Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Dec 17, 2015

High yield bonds resilient despite selloff

High yield bond returns have been buffeted by the latest drama in the energy and basic resources, but a closer look reveals that both the asset class, indices and the ETFs that track it have proven to be much more durable than expected, as evidenced by:

- Spread widening driven by and largely contained to sectors exposed to these commodities

- Unchanged liquidity profile of the bonds which make up the iBoxx $ High Yield index

- Tracking error of the HYG ETF has been steady despite outflows and record trading volumes

With concerns growing around the US high yield bond market, investors have been fleeing the asset class. Once sturdy in the run up to previous Fed meetings, ETF investors are now shunning high yield bonds amid the growing consensus around the outcome of the December Fed meeting. As a result, some $2.75bn has been pulled from the 24 US listed High Yield ETFs in the past five trading days.

These outflows coincided with adverse market movements as the asset class, as tracked by the Markit iBoxx $ Liquid High Yield index, has fallen by 3.8% on a total return basis since the start of September. While declines have also been seen in other bond asset classes in anticipation of a Fed rate hike, growing bearish sentiment towards high yield bonds has compounded the returns. The index has seen its annual benchmark spread widen to 652bps as of December 14th; a three and a half year high.

Deeper analysis reveals that the index's spread widening has been driven by the lowest quality constituent bonds, which make up the CCC ratings bans. That section of the market has seen its yield surpass 15% above US treasuries - a post financial crisis high.

Spreads widen but contained

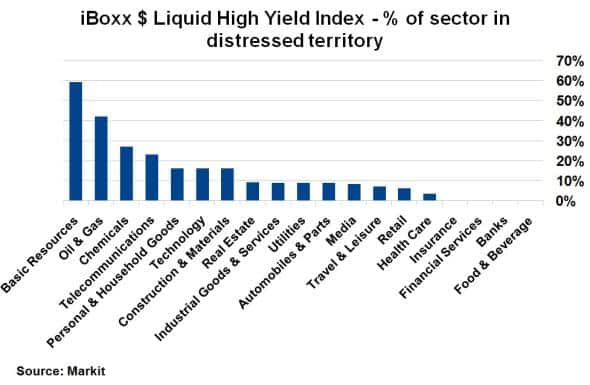

While these moves appear worrying at first glance, a look at the index's constituent bonds shows that the widening has not been uniform across all sectors, as the proportion of bonds trading at a distressed level (a spread greater than 1,000bps) varies widely across the index.

More specifically, the current headwinds have been felt most acutely across sectors which are closely linked to commodities. The Oil & Gas and Basic Resources sectors have 42% and 60% of their constituent bonds by weight in distressed territory. The distressed level across the index stands at 14%, underscoring the challenges faced by these two sectors as investors weigh in the effect of the recent collapse in commodities prices.

Putting aside these two struggling sectors brings the distress level on the index down to less than 10% by weight. Only five of the remaining 17 sectors that make up the iBoxx $ Liquid High Yield index see their bonds trading at a distress level of 10% or below; suggesting little contagion in the wider US dollar high yield market.

Apart from the price of commodities, spots of idiosyncratic risk in other sectors such as Telecoms remain (e.g. Sprint). General market volatility with the impending Fed interest rate hike has also weighed in on the market.

HY bond liquidity unfazed

As with previous periods of bond market volatility, the recent selloff was accompanied by a chorus of observers attributing the market moves to a lack of liquidity in high yield bonds.

But a closer look at the bonds which make up the Markit iBoxx $ Liquid High Yield index shows that this doesn't appear to be the case. TRACE volumes remained stable over the worst of the selloff on December 11th, with $2.08bn of trades registered on that day; more than the average volumes registered over the previous ten trading days.

According to Markit's bond pricing service, dealer counts actually rose steadily in the opening two weeks of December, with the average count among the index constituents increasing from 7.5 in the opening week to nearly 9.5 on December 11th. Far from scaring traders, the volatility actually attracted more dealers to the market.

This helped ensure that overwhelming majority (85%) of the underlying constituent bonds which make up the index held on to the highest possible liquidity score of 1, according to Markit's bond pricing service. In fact, not one of the index's constituent earned a score less than 3 during the depths of the selloff. The Markit liquidity score takes into account bid/ask spreads, dealer quotes, number of sources, shadow liquidity and maturity to calculate a broad-based liquidity measure.

Investors flock towards $HYG

The high yield bond volatility saw investors turn towards HY fixed income ETFs with previously unseen vigour. The iShares iBoxx $ High Yield Corporate Bond ETF ($HYG), which tracks the Markit iBoxx $ Liquid High Yield index,sawrecord market activity as trading volumes surged. According to Markit's ETP analytics service, 31.88mn shares were traded on December 11th with another 21.78mn on December 14th; well above previous instances of market stress seen at the end of 2014 and in August/September 2015.

The surge in trading volumes demonstrated the growing popularity of $HYG as the preferred tool to take a macro view in times of high market volatility. The volumes were also accompanied by nearly $1bn of outflows over the last two days, decreasing the number of shares outstanding in the ETF by -3.74% and -2.77% on December 11th and 14th respectively. These relatively modest moves further justify the ETF transmission process, especially in times of stress.

The tracking difference, which measures how closely the ETF matched its underlying constituents, remained relatively sanguine at -2.93bps. Previous bouts of market volatility such as the 2013 "taper tantrum" saw the ETF differ from its underlying assets by a much wider margin, demonstrating the heightened efficiencies made in the ETF industry over the years.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122015-credit-high-yield-bonds-resilient-despite-selloff.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122015-credit-high-yield-bonds-resilient-despite-selloff.html&text=High+yield+bonds+resilient+despite+selloff","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122015-credit-high-yield-bonds-resilient-despite-selloff.html","enabled":true},{"name":"email","url":"?subject=High yield bonds resilient despite selloff&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122015-credit-high-yield-bonds-resilient-despite-selloff.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=High+yield+bonds+resilient+despite+selloff http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122015-credit-high-yield-bonds-resilient-despite-selloff.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}