Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 22, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Bank of Internet USA, United States Steel and Harley Davidson: top shorts in America

- Elevators and ATM providers attract short sellers in Europe ahead of earnings

- Duty free store Hotel Shilla and anime game developer Marvelous are most shorted in Apac

North America

Most shorted ahead of earnings in North America this week is high net worth mortgage lender Bofi Holding. The holding company of Bank of Internet USA has 34.8% of shares outstanding on loan. Shares in the lender have continued to fall since news broke of a federal lawsuit filed against the firm last year.

Second most shorted is United States Steel, whose shares have fallen almost 70% in the last 12 months with short interest breaking 30% in the first weeks of 2016 reaching 31.2% of shares outstanding on loan. Earnings and revenues have dived in the last year as the firm battles falling steel prices as it attempts to implement aggressive cost cutting programs to offset revenue declines.

Natural gas and coal producer Consol Energy has seen shares fall by 24% year to date as short sellers continue push to short interest higher with shares outstanding on loan reaching 28.8%.

Hurt by dollar strength in 2015 and attracting significant levels of shorts already in September 2015, Harley Davidson shares have fallen a further 27% and shorts have increased positions further by two-thirds. Shares outstanding on loan currently stand at 16.6%.

Western Europe

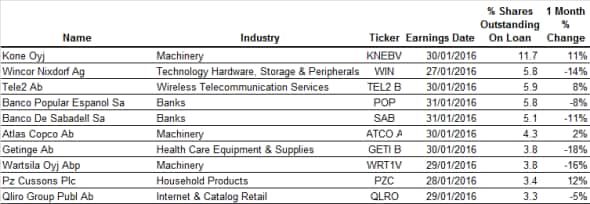

Most shorted in Europe ahead of earnings is elevator and escalator manufacturer Kone with 11.7% of shares outstanding on loan. The shares have tracked movements in wider European indices, falling 6% year to date.

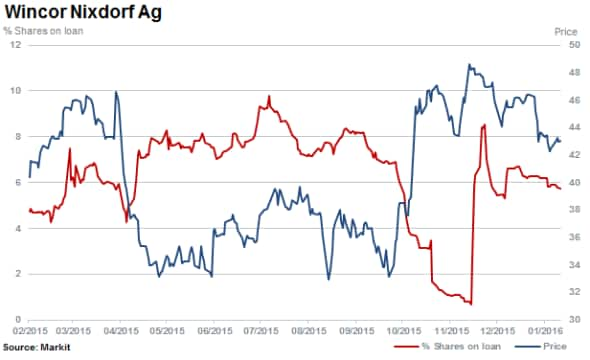

Second most shorted in Europe with 5.8% of shares outstanding on loan is Wincor Nixdorf, a German based global provider of ATMS, software and IT solutions to the retail banking sector. Shares in the company rallied sharply towards the end of 2015 as rival Diebold made a $1.9bn bid for the company.

Apac

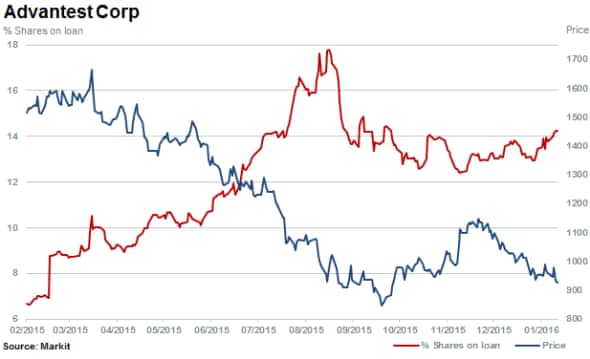

Most shorted ahead of earnings in Apac is Tokyo based Advantest Corp with 14.2% of shares outstanding on loan. The company provides semiconductor and components testing services.

Second most shorted ahead of earnings in Apac is Korean hotel and duty free shop operator Hotel Shilla, which is suffering from a slowdown in Chinese tourism. Hotel Shilla has seen a 40% increase in short interest year to date with 13.1% of shares outstanding on loan currently. Shares have plummeted over 50% in the last six months after the company won the rights to open a duty free store in Seoul.

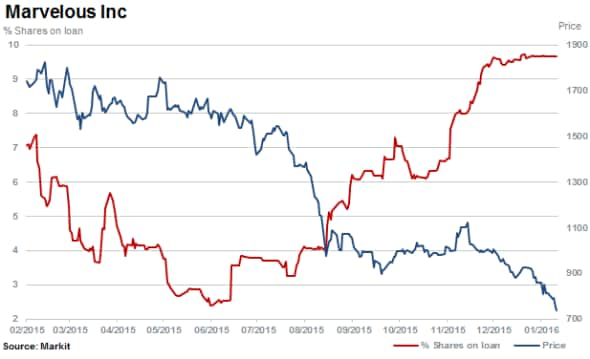

Japanese anime game developer Marvellous is the third most shorted in Apac with 9.7% of shares outstanding on loan. Shorts have increased positions by two-thirds in the last three months, while the company's stock has fallen by one-third.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}