Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 19, 2015

Investigating impact of changing yield curve term structure on equity sectors

With US interest rates set to rise, we look at which stocks look set to fare well in an environment of tightening monetary policy, and which look set to suffer the most.

Rate hikes on the way

The US Federal Reserve's Open Market Committee is widely expected to drop the word 'patient' from its policy statement at its March meeting; a small but significant change that has big ramifications.

The term patience was used to assure markets that the Fed would not raise interest rates for at least the next two meetings. The change therefore leaves the FOMC with the ability to adapt policy quickly in reaction to the changing economic data flow, and in theory opens the door for a hike in the funds rate as early as June.

A recent deterioration in the economic data flow, alongside still-weak wage growth and worries about the market impact suggests that the FOMC will not choose the option of hiking rates as early as June. However, expectations have risen that policy will start to be tightened in September providing the data do not continue to worsen, and will continue to do so.

Interest rate term structure

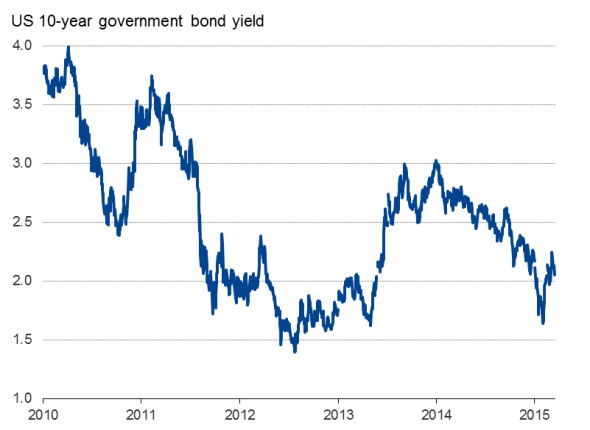

Corporate performance, and therefore stock prices, will depend however not just on when rates start to rise but also on the speed and extent of further rate hikes, i.e. the interest rate term structure. To investigate this, we use Markit's Yield Curve Slope Sensitivity factors, which gauge the exposure of stock prices to monthly changes in the term structure of interest rates (ten year - one year US treasury yield).

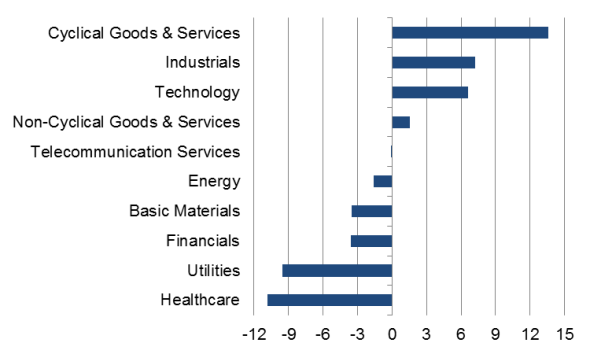

Sensitivity of stocks to steepening interest rate term structure

A value of 13.6% for Cyclical Goods & Services, for example, indicates that 13.6% more stocks are in the top 10% of stocks that perform well when the yield curve steepens than the bottom 10%, indicating that a steepening yield curve is expected to benefit this sector the most. A value of -10.8% for Healthcare indicates that 10.8% more stocks are in the bottom decile versus the top decile suggesting that a flattening yield curve is expected to benefit this sector the most.

If we assume that interest rates rise this year and then keep rising over time, as the bond markets price-in higher inflation (resulting in a steepening of the yield curve), the sector which is set to perform best is Cyclical Goods & Services, followed by Industrials and then Technology (see chart).

However, if interest rates are predicted to remain low in the longer term (resulting in a flattening of the yield curve), Healthcare and Utilities stocks are set to enjoy the strongest gains.

The findings, based on models derived from past performance of stocks, fit the theory reasonably well. A steeping yield curve is generally associated with an expectation of rapid economic growth which generates inflationary pressures. By their nature, cyclical stocks (often those for which demand is elastic) tend to do well in this environment. A flat yield curve, in contrast, means low inflation is anticipated, usually associated with low growth. In this environment, defensive stocks, such as Healthcare and Utilities (for which demand is largely inelastic) tend to outperform.

FOMC guidance v bond markets

The speed and extent to policy tightening is therefore crucial to equity performance, but this of course remains hotly debated.

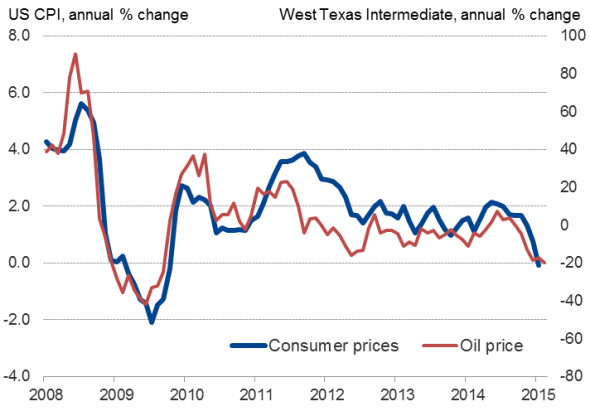

The latest guidance from December indicates that the FOMC expected the funds rate to rise to 1.125% by the end of 2015, then 2.5% by the end of 2016 and up to 3.6% by the end of 2017. However, the bond markets are not pricing in such an aggressive tightening, with ten-year Treasury yields hovering at just over 2%, according to Markit's bond pricing data. The divergence mainly reflects different views on inflation: a concern among FOMC members that inflation will pick up from recent lows is not widely shared in the bond markets, where 'secular stagnation' theories have found favour.

With the FOMC's latest decision looking, any dovishness should therefore favour Utilities, Healthcare and Financials, but any increase in Fed's hawkishness should favour the cyclical Goods and Services sector, according to the factors. That is, of course, unless the hawkishness rattles the markets to the extent that all sectors see losses.

Inflation

Bond markets price in weak future inflation

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-Economics-Investigating-impact-of-changing-yield-curve-term-structure-on-equity-sectors.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-Economics-Investigating-impact-of-changing-yield-curve-term-structure-on-equity-sectors.html&text=Investigating+impact+of+changing+yield+curve+term+structure+on+equity+sectors","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-Economics-Investigating-impact-of-changing-yield-curve-term-structure-on-equity-sectors.html","enabled":true},{"name":"email","url":"?subject=Investigating impact of changing yield curve term structure on equity sectors&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-Economics-Investigating-impact-of-changing-yield-curve-term-structure-on-equity-sectors.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investigating+impact+of+changing+yield+curve+term+structure+on+equity+sectors http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-Economics-Investigating-impact-of-changing-yield-curve-term-structure-on-equity-sectors.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}