Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Dec 17, 2015

Risk appetite returns as Fed takes historic step

Credit markets reacted buoyantly as the US Fed took the monumental step in raising interest rates for the first time in nine years.

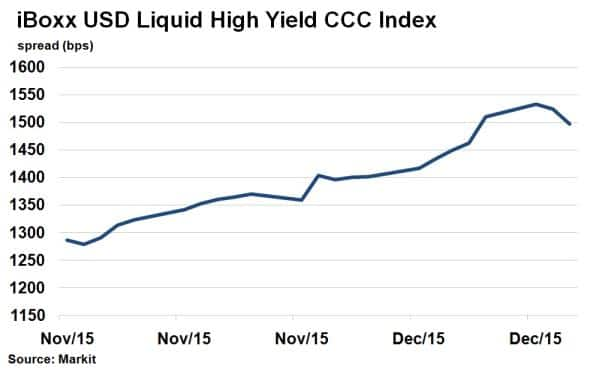

- The iBoxx USD Liquid High Yield CCC Index spread tightened 27bps after Fed meeting

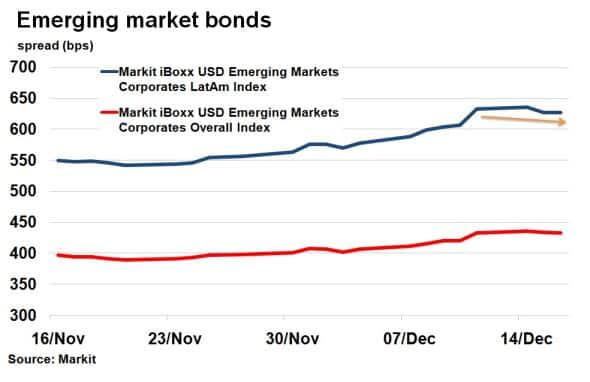

- EM Dollar denominated bonds held up despite further commodity price pressure

- Europe reacted positively, with the Markit iTraxx Europe Main 3bps tighter intraday

Exactly seven years after the US Federal Reserve (Fed) decided to embark on a zero interest rate policy, the state of the US economy has finally been deemed strong enough to withstand the path towards normalisation.

With the 25bps hike wrapped in very cautious forward guidance, financial markets reacted positively. The US dollar barely budged and the stock market rallied, affirming the smooth communication between the Fed and market participants.

It was also a welcome relief for credit markets marred by volatility this month, which saw US high yield bonds under scrutiny. This can be seen by the Markit iBoxx Liquid High Yield Index, which saw its annual yield rise from 7.7% to 8.41% over the first two weeks of December. Much of this was driven by the lower rated bonds in the index, which have seen credit risk rising since October.

Despite the continued downward pressure on commodity and oil prices yesterday, the rate hike brought the free fall in high yield bonds to a halt. The Markit iBoxx USD Liquid High Yield CCC Index saw its annual spread, a measure of credit specific risk, tighten 27bps yesterday. Over the last two days the index has tightened 35bps, a period which was preceded by nine consecutive days of widening. It was a similar case for higher quality investment grade bonds with the annual spread on the Markit $ Liquid Investment Grade Index tightening for the first time in seven days, just as it was being dragged down by the high yield sector.

Dollar emerging market credit remained sturdy, with the hike and subsequent rhetoric from the Fed meeting negating external factors such as lower commodity prices and Brazil's cut to Junk status by rating agency Fitch. Brazil's sovereign 5-yr CDS spread saw a 22bps widening to 476bps yesterday, but this negative credit action had limited impact on US dollar denominated Latam corporate debt. The Markit iBoxx USD Emerging Markets Corporates LatAm Index spread remained flat at 626bps, while the Markit iBoxx USD Emerging Markets Corporates Overall Index spread saw a modest 2bps tightening. However, risks stemming from further US dollar appreciation remain.

Europe's reaction was more buoyant, with German 10-yr bunds tightening 4bps to 0.64%, according to Markit's bond pricing service's 12pm London levels. Corporate credit also rallied with the Markit iTraxx Europe Main 3bps tighter intraday this morning. A weaker Euro versus the US dollar bodes well for the European region's export economy.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122015-Credit-Risk-appetite-returns-as-Fed-takes-historic-step.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122015-Credit-Risk-appetite-returns-as-Fed-takes-historic-step.html&text=Risk+appetite+returns+as+Fed+takes+historic+step","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122015-Credit-Risk-appetite-returns-as-Fed-takes-historic-step.html","enabled":true},{"name":"email","url":"?subject=Risk appetite returns as Fed takes historic step&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122015-Credit-Risk-appetite-returns-as-Fed-takes-historic-step.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Risk+appetite+returns+as+Fed+takes+historic+step http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122015-Credit-Risk-appetite-returns-as-Fed-takes-historic-step.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}