Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 22, 2016

ECB steps up dovish rhetoric; financial credit reeling

Credit markets reacted positively to fresh dovish ECB rhetoric, while US and European banks continue to see credit risk soar.

- Italian and Spanish government 10-yr bond yields tightened 7bps and 8bps after ECB meeting, decision, announcement

- Markit iTraxx Europe Senior Financials index has widened back to four month highs

- Venezuela's sovereign CDS spread is implying a 96% chance of default within five years

Draghi calms market

After disappointing markets last December with a modest addition to the ECB's current QE programme, President Mario Draghi made sure history didn't repeat itself as he hinted at further stimulus measures in March. In what has been a very volatile start to the year for credit markets, the dovish rhetoric was welcomed by market participants.

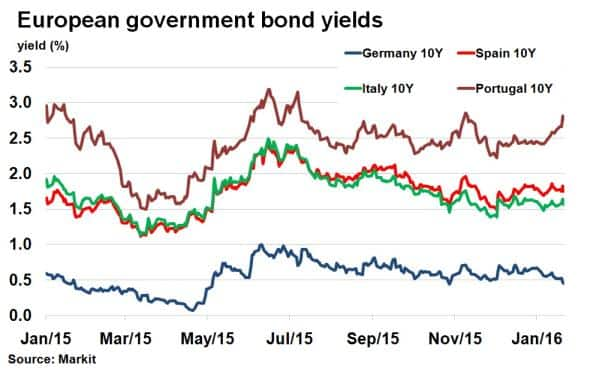

The prospect of further QE sent the yield on 10-yr German bunds to 0.44%, touching levels seen last May, according to Markit's bond pricing service. Bund yields have also fallen as investors have clamoured to safe haven assets amid the heightened risk environment seen over the past six months.

Periphery European government bond yields also fell as Italian and Spanish government 10-yr bond yields tightened 7bps and 8bps respectively. Portuguese 10-yr yields saw a more modest move, from 2.82% to 2.76%, just as levels started to approach six months highs.

Financials under pressure

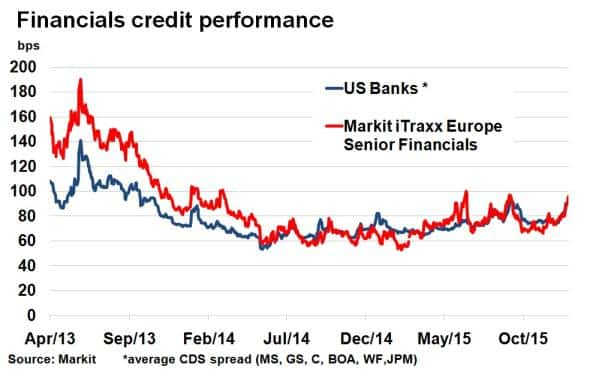

Financials was the outperforming sector among both European and US corporate bonds last year but 2016 has started unsteady as risk in the sector has widened.

On Wednesday, Italian bank Banca Monte dei Paschi di Siena came under scrutiny as concerns over bad loans surfaced. Its 5-yr CDS spread subsequently widened to 581bps as of January 21st, more than double the value seen at the turn of the year.

Risk quickly spread with fellow Italian bank Banco popular and Spanish lender BBVA seeing CDS spreads widen significantly. It marks a bad past few months for European banks, with both Novo Banco and Deutsche Bank also coming under much inquiry. Adding market volatility to the mix, the Markit iTraxx Europe Senior Financials index has widened to four month highs.

Things look equally as bleak across the Atlantic, where US banks have just finished reporting Q4 2015 earnings. Although a mixed bag (Goldman Sachs suffered further legal charges, while JP Morgan had their best year ever), CDS spreads have widened across the six major Banks. Citigroup, Goldman Sachs and Morgan Stanley all now see their 5-yr CDS spreads trade north of 100bps.

Venezuela's troubles resurface

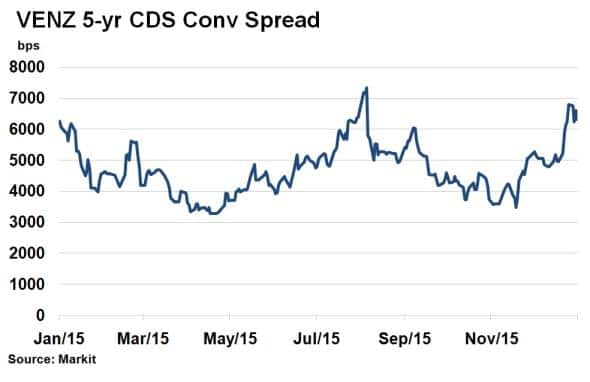

Back in August, Venezuela's 5-yr CDS spread widened to over 7,000bps before receding, but another economic crisis has sent spreads heading back to these highs.

As of January 21st, Venezuela's 5-yr CDS spread stands at 6,318bps implying a 96% chance that the oil dependent nation will default on its government debt over the next five years. Soaring inflation, further oil weakness and deep recession has called for the government to declare a state of emergency and powers to reform by economy by decree.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-credit-ecb-steps-up-dovish-rhetoric-financial-credit-reeling.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-credit-ecb-steps-up-dovish-rhetoric-financial-credit-reeling.html&text=ECB+steps+up+dovish+rhetoric%3b+financial+credit+reeling","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-credit-ecb-steps-up-dovish-rhetoric-financial-credit-reeling.html","enabled":true},{"name":"email","url":"?subject=ECB steps up dovish rhetoric; financial credit reeling&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-credit-ecb-steps-up-dovish-rhetoric-financial-credit-reeling.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ECB+steps+up+dovish+rhetoric%3b+financial+credit+reeling http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-credit-ecb-steps-up-dovish-rhetoric-financial-credit-reeling.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}