Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 21, 2016

FRTB: the Scrooge of Christmas?

Why trading desk holidays may never be the same again

Could there be a direct correlation between how much time traders will be allowed to take off for Christmas and how much capital firms will need to hold under FRTB? This question might seem incongruous, but our recent research shows that if the Fundamental Review of the Trading Book were applied today, then risk factor modellability, and consequently bank capital, might suffer from a little seasonal excess during the holiday period.

Under the FRTB text, for a bank to fully 'model' a risk factor and so benefit from the portfolio effects, the risk factor must be readily observable in the market. Risk factors for IMA are divided into modellable (MRFs) and non-modellable (NMRFs). A risk factor is only modellable if "real" prices for representative transactions are observed at least 24 times per year and with a maximum gap between observations of less than a month.

It's this maximum gap requirement that can lead to a significant number of risk factors becoming non-modellable over holiday periods. For example, if we group risk factor observations by currency and identify those that fail the modellability tests due to a gap in time, they occur during periods of national celebrations.

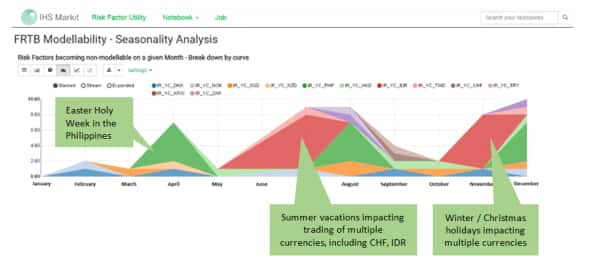

Using analysis on millions of trade observations carried out with our Risk Factor Utility shown below, we can see a steep increase in the number of NMRFs for the Philippine Peso over Holy Week, which is a week-long national holiday. A similar trend is visible over the Christmas period or winter holidays affecting multiple currencies including the Swiss Franc and Hong Kong Dollar.

So, could the introduction of FRTB and the desire to mitigate the associated capital charges lead to the cancellation of Christmas holidays for traders?

Well, probably not. The good news is that traders should be able to continue to enjoy national holidays if banks and the broader industry prepare in the right way for FRTB over the coming months.

In particular, access to a rich and diversified source of transaction data will be critical to mitigating NMRF capital charges. At present, individual banks are unlikely to be able to view real prices for all representative transactions in the market since they are directly involved in only a subset of these transactions and are also affected by the seasonality challenges outlined above.

Our previously published research demonstrates how external transaction data can be combined with a bank's internal data sets to increase modellability of risk factors. In our studies, this in turn led to capital charge reductions of as much as 40% through the reduction of NMRFs.

Another area we've explored is the use of proxies where modellability data for a risk factor is unavailable. Our research to date shows that well-chosen proxies can deliver significantly lower capital, although this is very much dependent on the portfolio and proxy methodology.

As banks start preparing in earnest for the introduction of FRTB, modellability of risk factors remains one the most significant challenges and the seasonality trends identified only add to this complexity. Leveraging pools of transaction data and solid proxy methodologies will not only help banks reduce the capital impact of NMRFs, but will also ensure that traders can continue to enjoy their national holidays and don't receive unwelcome capital charges as Christmas presents.

Chart: Yield curve risk factors turning non-modellable by month:

For more information on risk factor modellability under FRTB, please contact:

Tel: +44 20 562 6630

paul.jones@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21122016-In-My-Opinion-FRTB-the-Scrooge-of-Christmas.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21122016-In-My-Opinion-FRTB-the-Scrooge-of-Christmas.html&text=FRTB%3a+the+Scrooge+of+Christmas%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21122016-In-My-Opinion-FRTB-the-Scrooge-of-Christmas.html","enabled":true},{"name":"email","url":"?subject=FRTB: the Scrooge of Christmas?&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21122016-In-My-Opinion-FRTB-the-Scrooge-of-Christmas.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=FRTB%3a+the+Scrooge+of+Christmas%3f http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21122016-In-My-Opinion-FRTB-the-Scrooge-of-Christmas.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}