Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 20, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

- North American residential floorer and obesity fighting drug maker attracting short sellers

- Aixtron is the most shorted stock in Europe as short sellers increase positions by 20%

- Australian iron ore miner Atlas most shorted in Apac as record low prices persist

North America

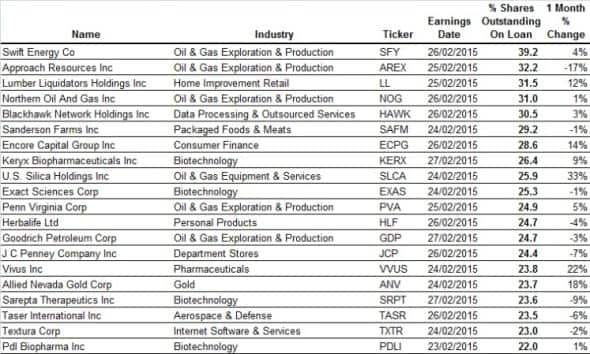

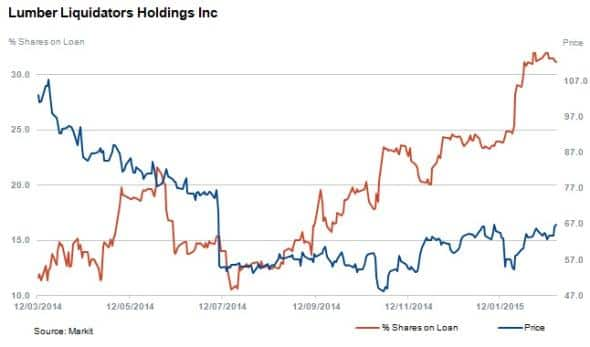

Oil and gas exploration firms dominate the top two spots this week in North America with the third place going to Lumber Liquidators. The residential hard wood floorer provider has 32% of shares outstanding on loan, a 12% increase on the previous month. The US housing market has shown initial signs of weakness, however this week saw interest rate expectations shifting once again as debate over a recent Federal Reserve meeting minutes has pushed out rate hike prospects.

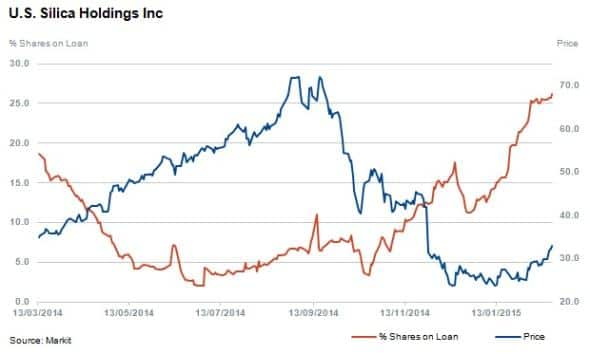

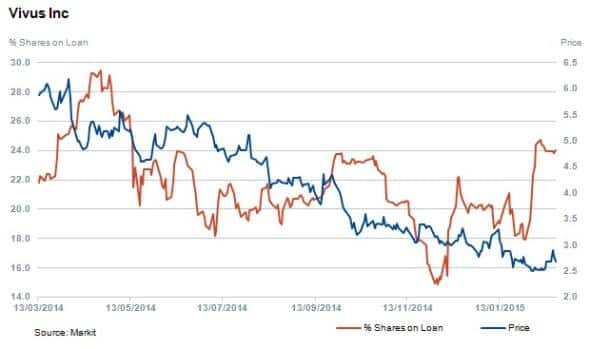

The firms seeing the most movement in short interest are US Silica Holdings and Vivus with 26% and 24% of shares out on loan respectively. US Silica has attracted short sellers who have held on to their positions despite the share price rallying by 34% in the last month.

Silica Holdings supplies specialised mineral proppants into the fracking industry which has come under heavy pressure due to sustained low oil prices and mounting rig closures.

Vivus, a biopharmaceutical company commercialising Qsymia, has seen its shares out on loan increase by 32% in the last month. Vivus's share price has dived by 52% in the last 12 months as the company continues to produce losses and analysts downgrade the stock as sales growth disappoints.

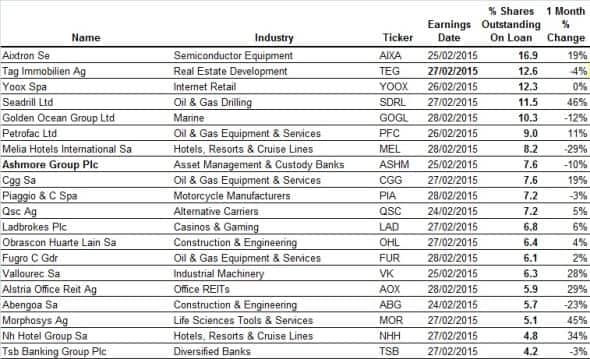

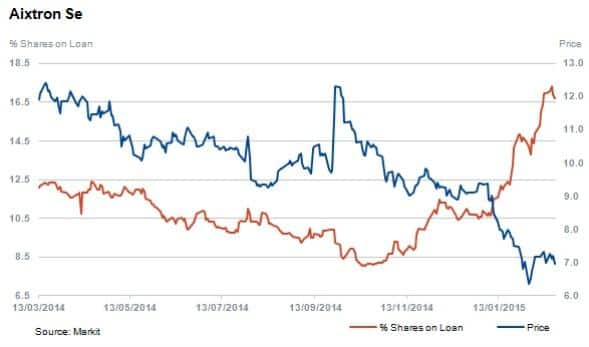

Western Europe

Most shorted ahead of earnings this week and perennial target for short sellers is Axitron with shares out on loan increasing by 18% in the last month to reach 17%. The German based firm generates 78% of revenues from the development and installation of equipment involved in the deposition of semiconductor materials, organic LEDs and electronics using nanomaterial.

Oil and gas firms in the region witnessing large moves in short interest in the last month include offshore driller Seadrill, oilfield service provider Petrofac and geoscience firm Cgg. These companies have seen increases in shares out on loan of 47%, 11% and 24% respectively. Seadrill currently has 12% of shares on loan compared to Petrofacs' 11% and Cgg's 8%.

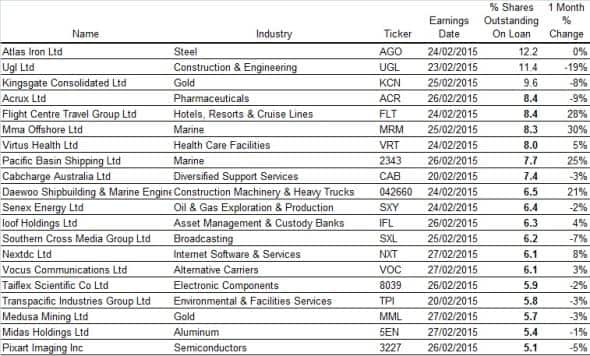

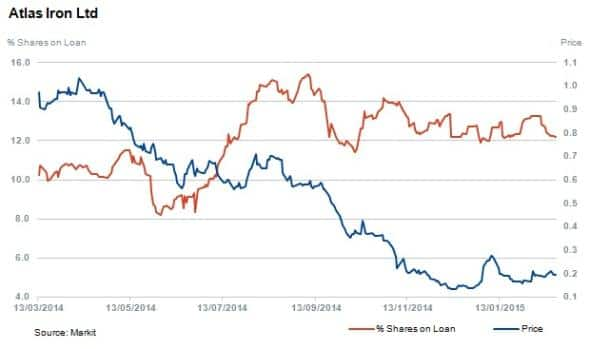

Asia Pacific

Australian firms take the top three short positions in Apac ahead of earnings this week, with independent iron ore miner Atlas taking pole position. The country's currency depreciation has not been enough to offset iron ore's price decline and Atlas has seen its shares decline by 80% in the last 12 months, with short interest currently standing at 12%.

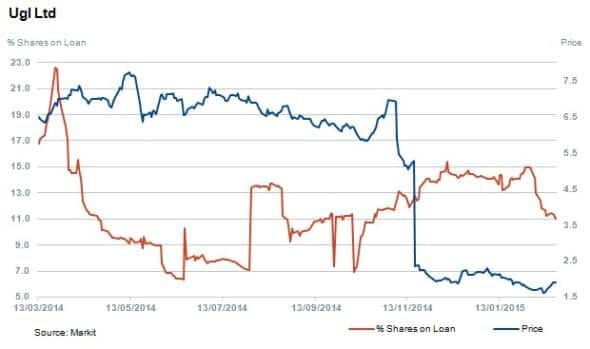

Contract construction and engineering firm UGL is the second most short sold in the region with 11% of shares out on loan. The firm's shares plummeted by 15% on November 6th 2014 as the company announced substantial write downs related to the Ichthys power project in Darwin. Subsequent to this decrease, shares took a dramatic dive on November 18th 2014 as the shares went ex-capital post the firm selling off a property unit returning $2.94 per share to shareholders.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}