Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 19, 2015

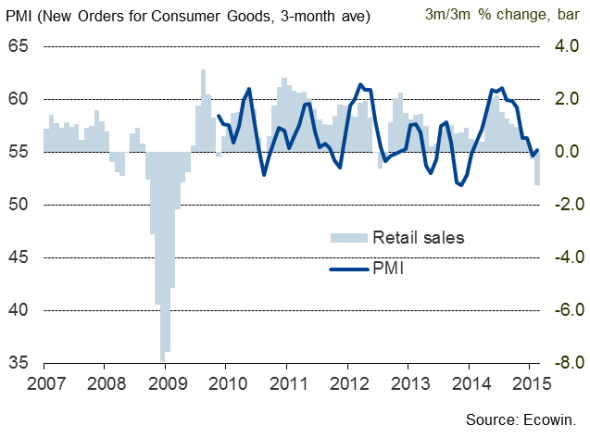

US Fed opens door for higher rates, but softens blow with dovish outlook

The US Federal Reserve opened the door for interest rates to start rising as soon as June, but softened the blow with a more dovish projection for the future path of interest rates. Bond and equity markets rallied at the prospect of less aggressive policy tightening, brushing off the Fed's downgraded economic growth forecasts. The focus now turns to gauging the likelihood of the Fed starting to tighten policy as soon as June. In this respect, next week's flash PMI data will provide an important indication of the extent to which economic growth has slowed in the first quarter.

Rate hikes on the way

As widely anticipated, the US Federal Open Market Committee dropped the word 'patient' from its policy statement at its March meeting. In doing so, the Fed drops is rates guidance (the word had been used in indicate that interest rates would not be raised for at least the next two meetings), giving the Fed the flexibility to alter policy at any time in reaction to the economic data, and in theory opening the door for a hike in the funds rate as early as June.

Despite unemployment rate now down to 5.5% and the Fed forecasting the economy to grow by around 2.5% this year and next (a touch weaker than the December forecast of around 2.75% for each year), Fed Chair Yellen stressed that policymakers would not be "impatient" in hiking interest rates, with rates only starting to rise when the Fed was "reasonably confident" that inflation would return to the 2% target in the medium term and it had seen further improvements in the labour market.

What this all means is up to interpretation, but suggests the bar to raising rates is in fact quite low. The Fed downgraded its forecast for inflation this year but still sees a good chance of it hitting 2% next year.

Source: Markit

Sensitivity of stocks to steepening interest rate term structure

Source: Markit

While the stronger dollar will continue to help drive down inflation (by reducing the cost of imports), next year should see inflation pick up again as the impact of the recent steep fall in oil prices falls out of the year-on-year comparisons.

The median projections from the FOMC members consequently show the funds rate rising to 0.625% by the end of 2015 (down from a projection of 1.125% back in December), with 15 of the 17 rate setters expecting rates to start rising this year. Rates are then forecast to rise to 1.875% by the end of 2016 (against a prior forecast of 2.5%) and up to 3.125% by the end of 2017 (lower than the 3.6% previously anticipated.

The new projections are a roughly 50 basis points downgrading of the rates outlook profile up to the end of 2017, reflecting the weaker growth and inflation projections.

The Fed has therefore softened the blow that rates look increasingly likely to rise this year with news that the future path of rate hikes will need to be less aggressive than previously thought.

Bonds and equities rally

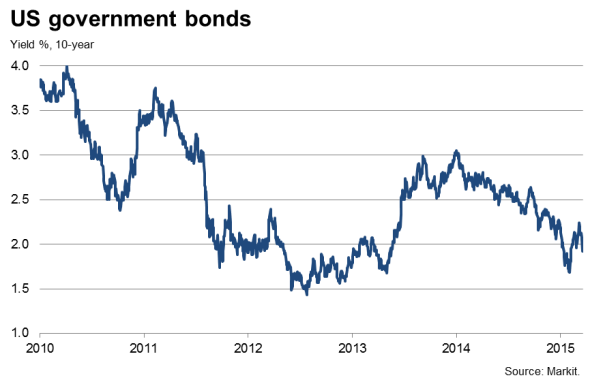

Bond markets have rallied in reaction to the dovish outlook presented by the Fed, pushing 10-year Treasury yields below 2%, having been as high as 2.4% earlier in March, according to Markit data.

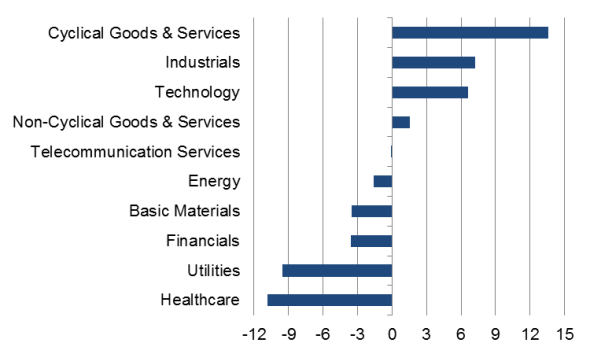

From an equity perspective, stock markets have also rallied, buoyed by the reduced likelihood of aggressive Fed tightening hitting economic growth. The flatter yield curve implied by the updated Fed forecasts favours defensive sectors, notably Utilities and Healthcare, as well as Financial stocks, according to Markit's Yield Curve Slope Sensitivity factors, which gauge the exposure of stock prices to monthly changes in the term structure of interest rates.

June hike in doubt as economy wobbles

Immediate attention will now turn to whether or not the Fed will choose to hike in June. Yellen repeatedly sought to calm expectations of an imminent rise in the FOMC press conference, and there are plenty of reasons to support the need for more time to assess the health of the economy.

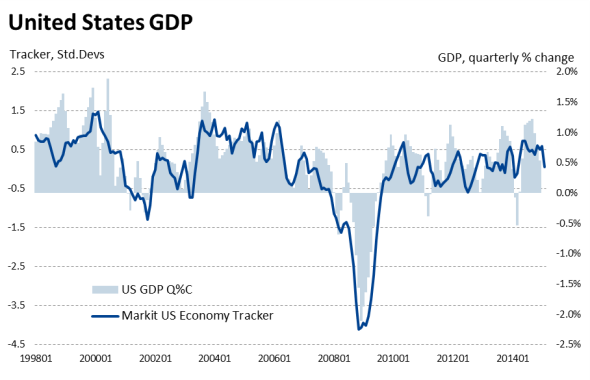

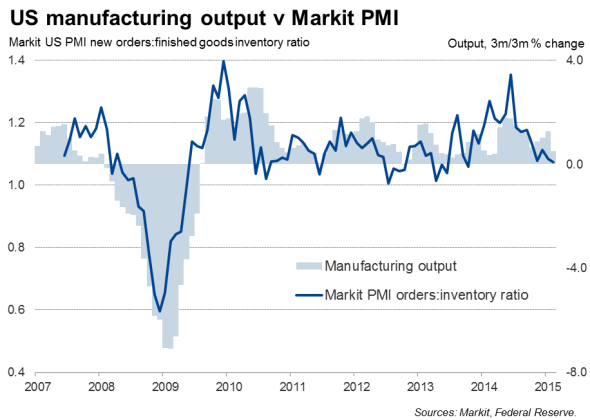

While employment growth remains robust, warning lights are flashing from other key indicators. Most notably, both retail sales and manufacturing output fell for a third successive month in February. The official and survey data available so far this year point to GDP rising at an annualised rate of 2.0% in the first quarter, according to Markti's nowcasting model. But this assumes we will see some rebound in series such as retail sales, factory orders and industrial production in March after February's data were thought to have been hit by extreme weather and port strikes. Growth could come in far lower if the rebound disappoints, worrying the Fed into postponing rate hikes at least until second quarter GDP data become available in July.

That leaves the September FOMC meeting as the most likely time for rates to start rising, assuming the data flow improves. However, with Markit's Business Outlook survey showing US companies the least optimistic since the global financial crisis, such an improvement is by no means assured. More will be revealed on 24th and 26th March, when Markit updates its PMI for manufacturing and services with March data.

US retail sales and PMI orders for consumer goods

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-economics-us-fed-opens-door-for-higher-rates-but-softens-blow-with-dovish-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-economics-us-fed-opens-door-for-higher-rates-but-softens-blow-with-dovish-outlook.html&text=US+Fed+opens+door+for+higher+rates%2c+but+softens+blow+with+dovish+outlook","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-economics-us-fed-opens-door-for-higher-rates-but-softens-blow-with-dovish-outlook.html","enabled":true},{"name":"email","url":"?subject=US Fed opens door for higher rates, but softens blow with dovish outlook&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-economics-us-fed-opens-door-for-higher-rates-but-softens-blow-with-dovish-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Fed+opens+door+for+higher+rates%2c+but+softens+blow+with+dovish+outlook http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-economics-us-fed-opens-door-for-higher-rates-but-softens-blow-with-dovish-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}