Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 22, 2015

European banking attracts investors

European banking ETFs have continued to attract funds and have enjoyed strong price returns of above 15% so far this year. However a recent selloff indicates that that a high level of uncertainty still exists.

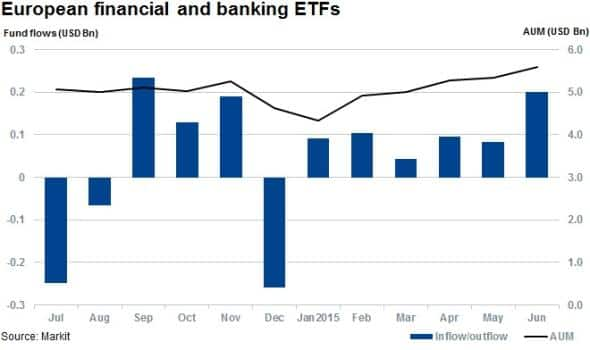

- European banking and financial sector ETFs have seen inflows of $617m in 2015

- Fund flows and rising stocks created all-time high $5.6bn AUM for financials-tracking ETFs

- European financials' credit rating rank dips below that of the UK

Banking on Europe

The European banking sector has been the target of public blame and regulatory penalties post the financial crisis. But investors have signalled their growing confidence in the sector over the last six months, with consecutive monthly inflows into banking and financial ETFs totalling $617m being recorded. With underlying stocks rising strongly, AUM of European financial and banking ETFs has increased from $4.3bn to $5.6bn year to date; an all-time high.

There are indications that the industry and regulatory environment have reached a possible turning point in regulatory penance expected by the banking sector. ETF investors may have timed a possible future rally in banking stocks.

Banking stocks in Europe have however pulled back from recent highs in May 2015, clouded by continued Grexit fears and possible contagion in capital markets.

European banking ETFs perform

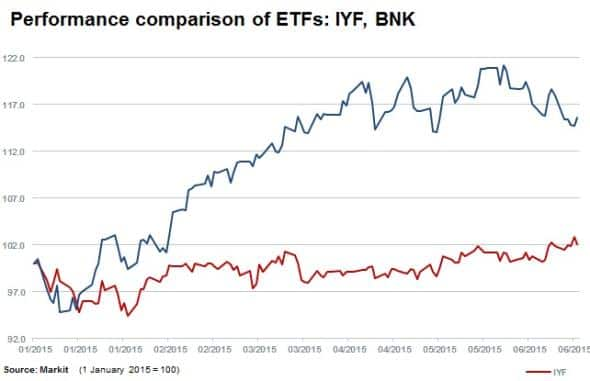

As of the end of May 2015, healthy year to date returns of 18% were delivered by the Lyxor UCITS Stoxx Europe 600 Banks ETF (BNK). The ETF tracks the Stoxx 600 Europe banks index and has $1.2bn in AUM.

Almost a third of BNK's exposure is allocated to UK banks (influenced by HSBC weight), followed by Spain, France and Switzerland. These four regions' geographical exposures represent 65% of the ETF's AUM.

The largest two holdings of BNK are HSBC (14%) and Banco Santander (8%), whose shares are down year to date by 3% and 4% respectively. The next largest BNK holdings are; UBS (6%), Lloyds (5.7%) and Barclays (5.4%) and are all up year to date by 26%, 14% and 9% respectively.

Comparing the price returns of BNK to an equivalent ETF tracking US financials can be achieved using the iShares US Financials ETF (IYF). European financials, as measured by BNK, have outperformed year to date but lost 2.5% in June while IYF rallied 1.5%. So far in 2015, BNK and IYF are up 15.7% and 2.1% respectively.

Credit risk remains present

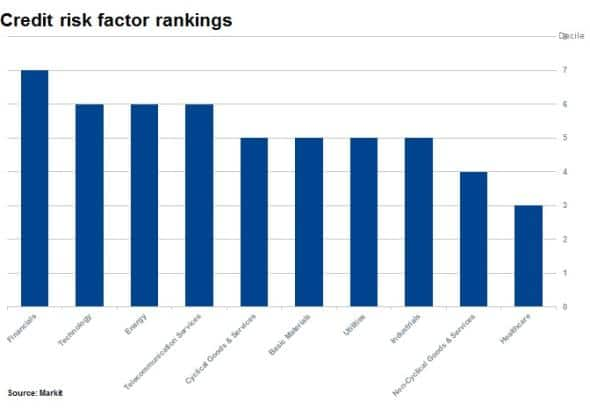

Despite this apparent vote of confidence from European ETF investors, the region's financials still carry some of the worst credit risk in the region, as measured by Markit's Research Signals Credit Risk Factor*. 11 of the 50 financial firms included in the Markit Developed Europe universe, are among the worst ranked 10% of all shares.

This large proportion of high risk names means financials have an average Credit Risk ranking of 64; the worst of all sectors which make up the developed Europe universe. This high risk ranking is unsurprisingly, led by Greek banks such as Apha Bank as well as periphery institutions such as Banco Comercial Portugues and Banca Monte dei Paschi.

This exposure to the risky end of the credit world could be the reason why the sector has experienced a pullback in recent weeks as the shares with the worse credit exposure have underperformed the wider European market by 1.5% so far in June.

*Markit's Research Signals factor Credit Risk, analyses CDS spread levels from numerous points across the CDS term structure to determine the level of credit risk priced in by the credit market.

Relte Stephen Schutte, Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062015-Equities-European-banking-attracts-investors.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062015-Equities-European-banking-attracts-investors.html&text=European+banking+attracts+investors","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062015-Equities-European-banking-attracts-investors.html","enabled":true},{"name":"email","url":"?subject=European banking attracts investors&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062015-Equities-European-banking-attracts-investors.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+banking+attracts+investors http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062015-Equities-European-banking-attracts-investors.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}