Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 15, 2016

Bank of England eyes further stimulus despite better than expected growth

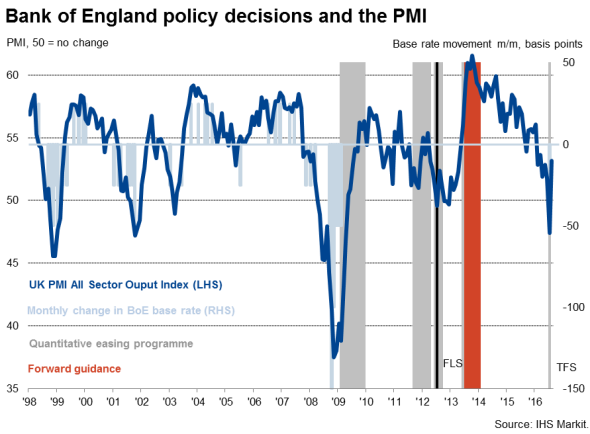

The Bank of England left policy on hold at its September meeting but signalled a further rate cut is likely in coming months, pending further news on the health of the economy in the wake of the Brexit vote.

The Monetary Policy Committee voted unanimously to leave interest rates unchanged after cutting to a record low of 0.25% in August, and all likewise agreed to make no change to the Bank's asset purchase programme.

The minutes note how the economy has fared slightly better than anticipated since the EU referendum. Business survey data showed a steep contraction of the economy in July but have since signalled a rebound in August. The August bounce-back has in fact been slightly larger than the Bank had been expecting, and - if September's data are also strong - third quarter growth could reach 0.3%, in line with the Bank's new projections.

However, even a 0.3% expansion represents a marked contrast to the robust 0.6% growth seen in the second quarter, prior to the EU referendum, and could be consistent with a possible further trimming of interest rates. The meeting's minutes again noted that "a majority of members expected to support a further cut in Bank Rate to its effective lower bound at one of the MPC's forthcoming meetings during the course of the year."

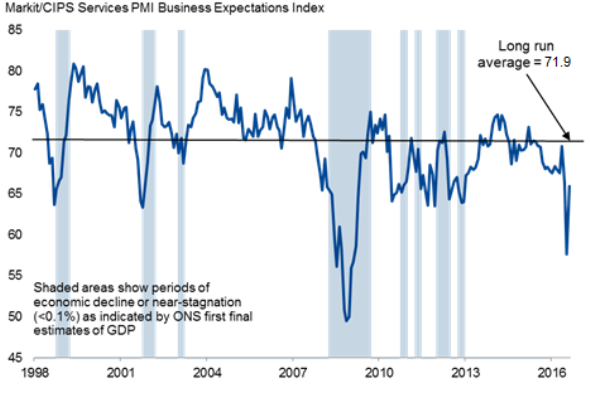

Importantly, business confidence remains at a very low level by historical standards amid uncertainty about the economic outlook. This suggests that business investment will be hit by the lack of confidence, a development which will be seriously worrying policymakers and be a key trigger for further stimulus.

Business optimism

It's likely therefore that we'll see further stimulus in coming months, providing of course that the economy remains on its current weak growth trajectory path.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092016-Economics-Bank-of-England-eyes-further-stimulus-despite-better-than-expected-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092016-Economics-Bank-of-England-eyes-further-stimulus-despite-better-than-expected-growth.html&text=Bank+of+England+eyes+further+stimulus+despite+better+than+expected+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092016-Economics-Bank-of-England-eyes-further-stimulus-despite-better-than-expected-growth.html","enabled":true},{"name":"email","url":"?subject=Bank of England eyes further stimulus despite better than expected growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092016-Economics-Bank-of-England-eyes-further-stimulus-despite-better-than-expected-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+England+eyes+further+stimulus+despite+better+than+expected+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092016-Economics-Bank-of-England-eyes-further-stimulus-despite-better-than-expected-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}