the benefits of a weakened yen.

Goods exports

Forward-looking indicators also disappointed. Raw material purchases fell at the steepest rate for a year as firms prepared to cut production further in the face of the downturn in orders. The ratio of orders to finished goods inventory, a useful indicator of future production trends, also hit a 12-month low.

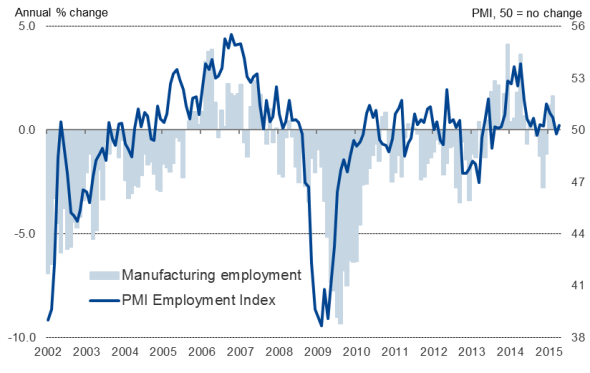

Employment meanwhile barely rose as firms saw little incentive to raise headcounts amid uncertainty about the demand outlook.

Employment

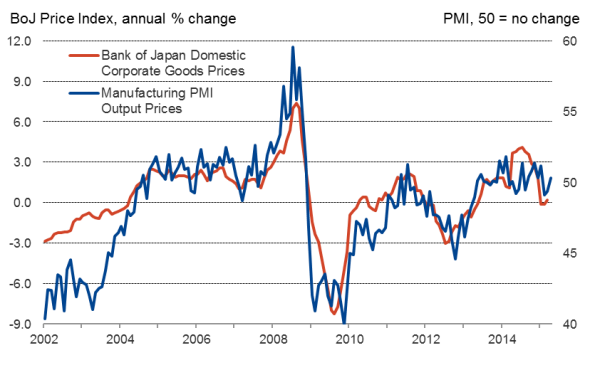

Underlying price pressures wane

For a government desperately seeking to boost inflation, the survey brought mixed news. Average input costs rose at the slowest rate in just over two years, pointing to a moderation of underlying inflationary pressures, while selling prices were largely unchanged, albeit rising marginally for the first time in three months.

Inflation in Japan is currently running at 2.4% but the core rate, which excludes volatile food prices and last year's sales tax rise, fell to zero, its lowest since May 2013. The disappointing PMI data therefore add to the risk that the rate could fall negative again in coming months as companies compete on price amid weak domestic demand and international commodity prices remain low.

Corporate goods prices

Stimulus doubts

The downturn signalled by the PMI increases the likelihood of the Bank of Japan having to do more to boost the economy. However, with the BoJ having already raised its annual QE purchases from "60-70 trillion to "80 trillion last October, any new downturn pushes policymakers to consider new ways to stimulate the economy other than simply expanding its asset purchase programme.

In the absence of further stimulus, there's a risk of investor appetite waning for exposure to Japanese stocks. Markit's exchange-traded fund data showed that funds exposed to Japan saw the strongest net inflows since early 2013 in the first quarter, but the inflows are already showing signs of easing in April. Data for the month so far show inflows of just $2.1bn, less than half the average of $4.4bn seen over the prior four months.

Markit's dividend forecasting team is already expecting overall dividend growth to be markedly lower this year than in 2014 due to the slower pace of economic growth and pressure on profits from higher import costs, and the outlook could deteriorate further in the absence of more aggressive policy action.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-Economics-Japan-manufacturing-PMI-raises-prospect-of-renewed-economic-downturn.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-Economics-Japan-manufacturing-PMI-raises-prospect-of-renewed-economic-downturn.html&text=Japan+manufacturing+PMI+raises+prospect+of+renewed+economic+downturn","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-Economics-Japan-manufacturing-PMI-raises-prospect-of-renewed-economic-downturn.html","enabled":true},{"name":"email","url":"?subject=Japan manufacturing PMI raises prospect of renewed economic downturn&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-Economics-Japan-manufacturing-PMI-raises-prospect-of-renewed-economic-downturn.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+manufacturing+PMI+raises+prospect+of+renewed+economic+downturn http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23042015-Economics-Japan-manufacturing-PMI-raises-prospect-of-renewed-economic-downturn.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}