Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 18, 2017

Real pay falls at faster rate despite lowest jobless rate in 42 years

Further signs of sluggish wage growth add to fears that UK economic growth will slow in coming months amid weaker consumer spending.

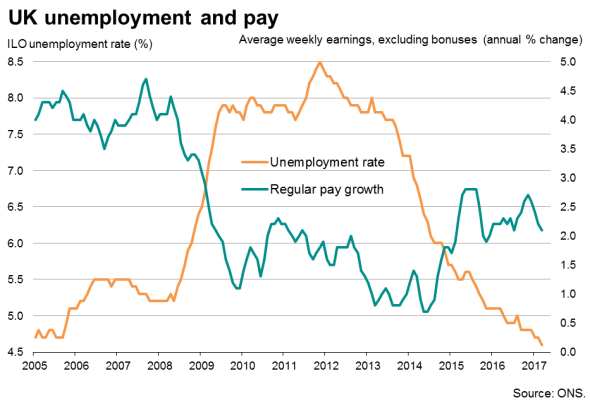

Data from the Office for National Statistics showed regular pay rising just 2.1% in the three months to March. That was the smallest gain since July of last year.

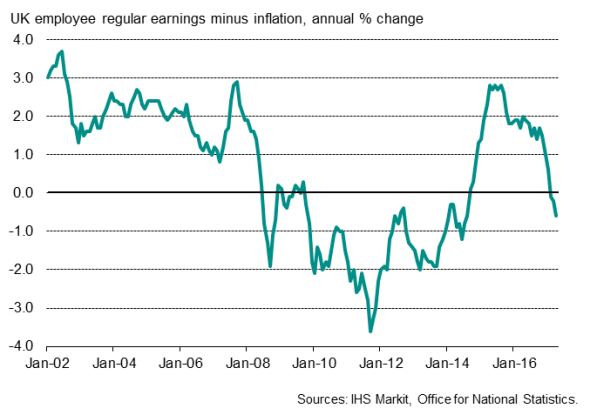

The pay data comes fast on the heels of news that inflation has spiked higher to 2.7%, meaning real pay is falling at the steepest rate for two-and-a-half years.

There was brighter news on unemployment and hiring. The jobless rate fell from 4.7% to 4.6%, its lowest since 1975. Over the same period, employment rose by a solid 122,000, confirming PMI data which also showed robust hiring being sustained into the second quarter.

The weakening wage trend amid an increasingly tight labour market underscores how the old rules of the labour market no longer seem to apply. The fact that fuller employment and lower unemployment is not pushing wages higher raises questions about the extent to which pay will rise in coming years. Employers seem able to dictate pay growth to a degree not seen in previous spells of very low unemployment.

Real pay growth

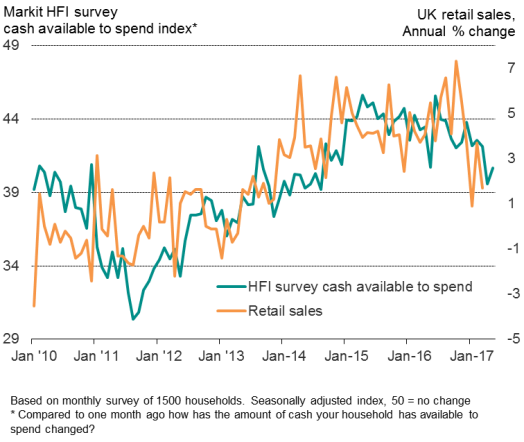

The impact of falling real pay is meanwhile already evident on family budgets. The Household Finance Index, a regular survey of 1,500 households also published today, showed finances being squeezed in May to one of the greatest extents in the past three years. The survey found on-going worries about the impact of rising prices and also saw a steep decline in the amount of cash that families have available to spend.

Household cash available to spend and retail sales

Cautious hiring

Looking further ahead, there are some signs of the employment trend remaining moderately robust. The number of job vacancies continued to rise at a monthly rate of 7,000, in line with recruitment industry survey data showing rising demand for staff from employers.

However, despite rising demand for employees, recruitment agencies meanwhile reported the smallest rise in people placed in permanent jobs for seven months in April, though the use of temporary staff picked up.

It's unclear as to the extent to which hiring is being curtailed by a reticence of companies to commit to filling vacant positions with permanent staff, or whether it's a case of rising skill shortages. The latter certainly seems to be a growing problem: recruiters reported that the availability of suitable staff to fill permanent positions deteriorated at the fastest rate since late-2015 in April. Such an intensifying shortage of suitable candidates raises further concerns as to the absence of upward pay pressures in the economy.

Demand for staff / vacancies

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052017-Economics-Real-pay-falls-at-faster-rate-despite-lowest-jobless-rate-in-42-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052017-Economics-Real-pay-falls-at-faster-rate-despite-lowest-jobless-rate-in-42-years.html&text=Real+pay+falls+at+faster+rate+despite+lowest+jobless+rate+in+42+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052017-Economics-Real-pay-falls-at-faster-rate-despite-lowest-jobless-rate-in-42-years.html","enabled":true},{"name":"email","url":"?subject=Real pay falls at faster rate despite lowest jobless rate in 42 years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052017-Economics-Real-pay-falls-at-faster-rate-despite-lowest-jobless-rate-in-42-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Real+pay+falls+at+faster+rate+despite+lowest+jobless+rate+in+42+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052017-Economics-Real-pay-falls-at-faster-rate-despite-lowest-jobless-rate-in-42-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}