Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 22, 2016

Top performing shorts of 2016

Our final note of the year reveals the best timed bear raids for short sellers

- North American short sellers found most luck in healthcare stocks

- Periphery banks make up four of the 13 highly performing European shorts

- Australian recruitment firm 1-Page returned over 90% for short sellers

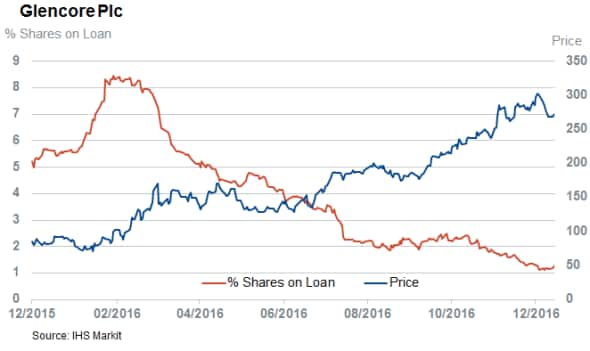

Stock markets around the world are ending 2016 on a high; however the year will be remembered for the many market swings which saw many of the worst performers rebound from the brink. One such example is commodities trading house Glencore, which saw its shares lose 20% in the opening two weeks of the year before they went on to triple in price; recouping nearly all the ground lost during the commodities slump.

These violent reversals of fortunes made for a challenging year for short sellers as simply blindly following the pack was no guarantee of returns. But despite the tough operating conditions, we still witnessed 99 stocks globally which returned at least 50% for short sellers after these shares experienced saw a fresh 52 week high annual high in shorting activity.

North America

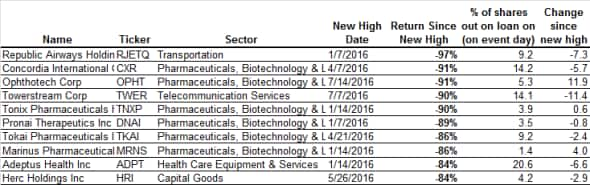

The most profitable North American short positions shifted from the oil patch, which provided the majority of 2015's best performing contrarian positions, to healthcare stocks. Overall, the pharmaceutical and healthcare equipment sector was responsible for a phenomenal 36 of the 58 highly successful short plays across North America in 2016.

The majority of these positions were in relatively small speculative names as the average market cap across these firms was less than $1bn at the time of being heavily shorted; however short sellers also have had some success catching some of Valeant's collapse. Shorts were relatively late in committing to the Valeant trade as despite Valeant's borrow demand only crossing the 3% of shares outstanding threshold in late March, short sellers still managed to catch more than half of the company's year to date collapse.

Overall the best performing healthcare short of the last year was another Canadian pharma name, Concordia International, whose shares have slipped by 91% since short sellers piled into the company back in April.

While healthcare was the most fertile ground for short sellers, the sector failed to produce the top performing overall position which goes to airline Republic Airways after filing for bankruptcy protection back in April. The company's shares have lost over 97% since experiencing a fresh 52 weeks high in shorting activity in the opening week of the year.

Europe

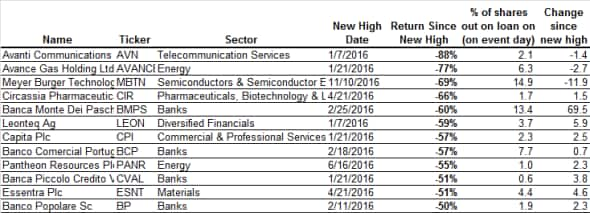

While healthcare stocks proved to the most profitable for North American short sellers, banks - specifically periphery institutions - were the best bets for shorts in Europe. Overall four periphery banks find themselves among the 12 European short plays whose shares have gone on to lose more than half their value since being targeted.

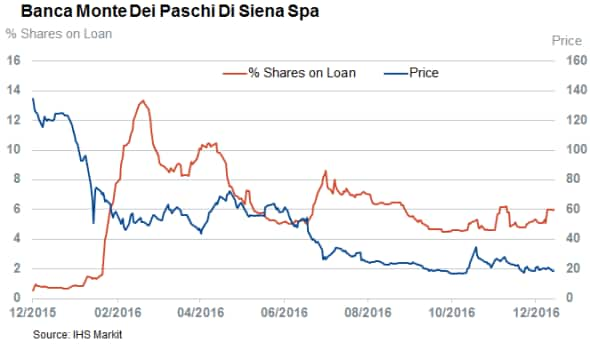

Italian Banca Monte Dei Paschi leads this trend as it has lost 60% of its value since short sellers targeted back in late February. Fellow Italian banks Banco Popolare Sc, Banca Piccolo Credito Valtellinese Spa and Banco Comercial Portugues Sa also make the list.

The UK provided plenty of successful short targets including the top performing European short play of the year, Avanti Communications. Avanti's shares are now trading 88% than in early January when it saw its first of many new highs in shorting activity.

Captia and Essantra join Avanti in the list of highly successful European short positions.

Asia

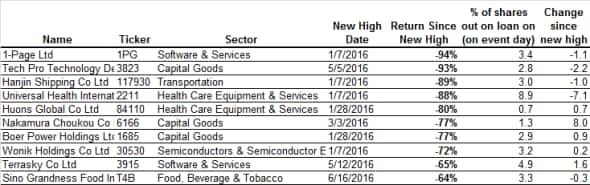

Asia also saw its fair share of profitable bear raids as 22 stocks have gone on to lose more than half their value since setting a fresh annual high in shorting activity.

These successful shorts plays are led by Australian recruitment firm 1-Page which has lost over 90% of its value since coming into short sellers' crosshairs back in January.

Bankrupt shipping firm Hanjin also proved lucrative for short sellers as they started to target the firm back in January and went on to record an 89% profit as the firm's troubles worsened.

While many of the successful Asian short trades of last year fell in the month after coming under scrutiny of short sellers, none more so than Hong Kong traded Universal Healthcare which lost 58% in the month since setting a fresh high in shorting activity.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22122016-Equities-Top-performing-shorts-of-2016.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22122016-Equities-Top-performing-shorts-of-2016.html&text=Top+performing+shorts+of+2016","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22122016-Equities-Top-performing-shorts-of-2016.html","enabled":true},{"name":"email","url":"?subject=Top performing shorts of 2016&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22122016-Equities-Top-performing-shorts-of-2016.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Top+performing+shorts+of+2016 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22122016-Equities-Top-performing-shorts-of-2016.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}