Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 19, 2015

Shorting US homebuilders while UK pays dividends

Homebuilder returns in the UK are seemingly on the up with increased dividend payments, marking a contrast to the US housing market where short sellers are congregating.

- UK homebuilders shares rally 12% in the last 30 days as fears of a slowdown fade

- Short sellers bet against the US market as it rallies 16% in the last 30 days

- UK homebuilders to increase dividend pay outs by 50% due to strong demand

UK demand for homes thriving

UK housing demand remains robust with firms such as Bellway and Redrow reporting solid results in recent weeks. Bellway posted a 25% increase in off plan sales, showing healthy demand for new builds. There are even efforts to help address skills shortages as homebuilders culled jobs during the recession and tradesmen have since relocated or changed professions entirely.

As concerns of a sharp UK housing market slowdown abate, homebuilders' shares have performed well over the past 30 days. UK homebuilders have averaged a 12% return, with Bellway and Redrow edging up by 11% and 34% respectively.

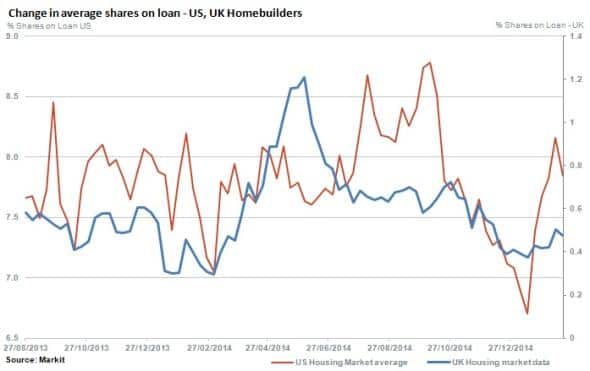

Using the average shares out on loan across the largest homebuilders in the UK to gauge sentiment reveals that short sellers covered positions in the second half of 2014. Average shares outstanding on loan peaked in June 2014 at 1.2%, declining by 75% to hit 0.5% at present.

Investors short the US market

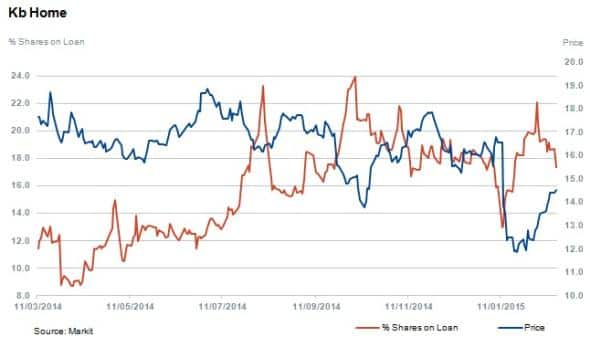

US homebuilders currently see 15 times more short interest than their UK counterparts, racking up an average of 7.8%. However the US market has seen short sellers cover slightly from a high of 8.7% reached in October 2014. Currently the most short sold homebuilder in the US is Kb home with 17.4% of shares out on loan.

Recent US residential construction data indicates a slowdown in single family homes in January 2015 as housing starts are near seven year highs. Kb Homes witnessed its shares fall by the most in two decades as the company guided earnings lower in January 2015 due to lower realised house prices and rising land costs.

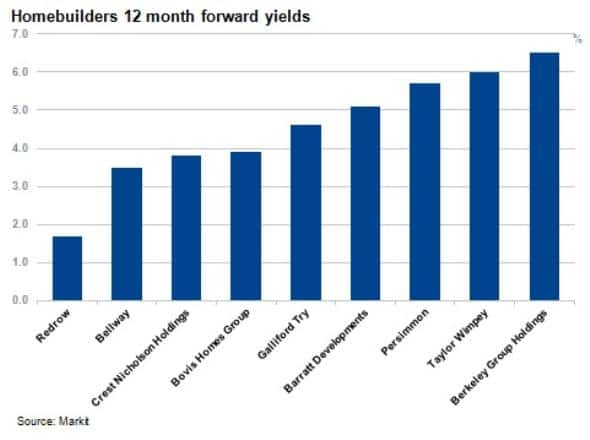

UK homebuilders paying up

According to Markit's dividend forecasting, distributions to shareholders among homebuilders in the FTSE 350 are expected to increase by 50% this financial year reaching "1.3bn, with ordinary payments up 25% to "668m and expected special distributions totalling "642m. Dividend growth is expected to slow following the significant jump in payouts in 2014.

Despite UK homebuilders being severely hit by the financial crisis and experiencing a dramatic fall in house prices, demand and prices have rebounded strongly. Accordingly companies resumed capital redistribution payments in 2013, at a low base, giving some room for further dividend growth. The net cash position of the majority of the players support shareholders' returns through ordinary or special distributions.

Barratt Developments, Berkeley Group Holding, Persimmon and Taylor Wimpey represents 80% of the payout of the sector (around 20% each). Taylor Wimpey is expected to increase its payout by 280% due to a commitment from the management to pay "250m in July 2015 and "200m thereafter.

In comparison, dividends for US homebuilders such as Kb Home and Lennar are expected to remain constant, while Toll Brothers lack of dividend program is also expected to continue.

Stacking up past returns

Despite strong rallies in both housing markets, historical returns highlight differences in investment outcomes.

The average returns across the largest UK homebuilders in 2013 and 2014 were 51% and 12% respectively, while the largest US homebuilders delivered on average a negative return in 2013 of -2.1% and 3.3% in 2014.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022015-Equities-Shorting-US-homebuilders-while-UK-pays-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022015-Equities-Shorting-US-homebuilders-while-UK-pays-dividends.html&text=Shorting+US+homebuilders+while+UK+pays+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022015-Equities-Shorting-US-homebuilders-while-UK-pays-dividends.html","enabled":true},{"name":"email","url":"?subject=Shorting US homebuilders while UK pays dividends&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022015-Equities-Shorting-US-homebuilders-while-UK-pays-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorting+US+homebuilders+while+UK+pays+dividends http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022015-Equities-Shorting-US-homebuilders-while-UK-pays-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}