Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 19, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week.

- Agricultural irrigation provider Lindsay and Winnebago is most short sold in North America

- Costly incorrect meter readings see Telecom Plus the most shorted in Europe

- China Huishan Dairy and bicycle retailer Asai Co sees highest short interest in Apac

North America

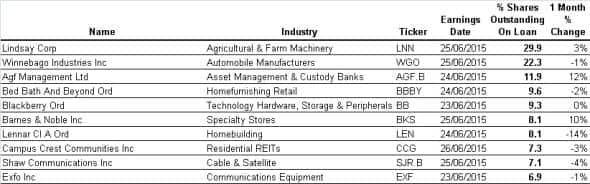

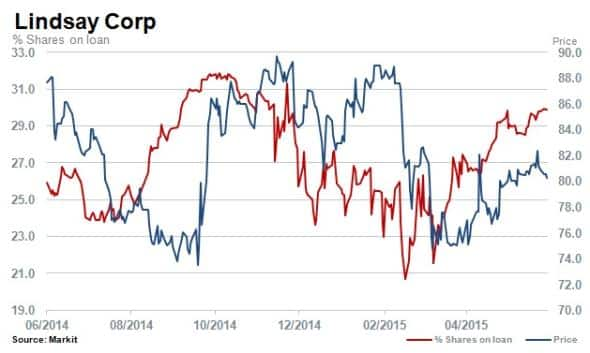

Most shorted ahead of earnings this week in North America is agricultural irrigation and infrastructure firm Lindsay. Shares out on loan have increased by 22% in the last three months to reach 30% currently. The company reported softer sales and earnings earlier in the year with US irrigation revenues down by 27%. The company's main revenue driver is net farm income which has been on the decline since 2013.

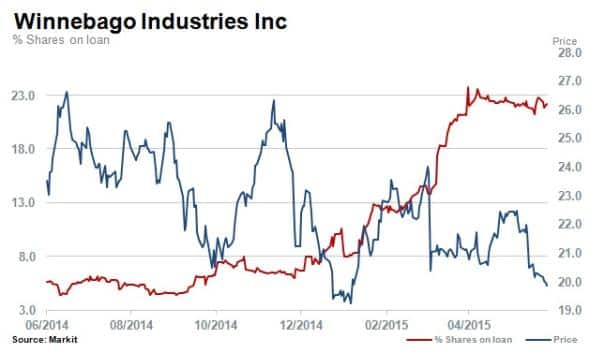

Shares out on loan have increased to 22% for Winnebago Industries, peaking at 23.8% in April after increasing fourfold over the year while the stock price has declined by a quarter. The iconic recreational vehicle maker reported an unexpected drop in earnings earlier in the year due to labour issues and higher expenses offsetting shipment growth.

Toronto based independent investment management firm Agf management has seen a 14% rise in short interest over the last month as shares outstanding on loan have increased to 12%. Shares in the stock are down 10% over the last month however and have slumped some 50% in the last 12 months. Revenues and earnings have declined for the firm for the last four consecutive years culminating in the company cutting its dividend in December 2014.

Shares in troubled handset maker Blackberry have declined sharply by 14% in the past month while short interest remains high at 9.2% of shares outstanding on loan. The company has managed to post positive earnings for the last two consecutive quarters however consensus forecasts point to a loss for the quarter ending May 2015.

Western Europe

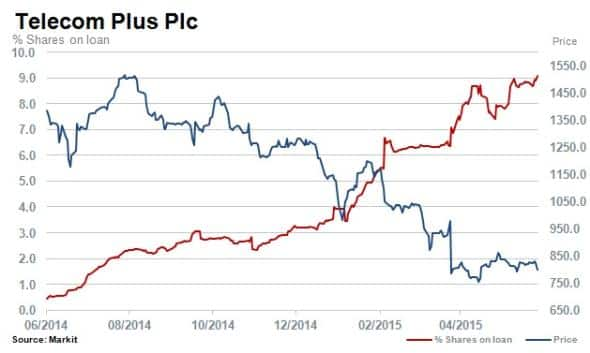

Telecom Plus, trading as Utility Warehouse, provides communication and energy services and is the most shorted firm in Europe ahead of earnings.

In April 2015 shares slid almost 15% when the company revealed that calculation errors in gas leakage figures would result in a "11m charge to earnings. Subsequently short sellers have increased their positions to all-time highs in the company with 9.1% of shares outstanding on loan currently.

While shares in Telecom have continued to decline since early 2014, the stock is down 40% over the last 12 months.

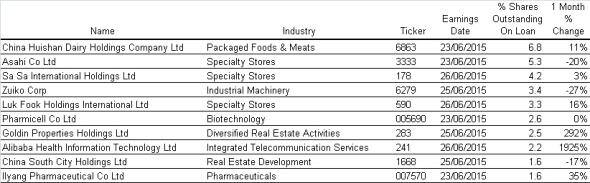

Asia Pacific

Most shorted ahead of earnings in Apac is China Huishan Dairy, one of China's biggest dairy producers. Shares out on loan have declined from 10% to 6.8% currently as the share price, while down by 7% over the last 12 months, has made a 37% recovery in the last six months.

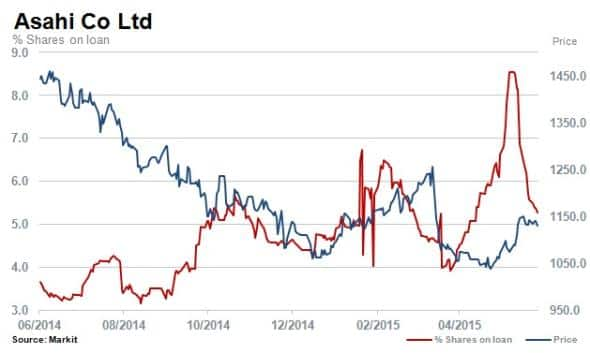

Japanese bicycle retailer Asahi is the second most shorted stock in the region ahead of earnings. In the beginning of June 2015, shares out loan spiked up to 8.5% before declining to 5.3% at present.

Relte Stephen Schutte, Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}