Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 19, 2015

ASEAN credit lifted by global yield drought

South East Asian economies have continued to outperform global growth statistics; a trend that has not gone unnoticed by yield starved investors.

- CDS spreads have tightened across four of the five ASEAN countries in the last year

- Local debt issuances have seen yields fall since the fourth quarter of last year

- Dollar denominated debt continues to provide additional yield over US debt, but the spread has been narrowing

Still trying to kick start meaningful growth in the wake of the financial crisis, Western economies have been engaging in loose monetary policies in order to stimulate growth.

Interest rates have remained below 1% since the crisis, and with deflationary fears added to the mix central banks have resorted to further unconventional monetary measures.

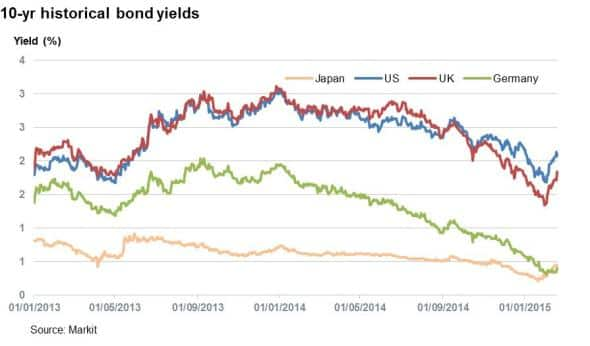

As a consequence, long term government bond yields have collapsed with all Western economies seeing bond yields dip below 2% this year. Europe and Japan, which have been engaged in reflationary monetary policies such as QE, have seen their currencies depreciate against the more optimistic US dollar. As a result, investors are looking to other areas of the fixed income market for returns.

SE Asian stability

One area investors seeking yield might consider is Emerging Markets, and in particular sovereign bonds. Within this grouping, South East Asia has been a standout performer, in particular the ASEAN-5 (Thailand, Malaysia, Indonesia, Philippines, Vietnam).

Macroeconomic conditions have been improving in the region. According to the IMF, growth in 2014 was a healthy 4.5%, and is projected to be over 5% in the next two years; far outstripping the global average. Current account deficits have been narrowing, benchmark interest rates remain at historical lows and prices have remained relatively stable. The group has also so far been resilient to the recent fluctuations in oil price, as most remain net importers and benefit from the falling energy prices. Big exporters, such as Malaysia, have done enough to diversify their economies over the years. This contrasts with other Emerging Market commodity-producing countries such as Russia, Nigeria and Brazil.

On the credit front, four of the five countries have secured investment grade ratings, with Vietnam the only one in junk territory, albeit by one notch, according to Markit iBoxx. 5-yr CDS spreads have also come down in the last year, with the exception of Malaysia. The cost to protect against Thai debt is now below that of advanced European economies such as Spain and Italy.

Bond returns

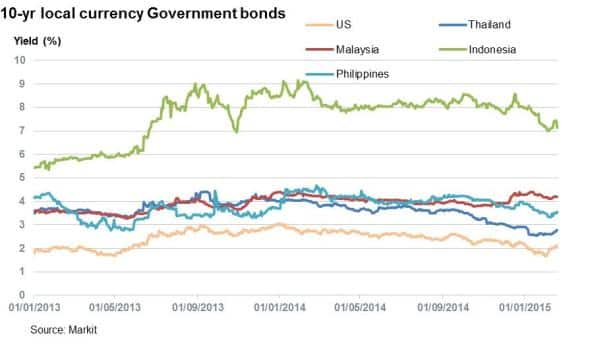

Local currency bonds (10-yr) saw yields hold steady in the region in the two years leading up to the last quarter of 2014. Yields have since tightened across the board with Thailand in particular seeing its ten year borrow yield drop around by more than a third to 2.77%, most likely driven by the region's strong growth and depressed global yields. Indonesia has been the exception as it yields more than 7%; a figure largely attributed to its high target interest rate.

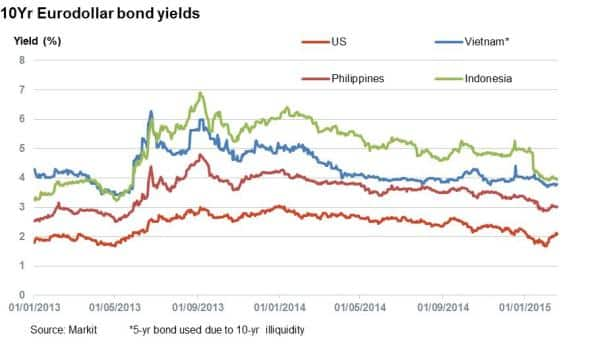

A more comparative way to look at bond returns may be to look at the Eurodollar market (US denominated debt issued by a foreign entity). Only three of the five countries issue in US dollars, and Vietnam only issues shorter term debt. The standout here is the Philippines whose dollar denominated debt provides around 95bps extra yield above equivalent US treasuries. The country grew 6.9% year on year in the last quarter, enjoys relatively stable inflation at 2.4%, runs a current account surplus and looks the strongest among the group.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022015-Credit-ASEAN-credit-lifted-by-global-yield-drought.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022015-Credit-ASEAN-credit-lifted-by-global-yield-drought.html&text=ASEAN+credit+lifted+by+global+yield+drought","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022015-Credit-ASEAN-credit-lifted-by-global-yield-drought.html","enabled":true},{"name":"email","url":"?subject=ASEAN credit lifted by global yield drought&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022015-Credit-ASEAN-credit-lifted-by-global-yield-drought.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ASEAN+credit+lifted+by+global+yield+drought http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022015-Credit-ASEAN-credit-lifted-by-global-yield-drought.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}