Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 22, 2015

Commodities bonds hit by slump

The last 12 months have seen energy and mining bonds lose out due to the global commodities slump, with both high yield and investment grade bonds still feeling the strain.

- Investment grade commodities bonds have underperformed the market in the last 12 months

- High yield commodities bonds have performed worse than their investment grade peers

- High yield oil & gas bonds have proven more resilient, but markets still wary of risk

Weakness in the commodities market has been one of the defining stories shaping market returns over the last 12 months. The fall from grace of commodities as an asset class is best illustrate by the performance of the Bloomberg Commodities Index which tracks over 20 commodities including livestock, metals and energy. The index hit a five year low in March of this year and has been hovering around the 100 mark ever since; around a quarter lower than the levels seen 12 months ago.

Commodities bonds underperform

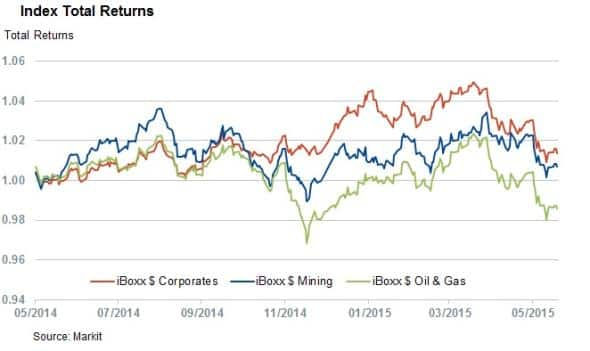

This commodities slump has seen mining and energy bonds underperform the rest of the market as investors priced the commodities slump into their bond portfolios. Over the last 12 month, the mining and oil & gas bonds which make up the Markit iBoxx $ Mining and Markit iBoxx $ Oil & Gas indexes have underperformed the wider Markit iBoxx $ Corporates index by 0.7% and 2.8% respectively.

This underperformance has been driven by increased risk perception, as gauged by the index asset swap margin which measures the extra yield investors would require in order to swap out their exposure to the respective bond issuances. 12 months ago, the asset swap rate of constituents of the Markit iBoxx $ Oil and Gas stood at 150bps. This number has since climbed by over a third to 206bps, as of latest count. The mining index has seen a swing of equal magnitude, with its asset swap rate jumping by 38% to 241bps in the last 12 months.

High yield even more volatile

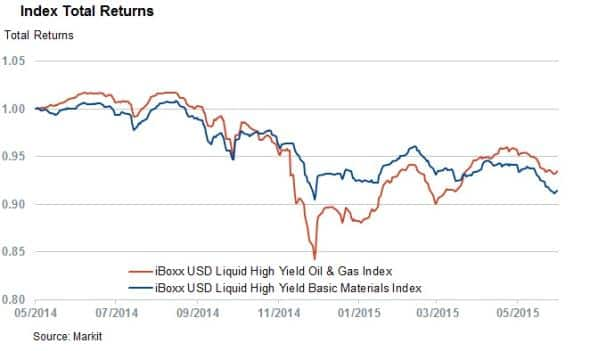

Speculative high yield bonds have fared even worse in both sectors with the Markit iBoxx USD Liquid High Yield Oil & Gas Index and Markit iBoxx USD Liquid High Yield Basic Materials Index both down by over 5% in the last 12 months.

Unlike the investment grade universe, the non-energy commodities bonds that make up the Markit iBoxx USD Liquid High Yield Basic Materials Index have underperformed their Oil & Gas peers after seeing a fall of 9% as opposed to the 7% fall seen by their oil and gas equivalents.

This underperformance in basic material bonds has been driven somewhat by the performance of coal bonds which make up 12.7% of the index. The continued oversupply of coal has seen the equity market turn increasingly bearish in coal names; something which has been mirrored in the bond world with some Alpha Natural Resources issues now trading at ten cents on the dollar.

Oil & gas rebounds, but risk still present

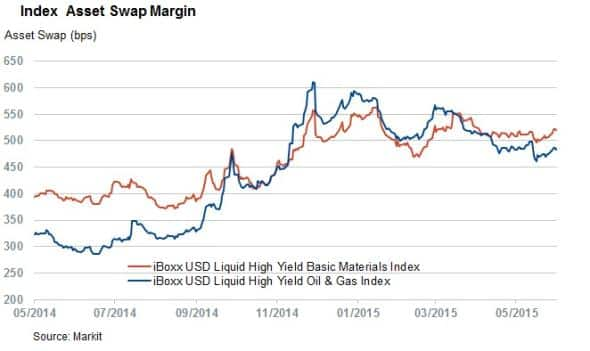

The one redeeming factor in the high yield commodities bonds has been the fact that oil and gas names have rebounded strongly from their lows seen in the closing weeks of last year. High yield oil and gas names are up by 10.9% on a total return basis from the lows seen on December 16th. This has been driven by a brightening in investor perception in the wake of a stabilisation in oil prices at around the $60 per barrel range.

This relative stabilisation of energy names has seen the asset swap rate of the Markit iBoxx USD Liquid High Yield Oil & Gas Index fall from 600bps in December to 483bps as of latest count. Despite the recent fall in risk perception, the index asset swap of the high yield oil & gas index is still around 50% higher than 12 months ago, showing that investors still remain wary of holding energy bonds despite the recent rally.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062015-Credit-Commodities-bonds-hit-by-slump.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062015-Credit-Commodities-bonds-hit-by-slump.html&text=Commodities+bonds+hit+by+slump","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062015-Credit-Commodities-bonds-hit-by-slump.html","enabled":true},{"name":"email","url":"?subject=Commodities bonds hit by slump&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062015-Credit-Commodities-bonds-hit-by-slump.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Commodities+bonds+hit+by+slump http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062015-Credit-Commodities-bonds-hit-by-slump.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}