Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 19, 2015

Short sellers aim for the big screen

The relentless growth of alternative digital delivery platforms and the "instant release premiere" of The Interview have forced traditional cinematic businesses to adapt in order to stay relevant to today's consumers.

- Imax sees 11.8% short interest, despite rising stock price

- 85% of The Interview's first week's earnings derived from online distribution

- US cinema operators Regal Entertainment and Cinemark Holdings targeted by short sellers

Consumer habits have changed markedly over the last decade, but their appetite for filmed content is as ferocious as ever.

The Interview's online release in late 2014 was dueto malicious cyber-attacks on the company, but the debacle provided the first large scale test case for instant online or video on demand (VOD) release and revealed that audiences are ready and waiting. The Interview earned $18m in its first weekend and 84.4% of this was via online channels. This release effectively cut out cinema chains, although most in this case actually opted out of screening the feature.

This episode demonstrates that content creators are now capable of launching a film globally, on their own or via partners, to millions of people instantly. It should come as no surprise that theatre owners have sounded the death of the cinema at the hands of Netflix and its peers.

Only in cinemas

The delay between theatrical release to online distribution or DVD) has sheltered cinema chains to some extent, as a major part of their value proposition is screening the latest content.

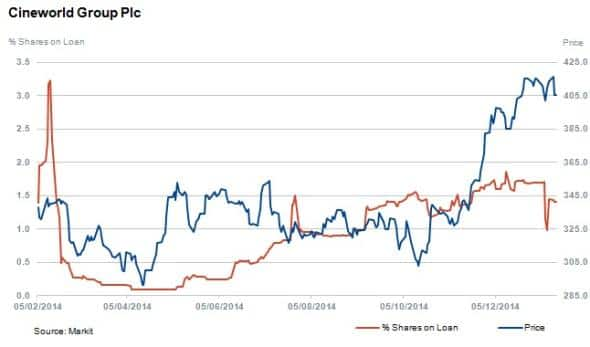

The UK's largest cinema operator Cineworld, released trading numbers earlier this year that at first glance suggest the chain is thriving, defying the rapid growth in delivery of content via online networks.

But upon closer inspection, Cineworld's numbers reveal admissions in the UK and Ireland were actually down 3.7% in 2014 and the good results were driven by M&A and business growth in Eastern Europe, where admissions grew by 4%. The stock is up 17% over the last 12 months with shares outstanding on loan at 1.7%.

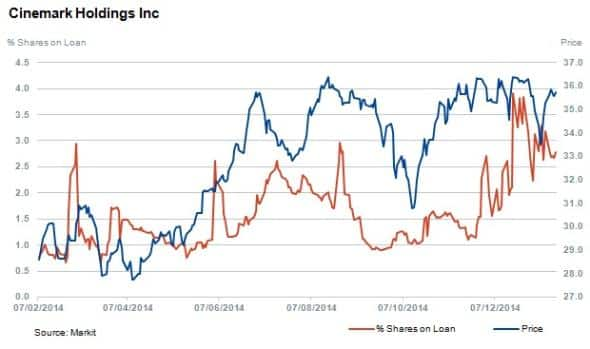

In the US cinema market, Regal Entertainment and Cinemark Holdings are two names that see significant levels of shares outstanding on loan at 6.6% and 2.8% respectively.

While Regal has seen short sellers retreat 41% since last year and a flat share price performance, Cinemark has seen short interest more than double and the share price increase by 14%.

Content creation key

Content is king, and the creators of content have performed better relative to cinema chains and distribution platforms over the last year. Time Warner, Sony Corp and Walt Disney shares are all up over 25% in a year.

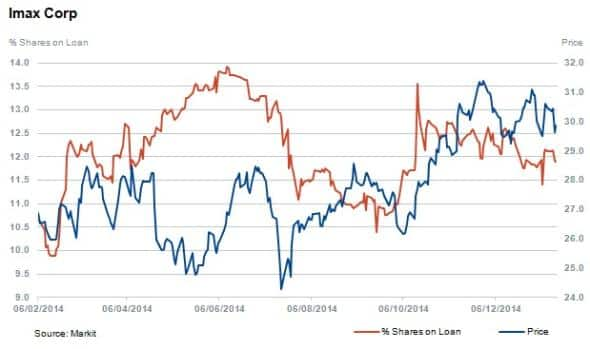

Imax, who operates high end cinemas globally, has focused on an immersive experience and continued to increase revenue despite industry pressures. The stock has however consistently attracted short seller's attention over the last five years. Imax's share price is up 7.4% over the last year, with short interest increasing by 10.9% to 11.8% of shares outstanding on loan.

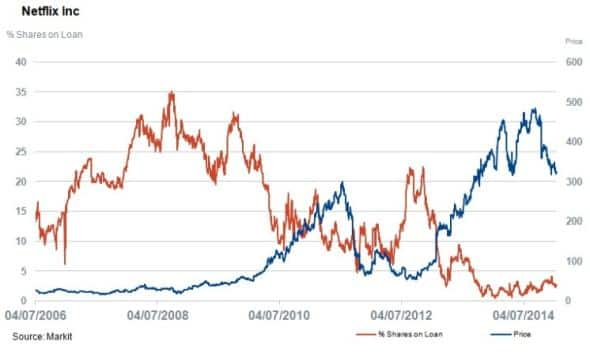

Shorting Netflix

Netflix, the subscription streaming service launched in 2002, has changed and grown dramatically over the last decade. Short interest in Netflix peaked in September 2008 when 35.2% of shares outstanding were shorted. Short sellers, sceptical of the business model, were subsequently sent covering as revenues and profits grew rapidly, seeing the stock price increase 970% (to date) since short interest peaked in 2008.

As other streaming video services grow and achieve prominence, rapid growth will be harder for Netflix to sustain. The firm reported lower than expected subscriber growth numbers in October 2014 which sent the stock down over 25% in a day. While shares outstanding on loan currently are nowhere near 2008's highs, they have increased by 209% over the last 12 months to 2.8%.

Relte Stephen Schutte, Analyst at Markit

Posted 19 January 2015

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012015-Equities-Short-sellers-aim-for-the-big-screen.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012015-Equities-Short-sellers-aim-for-the-big-screen.html&text=Short+sellers+aim+for+the+big+screen","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012015-Equities-Short-sellers-aim-for-the-big-screen.html","enabled":true},{"name":"email","url":"?subject=Short sellers aim for the big screen&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012015-Equities-Short-sellers-aim-for-the-big-screen.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+aim+for+the+big+screen http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012015-Equities-Short-sellers-aim-for-the-big-screen.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}