Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 18, 2015

Weak UK wage growth strikes warning note on economic recovery

The number of people in employment has risen to an all-time high, but despite the jobs boom and wider economic recovery wage growth remains weak. The lack of wage growth leaves the economy vulnerable to setbacks, especially as growth has one again become all too dependent on consumer spending.

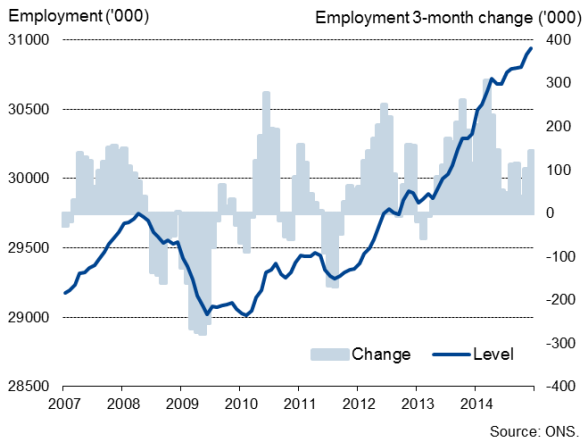

Rising employment

Data from the Office for National Statistics showed that employment continued to rise at the start of the year, up 143,000 in the three months to January compared to the prior three months and the strongest gain seen since the second quarter of last year. The rise pushed the employment rate up to 73.3%, an all-time high. However, the increase was insufficient to drive the unemployment rate down.

UK employment

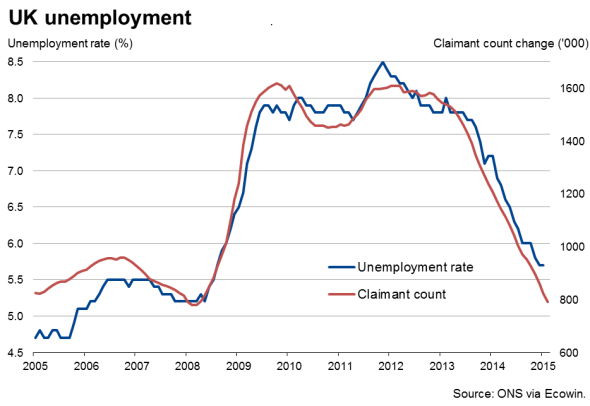

The joblessness rate held steady at 5.7% in the three months to January, albeit its lowest for seven years. A further marked fall in the claimant count and strong employment growth signalled by the business surveys suggests the rate should continue to trend lower in coming months, down to 5.6% in February.

Wage growth disappoints

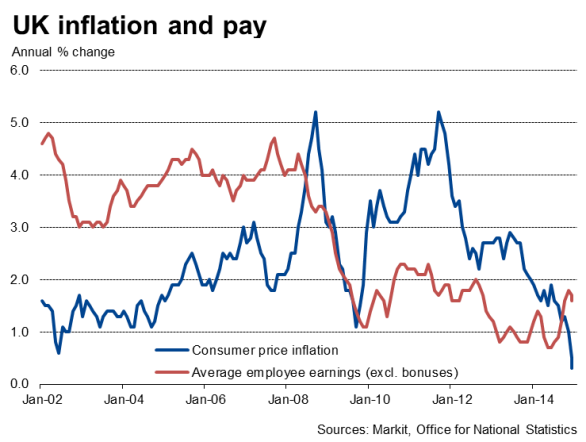

The data also indicate that, while employment has risen, the recovery remains one which has failed to benefit households to the extent that would have been expected. Average weekly earnings rose just 1.8% on a year ago in the three months to January, dipping from 2.1% at the end of last year. If bonuses are stripped out, the rate of increase eased to 1.6%.

Private sector pay has fared slightly better, up 2.1% on a year ago in the three months to January (2% excluding bonuses), but that's down from December and a surprisingly weak rate of increase given the pace of economic growth seen over the past year and the commensurate labour market tightening.

The number of people per unfilled job vacancy has more than halved from a peak of 5.9 in late-2011 to just 2.5, its lowest since May 2008 and a level which would normally mean skill shortages enable workers to negotiate higher pay. In this recovery that has simply not happened, something which is thought to reflect a combination of weak wage bargaining power and the increase in lower paid jobs compared to before the recession.

Fragile economy

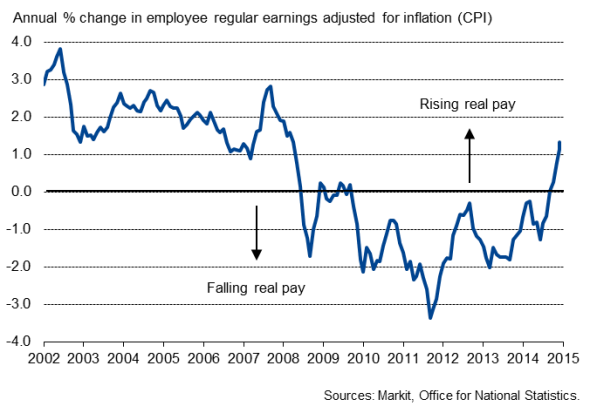

The lack of wage growth leaves the consumer-led economic recovery dependent on low inflation. With business investment falling, the economic upturn is being driven by rising consumer spending, which can in turn be linked to households taking advantage of lower prices and the boost to spending power resulting from the recent tumbling of inflation to just 0.3%. In real terms, pay growth has consequently picked up to 1.3%, its highest since 2008.

Real pay growth

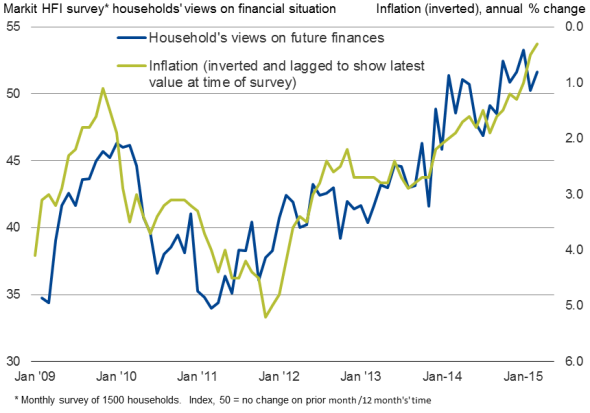

Markit's household finance survey shows consumers feeling more buoyant than at any time since the financial crisis so far this year, but the survey also shows this is largely a reflection of low inflation rather than rising incomes.

Unless wages and business investment start rising, the recovery is looking worryingly fragile with its dependence on consumers and susceptibility to spending being hit by any rise in inflation.

Household sentiment and inflation

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Economics-Weak-UK-wage-growth-strikes-warning-note-on-economic-recovery.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Economics-Weak-UK-wage-growth-strikes-warning-note-on-economic-recovery.html&text=Weak+UK+wage+growth+strikes+warning+note+on+economic+recovery","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Economics-Weak-UK-wage-growth-strikes-warning-note-on-economic-recovery.html","enabled":true},{"name":"email","url":"?subject=Weak UK wage growth strikes warning note on economic recovery&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Economics-Weak-UK-wage-growth-strikes-warning-note-on-economic-recovery.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weak+UK+wage+growth+strikes+warning+note+on+economic+recovery http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Economics-Weak-UK-wage-growth-strikes-warning-note-on-economic-recovery.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}