Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 20, 2015

US banks' credit deteriorates

Lacklustre US bank earnings, combined with the prospects of a US rate rise and geopolitical risks, have seen credits deteriorate.

- All five major US banks have seen CDS spreads widen in days post earnings

- Wells Fargo's spreads have widened to the highest levels since November 2013

- Fixed income investors are now requiring over 1% of extra yield to hold US domestic bond debt

Jefferies' earnings in December last year signalled an early sign of stress in investment banking revenue along with downturns in both fixed income and equities trading. In the past week, Citigroup, Bank of America and JP Morgan all followed suit, announcing earnings which came in below analysts' forecasts, impacted by poor trading and the heavy fines levied by regulators. The shares of Wells Fargo and Goldman Sachs, which announced results ahead of expectations, also underperformed the S&P 500 as investors factored in the prospects of further regulatory action and the impact of the recent fall in energy prices.

CDS Spread Widens

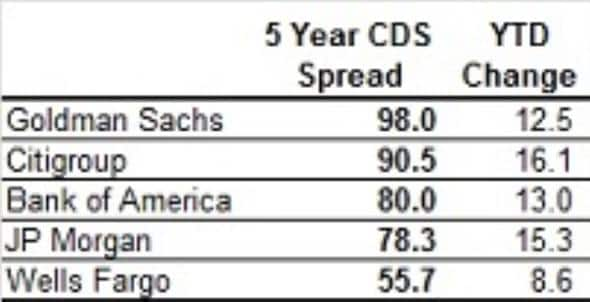

Bank credits have reacted adversely to the recent bearish sentiment, with CDS spreads having widened across all five large US banks, including those which posted solid results.

The 5 year CDS spreads in all five major US banks are currently trading spreads at levels not seen since the first quarter of last year, or in Wells Fargo's case, since November 2013.

Citigroup, which incurred significant exceptional regulatory charges, has seen its CDS spreads nearly double since the summer. This appears to be in line with a general trend of increased investor concerns around the credit risk associated with US banks.

It is worth highlighting that Goldman Sachs, which posted strong fourth quarter earnings, currently sees the widest CDS spread out of its peer group.

Investors demand extra yield

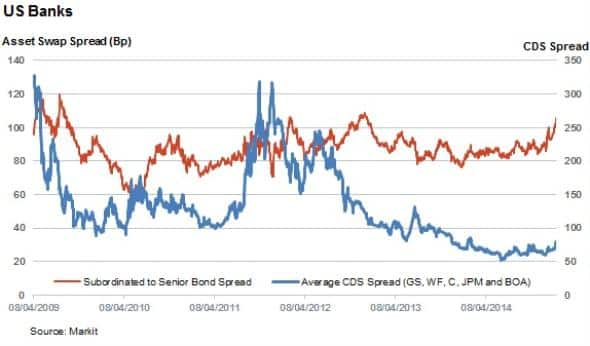

Another sign of the increased stress in the bank credit market is the fact that investors are now demanding over 100bps of extra yield to hold junior US bank debt, a number that has surged significantly in recent days. The asset swap spread difference between subordinated and senior bank debt has risen to 102 bps, a level not seen since the end of 2012. A widening gap usually signals growing concern as investors seek safer havens by buying senior debt while selling subordinated tranches.

In assessing the prospects for US banks, it is important to consider the bigger picture. The state of US banking is arguably much healthier than any time in the last six years. Systemic risk has been greatly reduced as regulators have clamped down questionable practices and forced financial institutions to build up hefty buffers and apply rigorous stress testing. This could beg the question as to whether the recent bout of negativity could actually provide investors with some value, and highlight a disconnect between credit and cash investors. This statement holds true as the average CDS spread of the previously mentioned banks was twice the current level the last time subordinated US bank bonds traded 100bps above their senior peers.

Neil Mehta

Analyst

Markit

Tel: +44 207 260 2298

Email: neil.mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012015-Credit-US-banks-credit-deteriorates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012015-Credit-US-banks-credit-deteriorates.html&text=US+banks%27+credit+deteriorates","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012015-Credit-US-banks-credit-deteriorates.html","enabled":true},{"name":"email","url":"?subject=US banks' credit deteriorates&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012015-Credit-US-banks-credit-deteriorates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+banks%27+credit+deteriorates http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012015-Credit-US-banks-credit-deteriorates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}