Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 17, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings this week

- Short sellers target motorcycle manufacturers as sales dwindle

- In the UK, Sports Direct sees high short interest

- Asian short sellers stay the course in Metaps and ASJ despite recent pain

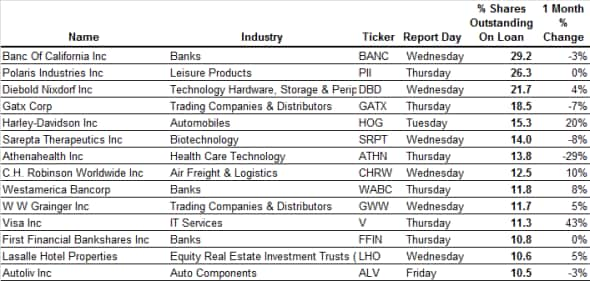

North America

The high conviction short play this week is Californian regional bank Banc of California (BANC). Just under 30% of the LA-based lender's shares are out on loan as of the latest count - which is near the all-time high for the firm. Short sellers first started to take notice of the firm back in October 2016, when an anonymous report alleged it had ties to a convicted fraudster. While no link has been found to date, BANC shares fell by over 30% and prompted the ouster of its CEO. Since then, the shares have regained all of the lost ground, but short sellers have been willing to double down, and demand to borrow BANC is now twice the level seen in October of last year.

Banc of California isn't the only regional bank on this week's list of heavily shorted shares: Westamerica Bancorp and First Financial Bank shares also have more than 10% of their shares out on loan.

The vagrancies of the motorcycle industry are the other trend stirring short sellers this week. The industry has been struggling to attract new riders and sales have stagnated since the financial crisis, as noted in a recent news article citing industry data. This opportunity has seen short sellers circle round the industry's two main listed shares, Polaris Industries and Harley-Davidson. Of the two firms, short sellers are most bearish on Polaris; it has a very significant 26% of its shares on loan, which is a third more than the 15% in its peer.

However, this gap is rapidly closing, as demand to borrow Harley-Davidson shares increased by a fifth in the last month. Citing the sector's current "secular erosion", Harley Davidson was recently downgraded by Alliance Bernstein and brokers are starting to catch on to this bearish trend.

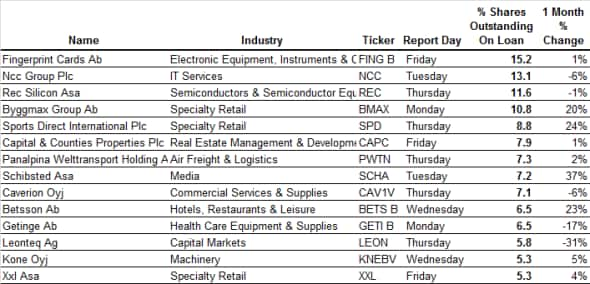

Europe

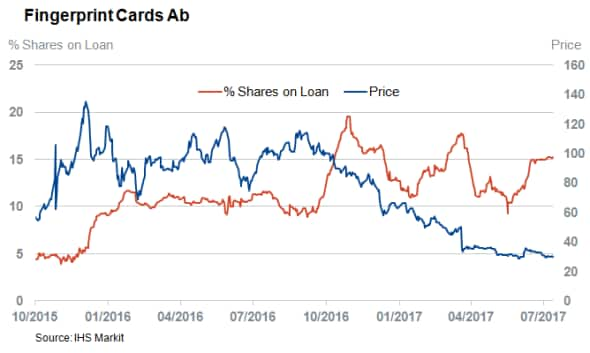

The top short among firms in Europe is Swedish biometric firm Fingerprint Cards, which has 15% of its shares on loan. In recent months, the company suffered from a collapse in demand for fingerprint scanners, and this led to a massive 54% fall in revenue. Fingerprint shares are down by over 75% since late 2015, and further pain may be on the horizon, as demand to borrow Fingerprint climbed more than 50% in the last six weeks.

The other company with a large increase in short interest is UK sportswear firm Sports Direct. Short sellers increased their positions by a quarter in the last month.

While it may be easy to assume this increased shorting activity is due to the firm's ongoing legal battle with a former executive - which brought accusations of drunken backroom "banter" into the open - short sellers are most likely targeting the company for its exposure to UK consumer spending.

The other Brexit related trade, London real estate, will also feature in this week's agenda, after developer Capital & Counties announced earnings on Friday. The company came under sustained pressure from short sellers in the months following the referendum. The demand to borrow has fallen by a third, but plenty of skeptics still need to be placated. Compared to the average UK stock, Capital & Counties has over twice the proportion of its shares on loan.

Asia

With 17.5% of its shares out on loan, payment software firm Metaps is by far and away the highest conviction Asian short this week. The company, which offers trend payment and monetising solutions for mobile applications, has seen its shares triple over the last 12 months. Short sellers are unconvinced, however, as demand to borrow has steadily increased to the current all-time high.

A similar trend has occurred over a much shorter period of time in internet hosting firm ASJ. Short interest in the firm increased by more than 900%, while its shares jumped by a similar margin.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072017-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}