Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 19, 2015

Bond investors return to European paper

European government bonds have had a wild ride for the last six months, but the growing chorus calling for more stimulus in the region have seen investors return to the asset class.

- 10 year bund yields now 40bps off their summer highs

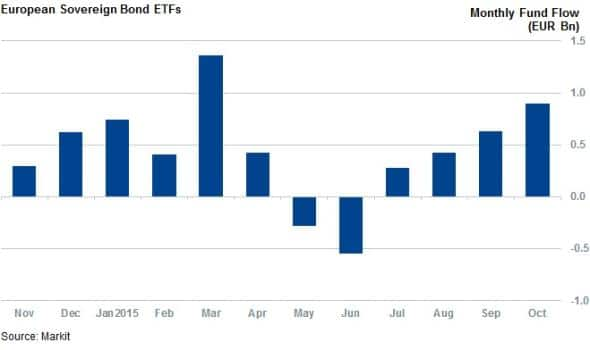

- European government bond ETFs on track for their best monthly inflows since record March

- Periphery trade back on as ETF investors look to take advantage of tightening yields

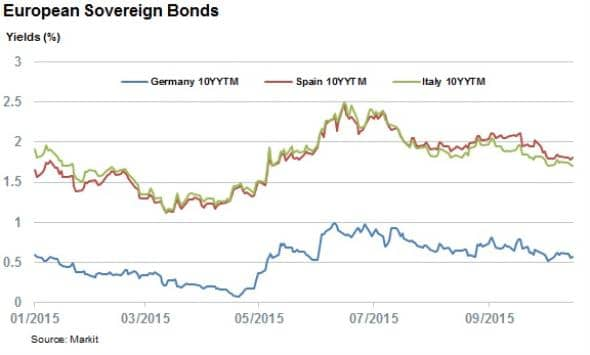

European government bonds were one of the high conviction plays as investors sought to get ahead of the European Central Bank's quantitative easing program. This trend saw yields on German bunds tighten to all time lows in May when 10 year bund yields dipped below 7bps. That consensus was not to last, however, with Bill Gross famously calling bunds the "short of a lifetime". The resulting market reaction, combined with uncertainty around the Greece situation, saw bund yields surge back up above the levels they started the year at with yields briefly touching the 1% mark in June, over 10 times the lows seen a few weeks prior.

The global volatility has seen investors return to the asset class. However, market uncertainty saw investors return to bunds as yields briefly touched 50bps a few weeks ago, half what was seen in the previous year. While investor desire for a safe asset looks to have been a contributing tailwind to the asset class, the last few weeks of weakening economic news, combined with inflation gauges in the region retreating back into negative territory, has led an increasingly loud chorus of market observers to call for more quantitative easing. This has in turn seen government yields across the region fall from their recent highs.

ETF investors return to the asset class

This growing chorus is also reflected in ETF flows into products exposed to Eurozone sovereign bond ETFs over the last few weeks. Investors trimmed exposure to the asset during the worst of the market volatility but the subsequent yield tightening has seen inflows return in earnest with €1.3bn being added over the third quarter. The increasing market consensus regarding further stimulus in the Eurozone has seen the trend accelerate even further with investors pouring just under €900m into the asset class over the first three weeks of October. This puts October on track to be the best inflow month for the asset class since March.

Periphery trade back on

One particular trade that has been on ETF investors' minds over the last few weeks is the periphery tightening trend driven by the ECB essentially mutualising credit risk across the region. This stands to benefit holders of comparatively lower credit names across the region as the yields converge.

This trade looks to be in full play over the last few weeks. Periphery sovereign European ETFs have seen their best inflow month in over a year as investors piled over €100m into these funds, the most in over a year. The current spread between Spanish and Italian 10 year bonds and their German peers is still over 20bps off the lows seen in March, and investors are betting that an increase in quantitative easing across the region would see that spread fall, benefiting periphery bondholders.

Simon Colvin, Research Analyst at IHS Markit

Posted 19 October 2015

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102015-Credit-Bond-investors-return-to-European-paper.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102015-Credit-Bond-investors-return-to-European-paper.html&text=Bond+investors+return+to+European+paper","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102015-Credit-Bond-investors-return-to-European-paper.html","enabled":true},{"name":"email","url":"?subject=Bond investors return to European paper&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102015-Credit-Bond-investors-return-to-European-paper.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bond+investors+return+to+European+paper http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102015-Credit-Bond-investors-return-to-European-paper.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}