Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 19, 2015

US shrugs off European credit woes

Grexit concerns have intensified over the past week, roiling credit markets in Europe; while US and emerging markets shrug off Greece concerns as Fed sparks rally.

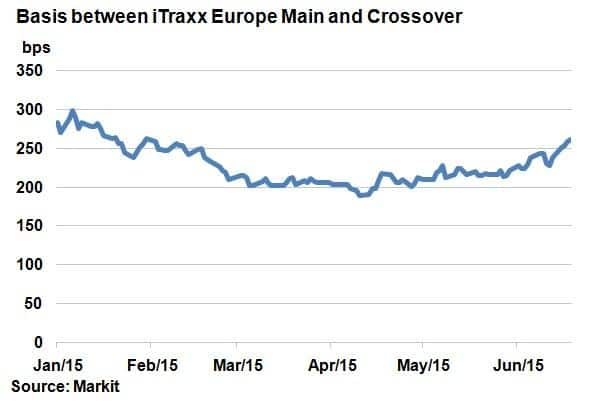

- The basis between iTraxx Main and Crossover has widened 32bps over the past week

- French 10-yr spread over bunds has spiked, breaking down core Europe relationship

- Fed's dovish tone comments see treasuries and emerging markets rally

European contagion

Rather unsurprisingly, yesterday's Eurogroup meeting of finance ministers failed to produce any plausible resolution to the ongoing Greek government bailout negotiations. With payment deadlines around the corner, the prospect of a default is firmly on the cards; unwelcome news for European credit markets.

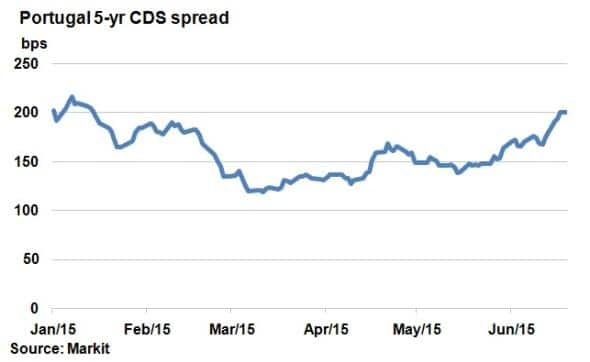

Fears of Greek contagion into Europe's periphery were largely contained in the first quarter of this year but as time passed with little positive progress, fears have resurfaced. This week, Portugal's 5-yr CDS spread widened to 200bps; the highest level since January 14th and 80bps higher than on March 6th. Portugal, bailed out by the ECB for $78bn in 2011, has typically been one of the more sensitive nations to eurozone turbulence.

It's been a similar story in European corporate credit, with the Markit iTraxx Crossover index continuing its ascent towards year to date (ytd) highs. The high yield index has widened 32bps over the past week and now trades at 262bps over its investment grade counterpart, the Markit iTraxx Main. This is the largest basis seen since the ECB's announcement of QE on January 21st.

But an even clearer signal of eurozone contagion intensifying was the reaction seen in French and German government bonds. Last Sunday saw another failed attempt for Greece and its creditors to settling their differences. French 10-yr yields widened 7bps on the back of the negative news, whereas 10-yr bunds actually tightened 10bps.

For the first time in eight months, the closely held relationship between Europe's core was broken down as the French 10-yr spread over bunds touched 40bps. This served as a reminder that in time of crisis, when fundamentals drive action (rather than technical factors), German bunds are seen as the only safe haven in Europe.

Yellen dovish

Wednesday saw the FOMC meet for their June meeting, with Fed chair Janet Yellen striking a dovish tone. 10-yr treasuries rallied as a result, ignoring Greek concerns across the pond.

A similar trend was observed in emerging markets, as governments indebted in US dollars cheered the news. The Markit iBoxx USD Turkey Sovereigns Index yield tightened 2bps while the Markit iBoxx USD Russian Federation Sovereigns Index rallied with yields tightening 10bps.

While a rate hike is expected towards the end of the year, policy will remain driven by the performance of key macroeconomic data. The US job market continues to perform well, but is struggling to induce enough inflation.

For now, with 5-Year Breakeven Inflation at 1.67%, well below the Fed's 2% target, hawkish tones remain dampened.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062015-Credit-US-shrugs-off-European-credit-woes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062015-Credit-US-shrugs-off-European-credit-woes.html&text=US+shrugs+off+European+credit+woes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062015-Credit-US-shrugs-off-European-credit-woes.html","enabled":true},{"name":"email","url":"?subject=US shrugs off European credit woes&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062015-Credit-US-shrugs-off-European-credit-woes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+shrugs+off+European+credit+woes http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062015-Credit-US-shrugs-off-European-credit-woes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}