Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 18, 2017

UK retail sales rebound in April, but upturn lacks legs

UK retail sales were better than expected in April, more than making up for a disappointing March and adding to data which suggest the economy started the second quarter on a strong footing. Questions persist, however, as to whether this upturn has legs.

Retail sales rebounded 2.3% in April, according to the Office for National Statistics, up 4.0% on a year ago and recovering nicely from a 1.4% decline in March.

The better news on the retail sector in April follows upbeat business surveys, which indicated that the pace of economic growth picked up at the start of the second quarter. However, we remain sceptical as to the sustainability of this brighter picture.

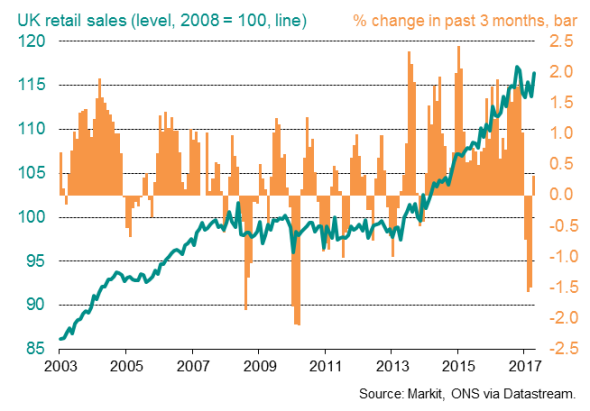

UK retail sales

The timing of Easter and better weather clearly looks to have played a role in boosting sales in April, so it's wise to treat the upturn with some caution. Looking at the underlying three-month trend, sales are up a mere 0.3%. With the exception of the first three months of this year, that's the weakest trend rate since the third quarter of 2014 (see chart).

The near-term outlook for the retail sector is challenging as the combination of rising prices and falling real pay looks set to hit consumer spending and hurt economic growth.

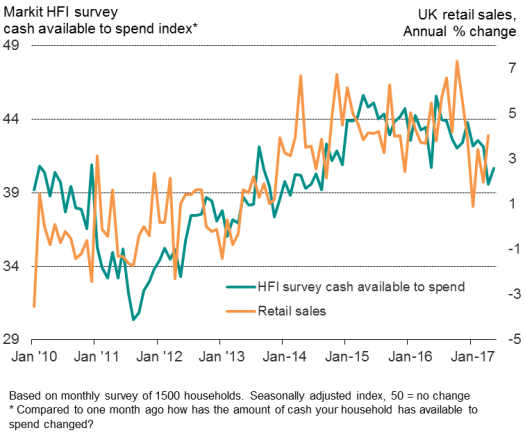

The latest survey of household finances showed the amount of cash that families had available to spend fell at a marked rate in May. Real pay is meanwhile falling again amid a combination of rising inflation and slower wage growth. Official data have already shown the household savings ratio to have fallen to a record low of 3.3% in the first quarter as past earnings are used to fuel current consumption. Such behaviour is clearly unsustainable and adds to suspicions that households will revert to pulling back on their spending in coming months.

Retail sales v households' cash available to spend

Sources: IHS Markit, ONS via Datastream

On the other hand, employment is at record levels and demand for staff looks set to continue to rise. Inflation should also peak before the end of the year and interest rates look unlikely to rise any time soon, adding some support to consumption further ahead. It nevertheless seems probable that consumers will not provide the same support to the economy in 2017 as in previous years.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052017-economics-uk-retail-sales-rebound-in-april-but-upturn-lacks-legs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052017-economics-uk-retail-sales-rebound-in-april-but-upturn-lacks-legs.html&text=UK+retail+sales+rebound+in+April%2c+but+upturn+lacks+legs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052017-economics-uk-retail-sales-rebound-in-april-but-upturn-lacks-legs.html","enabled":true},{"name":"email","url":"?subject=UK retail sales rebound in April, but upturn lacks legs&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052017-economics-uk-retail-sales-rebound-in-april-but-upturn-lacks-legs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+retail+sales+rebound+in+April%2c+but+upturn+lacks+legs http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052017-economics-uk-retail-sales-rebound-in-april-but-upturn-lacks-legs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}