Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 17, 2017

Global investors rotate to defensive postures

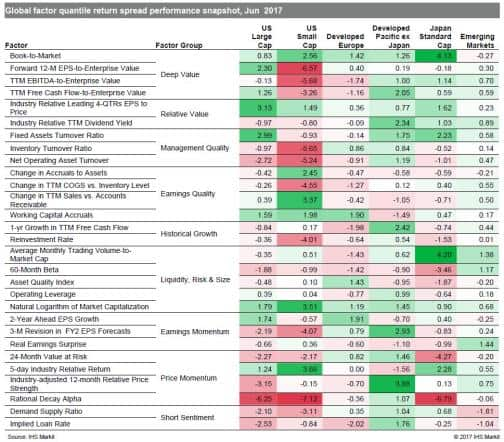

Global stocks have outperformed other major asset classes, posting attractive gains in the first half of the year, especially driven by technology stocks. However, investors are not consumed with euphoria as they rotate to a more defensive posturing across many regional markets. Some high flyers have given up gains as central bankers take on a more hawkish tone, oil entered a bear market and technology shares lost some momentum.

- US: Industry Relative Leading 4QTRs EPS to Price outperformed while Rational Decay Alpha lagged on a more defensive investor posturing

- Developed Europe: Investors favored positive analyst outlook captured by 2-Year Ahead EPS Growth

- Developed Pacific: As the sole exception among our coverage regions, developed Pacific markets outside Japan highly rewarded price momentum, an indication of risk-on trades

- Emerging markets: High quality stocks continued to outperform, gauged by measures such as Fixed Assets Turnover, Industry Relative TTM Dividend Yield and Real Earnings Surprise

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072017-Equities-Global-investors-rotate-to-defensive-postures.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072017-Equities-Global-investors-rotate-to-defensive-postures.html&text=Global+investors+rotate+to+defensive+postures","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072017-Equities-Global-investors-rotate-to-defensive-postures.html","enabled":true},{"name":"email","url":"?subject=Global investors rotate to defensive postures&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072017-Equities-Global-investors-rotate-to-defensive-postures.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+investors+rotate+to+defensive+postures http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072017-Equities-Global-investors-rotate-to-defensive-postures.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}