Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 22, 2015

Pay outlook weakens as 'noflation' looks set to dampen pay negotiations

Survey data collected from just under 2,000 employees in March and April point to disappointingly weak UK pay growth in 2015.

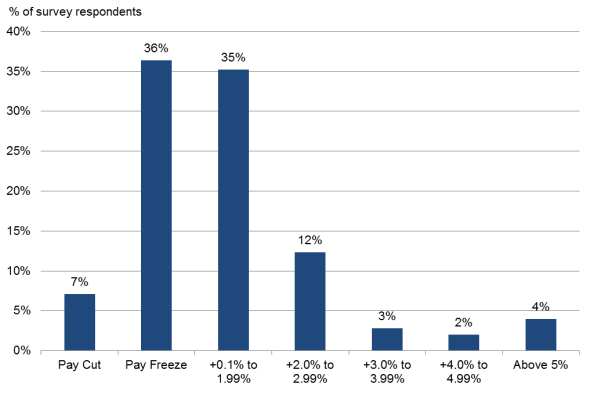

The representative survey of British households, polled by IPSOS Mori on behalf of Markit, found that only one-in-five employees expect their pay to rise by 2 percent or more in 2015. Just under one-in ten anticipate a pay rise in excess of 3 percent.

Just over one-in-three (36 percent) of all employees expect their pay to be frozen this year, while 7 percent expect to suffer a pay cut.

The survey responses collectively point to employee pay rising by just 1.0 percent this year on average.

UK pay expectations

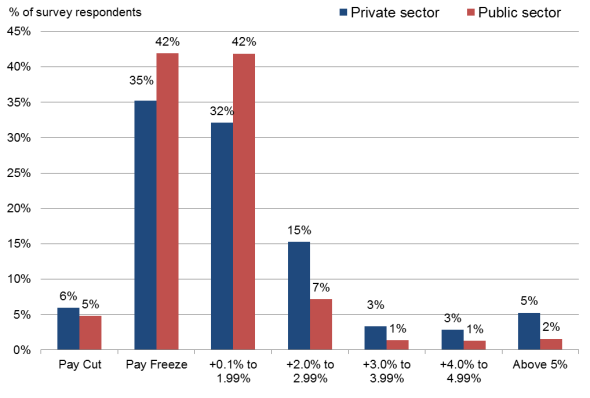

An average expectation of a 0.8 percent pay rise in the public sector compares with 1.3 percent in the private sector.

In the public sector, the proportion of employees expecting a pay cut or freeze rises to 47 percent compared to 41 percent in the private sector. Only 11 percent of government employees meanwhile anticipate their pay to grow by more than 2 percent in 2015 but this rises to 27 percent in the private sector.

Private & public sector pay expectations

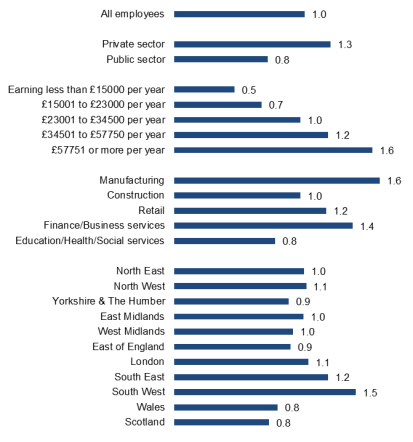

Expected pay growth rises according to the amount that people currently earn, although only modest growth is signaled for all salary bands. The highest earners (those whose incomes are in excess of "58k per annum) expect their pay to rise by 1.6 percent in 2015 while the lowest earners (with annual incomes below "15k) anticipate a mere 0.5 percent pay increase.

Manufacturing workers expect to see the biggest pay awards of all major sectors, expecting an average pay rise of 1.6 percent this year, followed by Financial & Business Services workers, who on average anticipate a 1.4 percent rise. A more modest 1.2 percent rise is expected in retail, dropping to 1.0 percent in construction.

By region, the most buoyant wage outlook was seen in the South West, where a 1.5 percent pay rise was expected on average. Employees in the Scotland and Wales were the most downbeat, expecting incomes to rise by just 0.8 percent.

Implied expected pay growth in 2015 (percent change on 2014)

Commenting on the survey, Chris Williamson, Chief Economist at Markit:

"The weak survey data raise doubts over the extent to which pay growth might revive in 2015, which in turn puts question marks over the sustainability of the economic upturn.

"The survey data suggest that growth of employee earnings is likely to remain weak in coming months, confounding widespread expectations of pay growth accelerating this year. The most recent official data showed headline pay growth slowing to 1.7% in the three months to February.

"Although there is recruitment survey evidence that skill shortages are driving up salaries offered to new recruits as companies compete for talent, the recent drop in inflation to zero appears to be feeding through to lower annual pay reviews for existing employees, holding down overall pay growth.

"The Bank of England is currently forecasting the economy to grow by 2.9% this year, fuelled by consumer spending rising on the back of higher real employee earnings. The worry is therefore that weak pay growth means the economy is reliant on ultra-low inflation to boost consumer spending power. With inflation likely to pick up later this year, economic growth could consequently slow more than policymakers are expecting."

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-Economics-Pay-outlook-weakens-as-noflation-looks-set-to-dampen-pay-negotiations.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-Economics-Pay-outlook-weakens-as-noflation-looks-set-to-dampen-pay-negotiations.html&text=Pay+outlook+weakens+as+%27noflation%27+looks+set+to+dampen+pay+negotiations","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-Economics-Pay-outlook-weakens-as-noflation-looks-set-to-dampen-pay-negotiations.html","enabled":true},{"name":"email","url":"?subject=Pay outlook weakens as 'noflation' looks set to dampen pay negotiations&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-Economics-Pay-outlook-weakens-as-noflation-looks-set-to-dampen-pay-negotiations.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Pay+outlook+weakens+as+%27noflation%27+looks+set+to+dampen+pay+negotiations http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-Economics-Pay-outlook-weakens-as-noflation-looks-set-to-dampen-pay-negotiations.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}