Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 16, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

- Lumber Liquidators most shorted ahead of earnings after its arsenic scandal

- Logitech sees a resurgence in short interest in the weeks leading up to earnings

- Great Wall Motor has seen a 17 fold jump in demand to borrow in the last month

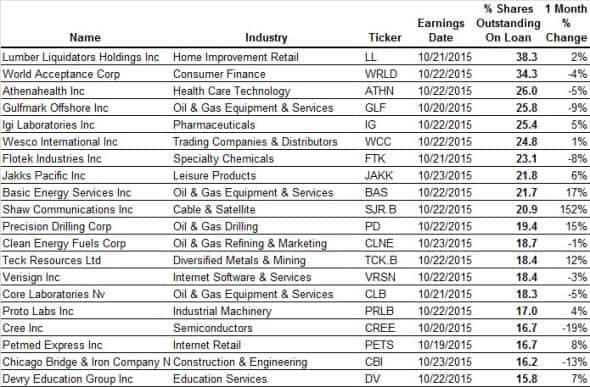

North America

The week's most shorted share globally is home improvement firm Lumber Liquidators, which sees 38% of its shares out on loan. The firm has been the target of short sellers for several years now as short interest has not dipped below the 10% mark in the last three years. Short sellers have been emboldened recently in the wake of a "60 Minutes" investigation regarding arsenic levels in some of its laminate floors. This in turn saw its shares tumble while short interest jumped to the current all-time high.

Oil continues to be in focus this earnings season with five oil and gas names making their way onto the most shorted list.

The most shorted of the lot is Gulfmark Offshore, which has 258% of shares out on loan. Short sellers have trimmed their positions somewhat as demand to borrow the offshore supply vessel firm's shares is down by a fifth from the highs seen earlier in the year.

While Gullfmark has seen short seller cover in recent weeks, the same can't be said for Basic Energy, the second most shorted energy name announcing earnings this week. Demand to borrow Basic shares has seen a more than fivefold increase in the last 10 months with over 21% of its shares now out on loan, an all-time high. This has continued in the month leading up to earnings with demand to borrow now 15% higher than a month ago.

Another favourite sector for short sellers, for profit education, is also making an appearance this week with Devry Education seeing just under 16% of its shares shorted. Demand to borrow Devry shares has surged by tenfold in the last six months after the firm announced a disastrous earnings in which it reported a double digit fall in enrolment.

Western Europe

Oil names also make an appearance in Europe this week with geophysical mapping firms Tgs Nopec and Petroleum Geo Services both making the most shorted ahead of earnings list. The former is the most shorted of the pair with 13.7% of shares out on loan, although both have seen significant short covering from the highs seen in January when both firms had more than 20% of shares out on loan.

Logitech also makes an appearance in the most shorted list. The firm has seen a 15% jump in short interest in the last four weeks to a new yearly high.

Short sellers have also been getting behind the slump in metals prices in recent months. This week sees Ssab experience the highest level of short interest in over 10 months after short sellers increased their positions by 18% in the last month.

The lone UK name to make the most shorted ahead of earnings list is Home Retail Group, which has seen its demand to borrow jump by 300% in the last four months to the highest level since the end of 2013.

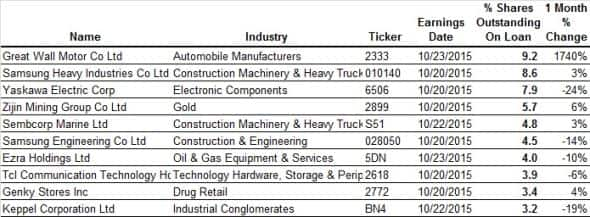

Asia Pacific

The standout name in Asia ahead of earnings this week is Great Wall Motor, which has seen demand to borrow jump by more than 15 times in the last month. Great Wall shares are down by over 60% from highs seen earlier in the name, and the recent weak Chinese growth number looks to have emboldened short sellers even more as the firm now sees 9% of its shares out on loan, the highest since early 2014.

The weak growth, trade and commodities data across the world has also been spurring on short sellers in global shipbuilding stocks in recent months. This week sees Samsung Heavy Industries, the largest shipbuilder in the world reach an all-time high of 8% in its shares out on loan ahead of earnings. This is over four times the levels seen 12 months ago as the firm struggles with a glut in global shipping.

Fellow ship engineering firm Sembcorp Marine also makes the most shorted ahead of earnings list with 4.7% of its shares out on loan

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}